The financial innovation of the century is heading down once more. It seems that a certain invisible hand and the old playground rules caught up with Bitcoin (BTC) and its peers once more. But this should not be too surprising. Seasoned investors know and have always known that the cryptocurrency business is a risky one, still. Commentators have been writing about the fact that Bitcoin has become a safe haven for Chinese capital fleeing a capital market that managed to erase about $5 trillion in value this year. Investors taking risks in those markets suddenly saw the rate of return for those risks turn negative, so Bitcoin was a logical choice. Russian investors in Cyprus came to the same conclusion in 2013. Back then, Bitcoin shot up, and then came slamming down. The invisible hand moderates in the cryptocurrency world as well, which means that people maybe focusing too much on the price of Bitcoin and missing the bigger picture.

Currencies are assets, apart from being a medium of exchange. Bitcoin as an asset is heavily influenced by demand and supply, and the cryptocurrency market is all influenced by the spillover effect. After all, invisible hands tend to have overtly powerful effects that are themselves often hidden in plain sight. In a sense it is unusual to see how other economic principles have been slow to catch up with cryptocurrencies. After all Bitcoin is the pioneer, the rule maker of the cryptocurrency world, but as an asset governed by the rules of the market, it has way too many close substitutes. In fact these substitutes are arguably as close to perfect substitutes as currency markets have seen. As a medium of exchange, other cryptocurrencies are not as close substitutes to Bitcoin as they could be.

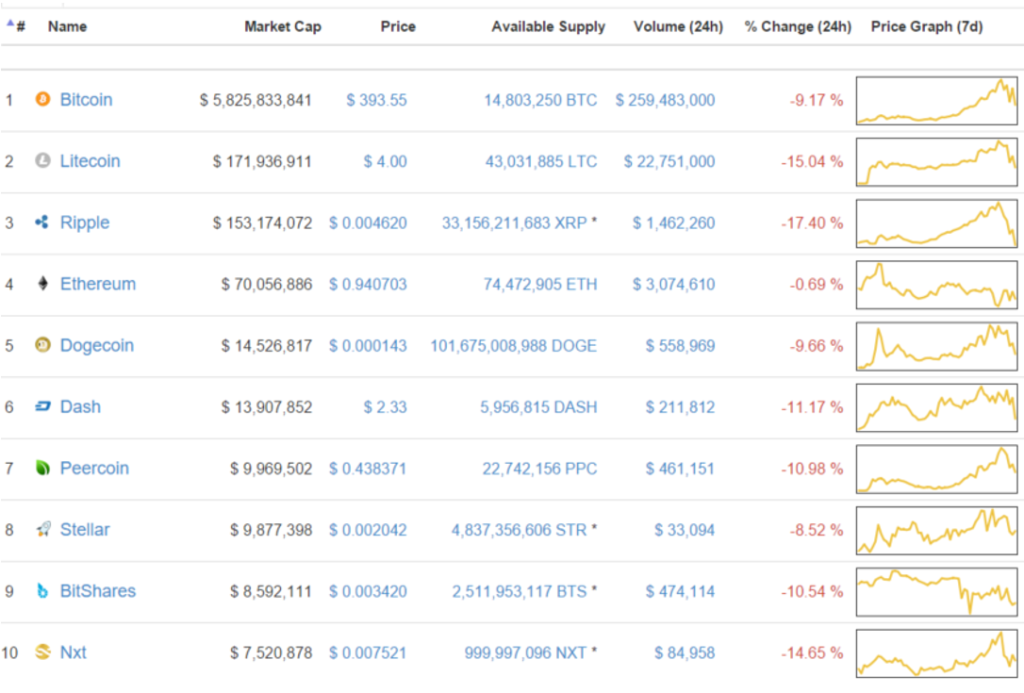

Bitcoin still enjoys a clear advantage over most of its peers since it has become the dominant name in the cryptocurrency world. It is an issue of trust, use and acceptance. This explains the premium people are willing to pay to buy it in comparison with other cryptocurrencies. In fact, they all work in a similar – if not exact – way. This means that investors looking for safe havens have somewhat undervalued Bitcoin’s substitutes. Since Bitcoin supply is limited to 21 million coins and half of that has already been mined, it is just a matter of time until the invisible hand puts an end to the discount rate on other cryptocurrencies. Price fluctuations in other cryptocurrencies, can help illustrate the case for Bitcoin substitutes:

A savvy albeit risk prone investor would probably be looking into Litecoin (LTC) as an investment to substitute Bitcoin as a safe haven. Given the mechanics of cryptocurrencies and the increasing acceptance rate of Litecoin as a means of exchange, it would make sense to invest in it. Considering that Litecoin copied Bitcoin’s architecture one to one, but was designed to have a coin supply 4 times as big as Bitcoin, it is safe to argue that once it reaches the same degree of acceptance that Bitcoin has reached, 1 Bitcoin should be worth 4 Litecoins.

Judging by market cap, Litecoin is currently 33 times smaller than Bitcoin, yet it is trading at roughly 1% of Bitcoin value. This means that if Litecoin was a perfect substitute for Bitcoin as far as its character as a medium of exchange is concerned, its price should be around 3 times higher in market cap terms. This is especially true considering that both currencies have reached the half mark in terms of total available supply. Market cap in this case, shows the degree to which acceptance influences cryptocurrency price.

Since cryptocurrencies in theory serve to buy and sell products and services anywhere in the internet, the invisible hand is probably positioning itself for yet another cryptocurrency coup. Judging by the differences in devaluation over the past 24 hours according to the chart (BTC -9.17%, LTC -15.04%), Bitcoin holders are still holding an edge over Litecoin holders, but Ethereum (ETH) holders are holding an advantage over both in terms of devaluation. This illustrates the complexity of the cryptocurrency market. It should also serve to inform all the cryptocurrency enthusiasts that it is not a monolithic market, despite Bitcoin’s heavy influence over it. Opportunities are widely available for those willing to take the risk. Keep in mind that the invisible hand also knows how to give.