By the time you read this, the Bitcoin Cash fork will probably be under way. The UASF deadline will probably be just a few hours away as well, and you should refrain from making any transaction on the bitcoin network until bitcoin.org and other reliable sources tell us it is safe to do so. While our funds sit tight in our wallets, our minds will continue wondering about what may happen.

We will engage in idea transaction more during the following days, which is why this is the perfect time for a thought experiment on how BTC and BCC will do after the fork. Newcomb’s Paradox may provide a nice angle from which we can analyze how the Bitcoin Cash fork may affect markets.

Disclaimer: This is NOT Investment Advice

Before we go down that road and explain what Newcomb’s Paradox is and how it may be related to the performance of BCC and BTC in the markets, it is important to warn any reader about the nature of this article. This is a thought experiment; it is NOT investment advice. Investors should be looking at other data to make their decisions. We will not take responsibility for any investment any reader makes based on this thought experiment.

Newcomb’s Paradox

Now that we have established that this is a thought experiment only, we can proceed to explain Newcomb’s Paradox. We will use the Wikipedia article as the only source to explain how the paradox and subsequent game theory works. That will allow us to keep this as simple as we can. According to Wikipedia, Newcomb’s Paradox is a game between two players in which one of the players claims to be able to predict the future. This is how the game goes:

- There is a predictor, a player and 2 boxes. Each box has its own label: Box A and box B.

- The predictor gives the player a choice. The player can either choose to take both boxes or only box B.

- Box A is clear and always contains $1,000.

- Box B is opaque and the predictor determines what it will contain. The player cannot know what Box B contains.

- If the predictor predicts that the player will choose both boxes – A and B – then Box B will be empty.

- If the predictor instead thinks that the player will choose box B, then that box will contain $1,000,000.

Possible Outcomes for Newcomb’s Paradox

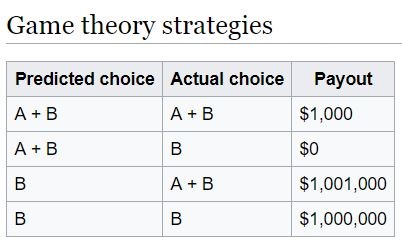

From the variables at play and the dynamics of the game between the predictor and the player, there are 4 possible outcomes to Newcomb’s Paradox:

- The predictor predicts that the player will choose both boxes. The player follows up and chooses both boxes. In that case the payout will be $1,000 because the predictor will leave box B empty.

- The variant for the outcome above would be that the player chooses only box B. In that case the payout is $0 because the predictor thought that the player will take both boxes.

- The Predictor thinks the player will choose box B. The player indeed makes that choice so the payout would be $1,000,000.

- The final possible outcome has the predictor predicting that the player will choose box B, but the player actually chooses both boxes. This will hand the player the maximum payout: $1,001,000.

The Implications of the Outcomes

The most glaring conclusion from Newcomb’s Paradox is that the predictor, despite his or her claims, cannot always predict the future. This should be obvious to anyone, but there are still predictors that insist on their ability to see the future. That is probably one of the reasons why the people behind the Bitcoin Cash fork, will create a new coin.

It is still possible for BCC creators to get a favorable outcome even if they are wrong about their predictions. Of the 4 possible outcomes in Newcomb’s Paradox, there are 2 in which the predictor is right and 2 in which the predictor is wrong. In one of those cases in which the predictor is wrong, the payout is still favorable to the predictor.

Applying the Outcomes of Newcomb’s Paradox to the Bitcoin Cash Fork

To understand how these outcomes could apply to the Bitcoin Cash fork, we must adapt Newcomb’s Paradox to bitcoin and cryptocurrency markets. Let’s assume the predictor is bitcoincash.org. Cryptocurrency markets – investors – will assume the role of the player. Box A will be BTC whereas box B will be BCC. That means the contents of box B will potentially remain unknown even when the players make their choices. The next critical variable we should adapt, is the payouts. Assuming cryptocurrency prices are correlated to adoption and investors buy in according to expected prices, the predictor will benefit from players picking box B – BCC.

Bitcoin Cash Narrows Newcomb’s Paradox and its Possible Outcomes

There is an additional assumption that we must consider when applying Newcomb’s Paradox to the Bitcoin Cash fork: Any player who has BTC and controls the private keys, will be able to claim an equal amount of BCC after the fork. Therefore, many of the players already chose both boxes, but what will happen right after trading on those boxes is enabled? Will players dump the unknown contents of box B driving the price down closer to 0? Will the predictor respond by dumping the known contents of box A – BTC – and driving the price of BTC down? Analyzing outcomes in such a case would require a more complex thought experiment, so we will try to keep it as simple as possible.

Assuming that players can choose, and will indeed do so the second they can either buy or sell Bitcoin Cash, the predictor has basically only one choice: to throw all its weight behind box B. Assuming bitcoincash.org will predict optimistically that all players will choose box B – BCC – then the players have the upper hand, because they should find the optimal solution and pick both boxes to get the maximum payout.

Dumping Box B and Breaking Newcomb’s Paradox

Since players might not be as optimistic about box B as the predictors, their interests might be best served by selling the unknown contents of box B the minute they get it. As we all know, this will allow them to get “free money”. That would completely break the logic of Newcomb’s Paradox, bringing the game back to an outcome that is closer to the variant in which the players choose box B while the predictor was thinking that players will choose both boxes. The crypto-equivalent of this outcome has the predictor throwing all its weight behind box B and still ending up with an empty box B, while the players enjoy the contents of the already known box A. Players don’t really lose anything, but the predictor loses everything.

Optimal Outcomes

Yet if the players and the predictor cooperate, then everyone should in theory, derive the maximum profit. The predictor will throw all its weight behind box B and that is clear to the players in the market. In that case, players should choose both boxes, but in the crypto-variant of Newcomb’s Paradox, players should keep the unknown contents of box B instead of dumping it. If we all follow that recommendation, assuming scarcity in BTC and in BCC are the same, then the price of both coins should rise. This should come as no surprise to anyone since it happened before with ETH and ETC.

The Limitations of a Thought Experiment

Nevertheless, the market has too many players and too few predictors. The actions of the predictors are somewhat transparent at this point, whereas the reaction of the players is a complete unknown. That is precisely when Newcomb’s Paradox reaches its limits insofar as a thought process that could give us some insight into how Bitcoin Cash markets will look like the minute after the fork goes through.