Last week’s Ethereum hard fork was uneventful. It went through unopposed and it was technically sound, but after its implementation, hackers resumed their attacks. Ethereum needs an additional hard fork to solve these problems, and it will get one. Now all the attention is on Ethereum Classic, which basically shares its DNA with Ethereum, making it vulnerable to similar attacks. Classic is going to implement a hard fork to deal with those DoS threats on October 25th. Nevertheless judging by its older relative’s behavior in the markets in the period of time leading to and after its fork, Classic may still face some headwinds, following the fate of its older relative.

ETC Shadowing ETH

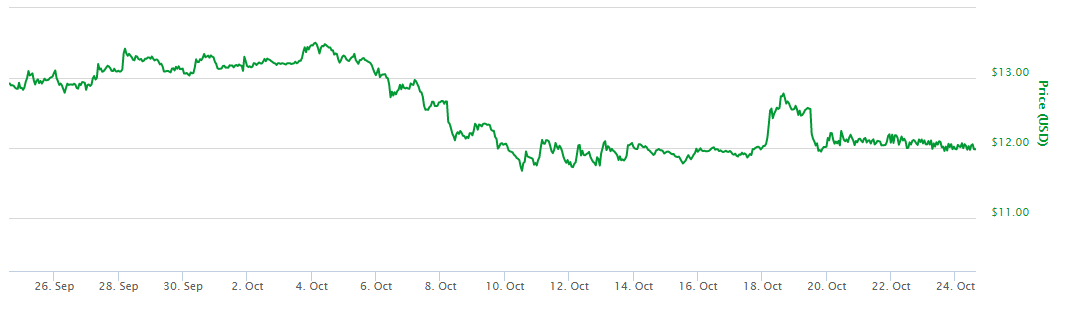

Data shows that both ETC and ETH have has similar performances during the last 30 days. Both show relative stagnation, then a dip followed by an optimistic spike, and then they just fall back down again. ETC spiked about a day and a half before the Ethereum hard fork, whereas ETH reached a two week high immediately after the fork. Since then both have gone back to a price level that is slightly above the pre-fork lows on the 30 day charts.

Additional Ethereum Fork Ahead will set the Pace

This behavioral pattern would suggest that gauging the behavior of ETC in the market will depend as much on the next Ethereum fork, as it will depend on Classic’s own fork. This should not come as a surprise. Both Ethereum and Classic are not only highly intertwined insofar as their DNA goes, but both are also almost perfect substitutes for one another. As far as functionality goes, in theory there is nothing that can be done on Ethereum that cannot be done on Classic in terms of Dapp creation.

Decoupling Ethereum and Classic

In fact, these projects are so closely related in the eyes of the market that the price of ETC is almost always guaranteed to be between 10 to 11 times smaller than that of ETH. That is almost a direct reflection of the hashing power on each network as well. While the rate on Classic holds between 620-640 GH/s, Ethereum is currently at around 7,200 GH/s. That ratio is almost identical to the price ratio between both coins. The degree to which a change in Ethereum can affect Classic and vice versa is unique in the world of cryptocurrencies, and decoupling will depend mainly on adoption trends.

Final Thoughts

Since adoption is also a function of how any of these projects will fare after the forks are completed, then there is also a chance that if either has difficulties with their forks, the other might stand to gain. Cryptocurrency enthusiasts all around will surely be following the developments after Ethereum Classic’s fork, and then again after Ethereum’s second fork, looking to see if any of the projects will break away from the other. However it seems that chances of decoupling in the near future are slim, so both projects will probably keep on sharing the fate of forks, security threats and market trends for some time to come.