LATOKEN Introduces its Own DEX

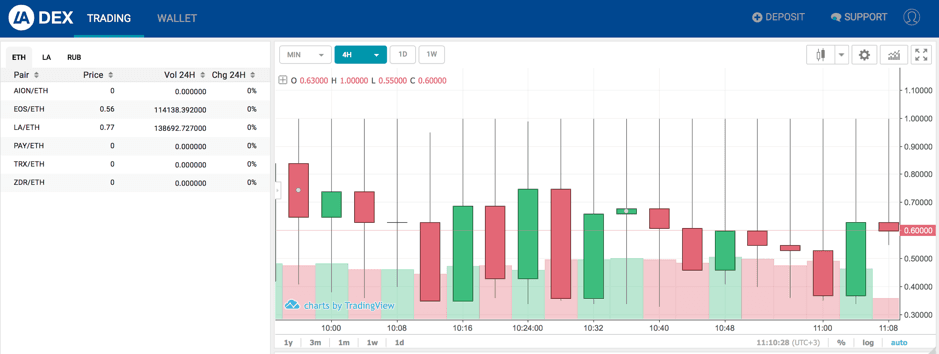

LATOKEN has released a beta version of LADEX – an open source, fully decentralized peer-to-peer exchange which is cheaper and faster than all other players in the market.

LATOKEN has released a beta version of LADEX – an open source, fully decentralized peer-to-peer exchange which is cheaper and faster than all other players in the market. LADEX aims to eliminate the custody problem in asset trading, making it as fast and convenient as the centralized analogs.

Quadriga Case Will Not Rrepeat

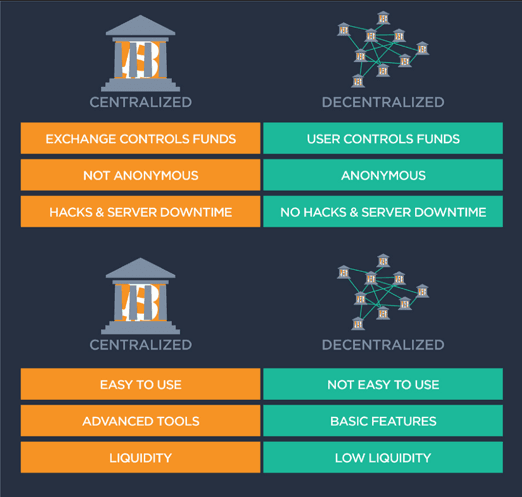

There is a significant advantage of decentralized exchanges when comparing them to centralized ones – they do not control your funds. Once you integrate your DEX wallet with JSON Keystore or Metamask, the only thing visible is your wallet address. No one can run away with your funds or reject your trades as they are regulated by smart contract and all transactions are added directly to the blockchain.

Decentralized exchanges are more ideologically suitable for the blockchain world and the future seems to be on their side to their safety and privacy features. Even though the advantages of decentralized exchanges are quite obvious, 99% of trades are nowadays processed on centralized exchanges. Why? Decentralized exchanges are usually not as user-friendly as centralized ones and their liquidity is considerably lower.

The one DEX which will combine itself high liquidity, simple interface and some typical characteristics of decentralized exchanges as safety guaranteed by smart contract and anonymity will probably conquer market attracting masses of traders.

A Faster and Cheaper Ethereum DEX

There are several indicators to measure a decentralized exchanges. The first one is TPS – the amount of transactions per second processed by the exchange. This amount is limited by blockchain capabilities. According to recent stats, each block in the Ethereum allocates approximately 8mln GAS which is used by transactions. IDEX — today’s biggest DEX — uses 130K GAS for each trade, making it impossible for it to execute more that 60 trades per block (4 TPS). With some protocol optimizations, LADEX uses 40% less to nearly 90K GAS per trade, which increases significantly to 6 TPS.

The speed (TPS) is also extremely important for security tokens which are required to bring equities from traditional markets to the blockchain exchange. Considering this reasons there is KYC to pass for using LADEX. This helps LADEX to solve custody problem (together with levelling up the TPS level) and gives the liquidity to assets listed on exchange.

This feature (TPS) is important for users not only due to transactions speed, but also because of transaction costs. LADEX will lower the GAS level to 60K GAS for one transaction.

Another performance indicator for decentralized exchanges is the commission. LADEX will charge only 0.1% per trade for transactions over $50 from maker and taker, while IDEX withdraws 0.1% from maker and 0.2% from taker.

The third thing to take in account is withdrawal time. LADEX’s smart contract was built to guarantee that any user can get funds in 24 blocks (5-6 minutes approximately). That is considerably less than the 100K blocks needed by the IDEX contract. They have even set manual withdrawal process to do it faster…

Future Developments

There are great plans in place for the development of LADEX. According to its roadmap, GAS price will be reduced to 60K per transaction within the next six month. During this period, algorithmic trading will also be enabled within LADEX. There is more. LADEX 2.0 will be free of exchange commissions and the TPS rate is expected to reach 1000.