In 2017, the only crypto investors who were not profitable were the ones who lost their private keys or invested in ETH bots. Acquiring a bitcoin position within the first quarter delivered returns that are very seldom found in global investing, but even these returns were eclipsed by many ICOs. The question that we have to ask ourselves must be, what is the future of ICOs?

Since the ICO of Mastercoin in 2013, this revolutionary funding mechanism has gained traction. The most prominent early ICO, without doubt, was that of Ethereum, which subsequently became the epicenter of the ICO craze that was to follow.

Ethereum brought the ERC-20 token standard, which took coin offerings from experimental forks of Bitcoin to an innovative funding mechanism for almost any endeavor by making token creation comparatively easy. The combination of ease of access and crypto mania created speculation that surpassed even irrational exuberance. Last year, hundreds of projects swarmed the market with ambitious roadmaps and substantial marketing budgets. These projects were picked up by ICO aggregator websites that often utilize a pay-to-analyze business model and eager investors rushed to find the next project that would offer a 10x return on investment within a couple of weeks.

ICO participation accelerated when top-tier projects became increasingly oversubscribed, resulting in extreme price increases when these projects started to trade on the open market. The potential return that these price discoveries offered attracted an even more significant part of the growing crypto community. To provide some insight, the Basic Attention Token ICO famously sold $35,000,000 worth of tokens in 35 seconds and went on to have a market cap well in excess of half a billion dollars.

As ICOs became a substantial sector within the general cryptocurrency market, several crypto participants became critical of new ICOs. Critiques included the following:

- Unfair distribution of tokens

- Centralized control

- Low quality proof of concepts (white paper and website the only development during the public sale)

- A high proportion of projects with fraudulent intent

- Funding goals are driven by avarice

- Low levels of accountability by founders to investors

One could easily witness the speculative nature of the market within the price action after exchange listing. The price would rapidly rise to multiples of the ICO price and rapidly retrace on occasion. Once the volume decreased, participants would move on to find the next white paper. This cycle of participation increased and peaked concurrently with the overall cryptocurrency market in December 2017.

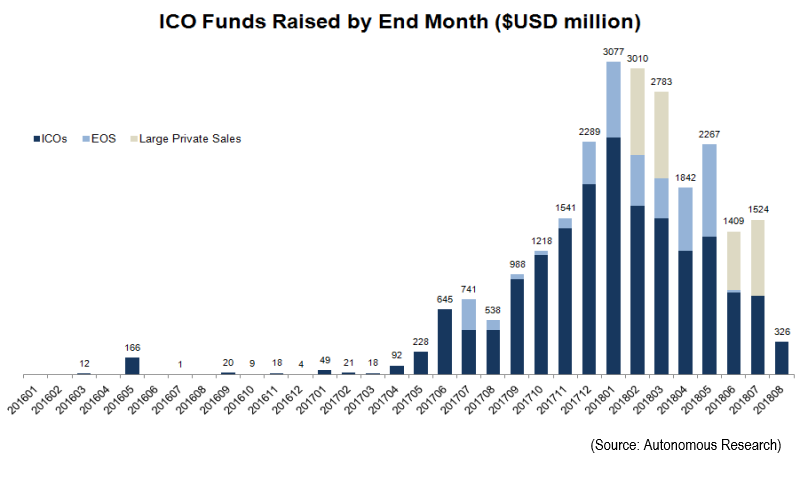

Since the first quarter of 2018, ICO monthly participation has declined drastically as indicated in the graph below. The market has matured, realizing that the fly-by-night nature of raising millions in ICOs, which are hype-driven and have little accountability, is not sustainable.

In hindsight, it is clear that several actors jumped at the opportunity of a market that ignored fundamental safeguards. One can argue that a significant portion of the projects that entered the space came with the primary intention of capitalizing on the mania without the intent of delivering on their technological promises.

A clear majority of ICOs that have launched in the past few months are far below their ICO price, with some down over 98% from their public sale prices. As the market returns from extreme irrational exuberance to a more sober relationship between price and value, the market will force new projects to take heed of the previously mentioned concerns.

Vitalik Buterin has recently expressed the opinion that phenomenal speculative growth in the crypto space is unlikely to be seen again given that many speculators are now aware of it. Future growth is therefore unlikely to be harnessed merely by inviting further speculation, as it was before.

Growth is still very much on the table, but the case for ICOs being defined by their tangible achievements is now much stronger. The standardization and formalization of the space are already happening at pace, infrastructure that demands transparency and accountability, enforced by smart contracts, will hopefully bring the needed balance.

The types of projects set to take full advantage of future ICO-type funding mechanisms are those who can self-fund or raise VC, but choose to run a token-sale (or similar) because of the specific and unique benefits offered.

Two examples of this type of project are those that require mass user-adoption, and those that can take advantage of the incentive-creating power of tokens. After engaging with the community and allowing it to share in the value created, the former will gain adoption much more effectively and potentially have a large user-base immediately. The latter has great latitude in which to creatively incentivize collaboration, contribution and loyalty.

The current state of the market affords the necessary peace to reflect critically on what has happened and to think on what is to come. The ICO as it has been understood by many has likely come to an end. This is likely for the better, as it is difficult to deny that yesterday’s ICOs often leaned towards short-term gambling. For those that take the time to invest in understanding the evolution of the space, there will still be many significant, less risky and more sustainable opportunities that present themselves through coin offerings that provide access to real-world returns.

The Invictus Hyperion Fund (IHF) token will be listed on several exchanges during September. 2018. Hyperion is a syndicated venture capital fund designed to provide token holders with diversified, early-stage investment opportunities in the blockchain industry. The fund seeks to achieve this by forming strategic partnerships with some of the most talented blockchain entrepreneurs and visionaries, assisting them with both financial support and essential connections in their efforts to deliver successful projects. To stay up to date with Invictus follow us on www.invictuscapital.com