Bitcoin (BTC) is the oldest and most famous cryptocurrency which is still in its teens, having only launched in January 2009. Yet, it has already achieved widespread recognition and has a unit value that far exceeds that of any fiat currency, having hit an all-time high (ATH) of $68,990 in November 2021.

Since bitcoin has a limited supply cap of 21 million, just under 2 million of which has yet to be mined, and an estimated 4 million is believed to be lost, it is interesting to know who the top Bitcoin hodlers are. It is especially interesting in terms of the overall percentage that their overall holdings represent since the entire ethos of BTC is for it to be as disseminated as possible to avoid centralization and monopolization of assets.

1. Satoshi is the Number 1 Bitcoin Holder

Satoshi Nakamoto is an obvious entry to this list, as they are the anonymous creator of the Bitcoin blockchain worked on the project for around two years, launched it, mined an estimated 1.1 million BTC, and then disappeared from any involvement in the platform about two years later in December 2010. Interestingly, this Bitcoin isn’t held in a single address but dispersed across 22,000 addresses. The BTC has remained in their wallets ever since. That is 5.24% of the total 21 million coins that will ever be mined that have remained untouched over 15 years.

2. Roget Ver

Roget Ver was an early adopter of BTC, having begun investing in it back in 2011 when it was valued at $1. He is known for founding and running Agilestar.com between 2004-2018, and being the current owner of Bitcoin.com, the cryptocurrency exchange and mining pool platform, among other sites and ventures. He is a big block proponent, who was a critical factor in the Bitcoin Cash fork. He reportedly owns about 400,000 BTC, which is equivalent to around 1.9% of all BTC. As of February 2023, this was valued at around $10 billion.

3. Binance

Binance was founded in July 2017. Although this was much later than many other cryptocurrency exchange platforms, they quickly gained traction thanks to their positive marketing tactics. It is a cryptocurrency exchange platform that also provides other blockchain services such as decentralized finance (DeFi) options, offering an NFT creation and marketplace service, ICO launchpad service, and cryptocurrency news pieces, among others. It has an estimated 90 million users internationally, as well as a daily average trading value of around $2 billion. It also facilitates an average of 1.4 million transactions per second. However, what makes Binance stand out is that it owns 250,597 BTC valued at over $4 billion and represents 1.2% of the total BTC supply.

4. The US Government

One of the most noteworthy government holders of Bitcoin is the United States. However, this is not due to investments, but rather from various seizures. One example is the 144,000 BTC that was initially confiscated from Silk Road in, as well as the 50,676 BTC that was confiscated from James Zhong in November 2022 who had hacked the site in 2012. Even though the US government used to auction off confiscated crypto, it has since started retaining it. It is estimated to hold at least 214,000 BTC (~$53 billion), which is just over 1% of the total Bitcoin cap.

5. The Bulgarian Government

This small European nation is estimated to have seized at least 200,000 BTC from illegal activities within its territory, and its government seems to be holding on to it. This figure would make Bulgaria the second largest governmental Bitcoin holder in the world. This equates to approximately 0.95% of all Bitcoin and was valued at nearly $5 billion as of February 2022.

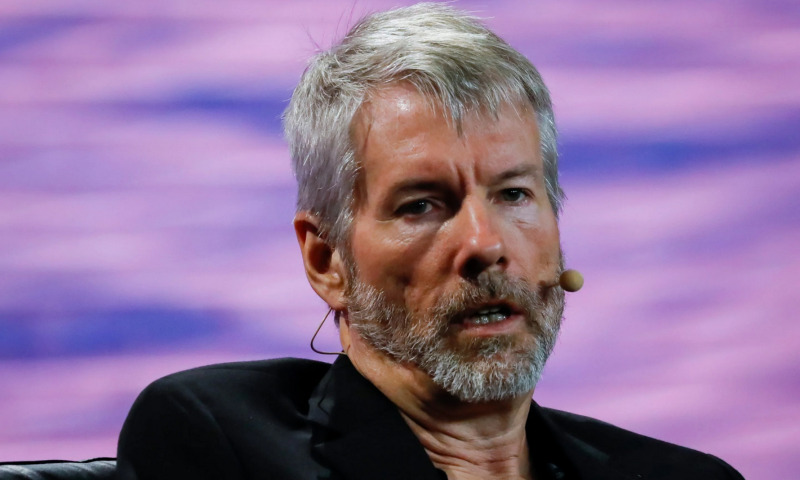

6. Michael Saylor and MicroStrategy

Michael Saylor is an American entrepreneur, rocket scientist, Bitcoin maximalist, and inventor. He co-founded MicroStrategy Incorporated in 1989 alongside Sanju Bansal and Thomas Saphr with funding provided by DuPont, for whom he was working as an internal consultant at the time. MiscorStrategy is a US-based company that provides business intelligence, mobile software, and cloud-based services. In July 2020, he announced that MicroStrategy would be looking into investing in various commodities including Bitcoin (BTC.)

The company then went on to invest in 21,454 BTC, which cost around $250 million at the time. Since then, he has been a major proponent of the widespread adoption of BTC and frequently appears as a speaker on the topic of news programs and podcasts. In February 2023, he announced that the company had acquired another 130,000 BTC. This puts their total at minimally 151,454 BTC. This accounts for 0.72% of total BTC and was valued at $3.7 billion in February 2023.

7. Bitfinex

Bitfinex is one of the oldest cryptocurrency exchange platforms, having been established in 2012. It currently lists over 200 tokens and 400 spot trading pairs. Its daily trading volume is around $166 million. As of December 8, 2022, BitFinex’s wallet held about 140,165 BTC. This was valued at about $3.5 billion in February 2023 and is about 0.67% of BTC’s total supply.

8. The Winklevoss Twins

Even though they should have their own entries on this list, they have always worked together and invested together, so we will discuss them together. Cameron and Tyler Winklevoss started amassing BTC in 2021 when it was valued at just $120. They were able to invest in about 1% of the circulating Bitcoin supply by the next year, thanks largely to the remainder of the $65 million in settlement funds that they had received from Facebook and then used to start up their investment firm, Winklevoss Capital Management.

However, they are now more famously known as the cofounders of the Gemini cryptocurrency exchange platform which has an average daily trading volume of around $200 million. Forbes estimated in 2021 that each twin held an estimated $1.4 billion in Bitcoin, or approximately 70,000 BTC each. Together this is 140,000 BTC, which represents about 0.67% of all BTC.

9. Eric Voorhees

Eric Voorhees is the founder of both Coinapult and SatoshiDice. However, his claim to riches came when he sold SatoshiDice for 126,315 BTC, which was valued at around $12.4 million. He then went on to found and become the CEO of ShapeShift.com, which is a cryptocurrency exchange and DeFi platform. It is unknown how much Bitcoin he currently holds, but if it is still at least 100,000, that is just under 0.5% of all BTC that will ever exist. This amount would have been worth $2.5 billion in February 2022. He continues to be a major voice in favor of BTC and often states optimistic opinions about where the market is heading.

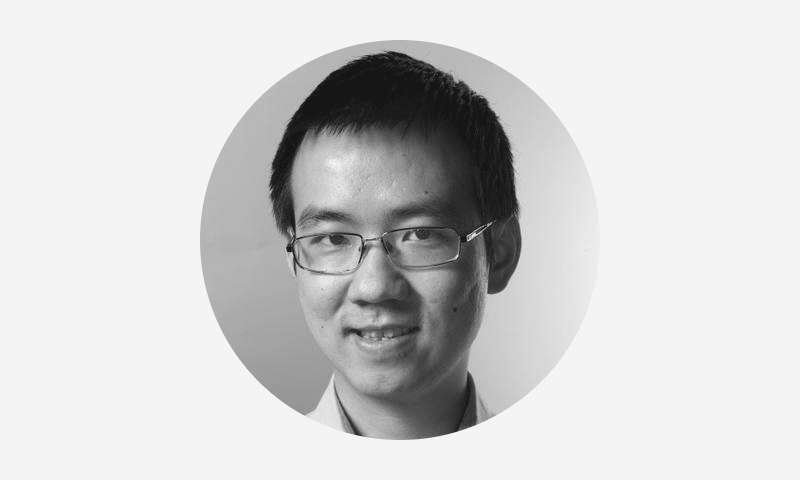

10. Jihan Wu

Jihan Wu is one of the owners of Bitmain and some of the biggest Bitcoin mining pools. He started as an analyst and equity fund manager. One of his major contributions to the Bitcoin space was when he discovered the Bitcoin whitepaper in May 2011 and translated it into Mandarin. At the same time, he believed so much in the project, that he borrowed 100,000 yuan ($15,000 at the time) to purchase 900 BTC. He then, along with fellow enthusiast Chang Jia, founded China’s first Bitcoin community site called ‘Babite.’ In 2012, he invested in ASICMINER, which was a BTC mining company. This venture was extremely successful and enabled him to later found Bitmain alongside Micree Zhan in November 2013.

In 2018, he was named the second richest cryptocurrency entrepreneur in China, with a net worth of 16.5 billion yuan ($2.39 billion), according to the Blockchain Rich List. According to Forbes, he is currently worth about $1.8 billion, although it is not known exactly how many BTC he owns.

Bonus entries

Unknown whales

According to River Financial, there are six whales (a wallet address that owns at least 1,000 BTC) who own between 49,800 – 94,505 BTC each. There is also the 2011 MtGox hacker who is still sitting on nearly 80,000 BTC in stolen funds. Altogether, this amounts to 444,918 BTC or 2.13% of all Bitcoin and is held by just seven unknown individuals.

Lost Bitcoin

As of June 2022, it was estimated that between 2.78 – 3.79 million BTC have been permanently lost to circulation. That is between 13.2%-18% of all Bitcoin that there will ever be. This BTC was usually lost either from early miners accidentally throwing away their hard drives or from people losing their wallet keys.

Why big holders are significant

Aside from the fact that nearly 20% of all Bitcoin being irretrievable makes BTC that much more scarce, it also makes the real percentage of circulating ownership of those players mentioned above that much higher. If we calculate the overall percentage of BTC owned by those listed above, the percentage comes to approximately 14.98% of the total BTC supply (excluding Jihan Wu, since we do not know his exact holdings.) But, if we were to take into account the missing 18% missing BTC, their share of the total available supply would be closer to 18.6%. That means the 32.98% of all BTC that will ever exist is either lost or belongs to a handful of individuals or entities. That is a major monopoly of resources that doesn’t even take into account the amount of BTC held by smaller whale addresses.

Calculations

21,000,000 ÷ 5 x 4 = 16,800,000

21,000,000 x 14.9% = 3,129,000

3,129,000 ÷ 16,800,000 x 100 = 18.6%

This arguably undercuts one of the basic tenets of BTC, namely that it is meant to be a decentralized digital currency that allows for the free distribution of and transaction of these currencies. But with such a large percentage of the total BTC supply being monopolized by a small percentage of overall users (there are estimated to be at least 44 million non-zero BTC addresses), this does not truly seem to be the case.