Discover the best Bitcoin casino bonuses available and get perks when you play.

Learn everything you need to know about cryptocurrency gambling and the best casinos where you can play with crypto.

Get the latest news and events in the world of crypto gambling, with stories and articles covering the news of the gambling scene.

Discover some of the best games you can play at the most popular cryptocurrency casinos in the world.

Find some inspiration and discover similar casinos you can play at.

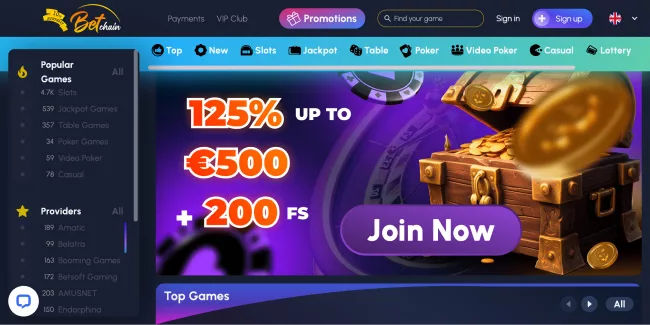

Since 2014, BetChain has been a service to the Bitcoin community and is one of the most successful Bitcoin casinos around, and boasts over 2000+ games with great bonuses for everyone.

Jump into the world of sports betting with our guides to the best Bitcoin and cryptocurrency sports betting platforms.

Keep up to date with the Esports and the latest developments from Esports gambling world.