Only 10 days ago, bitcoin was soaring together with other cryptocurrencies. Many analysts attributed the rise to the halving and the rise in valuation of other altcoins, to other endogenous conditions. The recent crash suggests that although endogenous conditions did enable these cryptocurrencies to rise, the main drivers behind the most recent surge, were indeed exogenous conditions. This calls for a more balanced and deeper approach to cryptocurrency valuation analysis, beyond the attractive headlines.

Of Brexit and Other Exogenous Woes

The main story over the past 2 weeks in economic and financial news, was the contentious Brexit vote. During the run up to the vote, over the last few days, Brexit fears have subsided since experts see the ‘remain’ camp prevailing. As a result, investors have been abandoning safe haven assets all around. Bitcoin features among those assets, and by extension, some of the other cryptocurrencies belong to the same category as well.

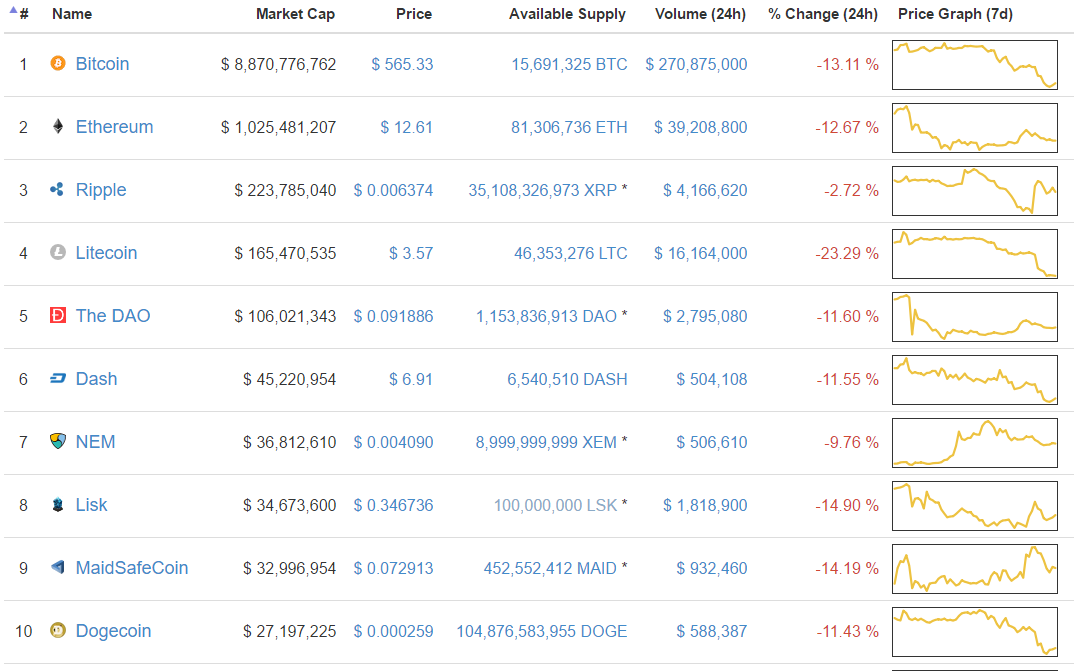

The result is that not only bitcoin faltered, but most if not all of the other cryptocurrencies experienced a dip. It is true that some faced unique challenges that have nothing to do with Brexit. Ether for example, faced the DAO hack and that triggered a sell off. However, it is clear that there are common exogenous factors affecting cryptocurrency markets.

Lack of Robustness Generates Volatility

As far as the endogenous forces go, one of the most underestimated factors has a lot to do with the current fall and ensuing volatility in cryptocurrency markets. Experts quoted in media reports seldom mentioned market cap as one of the main factors that may be responsible for the magnitude of altcoin volatility. The fact of the matter is that all the market cap of all the cryptocurrencies put together, does not exceed $11 billion USD. That causes trades that are worth a few million, to quickly inflate or deflate prices.

Perspective is the Key

Even though a small market cap can lead to great volatility, it is impossible to ignore the great leap that bitcoin and other cryptocurrencies such as Ether, have taken this year. At levels above $470 USD, bitcoin is above its highest point since the end of September 2014. At any point above $2 USD, Ether is above its highest point ever prior to February 2016. This overall gain could be attributed more to endogenous factors than to exogenous ones. Still it is important to keep in mind that the latest rallies and the latest falls are largely due to exogenous factors such as Brexit and fears over Chinese economic performance.

Bitcoin and Other Cryptocurrencies are Part of the Global Economy

One of the approaches that can be taken to analyze whether an investment in bitcoin or any other altcoin has the potential to be profitable, is to analyze each of them as if they were independent companies. By doing this, it is clear that the largest cryptocurrencies by market cap, will probably be the least volatile relative to the rest, yet low overall market caps are a sign of high volatility. Similarly, the functionality of each coin is different, which in a parallel world is tantamount to judging company performance by industry or economic sector. For instance, Bitcoin could be compared to PayPal – although many would say it is less comparable to a company and more comparable to a commodity such as gold – whereas Ethereum could be compared to a highly disruptive company that has the potential to change everything we do online – perhaps like Google.

Final Thoughts

This kind of analysis will help determine in a more objective manner, which altcoins enjoy endogenous potential and which don’t. This could be of great help when time comes to figure out the potential threats that these cryptocurrencies face – both endogenously and exogenously – as well as how well will they perform given certain kinds of shocks in the world economy. Most top articles and most of the headlines out there that draw readers, are largely missing this point. This leads to a situation in which both endogenous and exogenous factors are overstated. This should encourage investors to go deeper into their analysis before investing. Hopefully bitcoin and cryptocurrency fluctuation over the last month, will serve to highlight the need for more analysis into the effects of endogenous and exogenous factors in altcoin valuation.