PR: Thaler.One – Blockchain Investment Fund to Change How Tokens Work with Real Estate Investment Platform

Thaler.One announces plans to develop blockchain-based real estate marketplace and launch Thaler token backed by property assets.

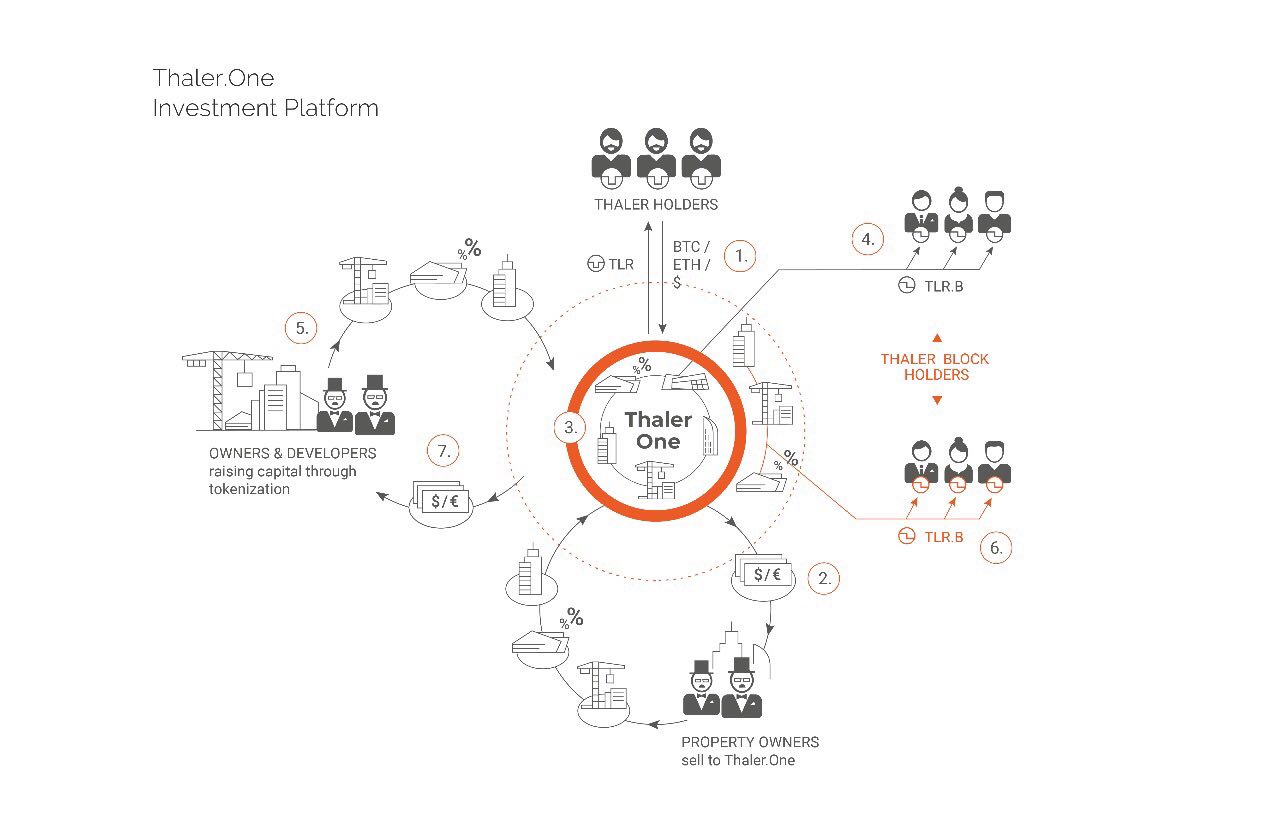

Zurich, Switzerland – Thaler.One, the blockchain-based investment fund, has announced plans to open the $220 trillion international property market to a wider range of private investors by introducing a decentralised platform, operating with both fiat and cryptocurrencies. Thaler.One is set on reaching the $5 billion of Assets Under Management (AUM) mark within the next three years. According to its founders, Thaler.One will set the new industry standard for next-generation digital transactions in the real estate market: the fund is professionally managed and advised by an international team of renowned real estate and investment banking professionals, setting it apart from numerous ‘generic’ blockchain-to-realty startups.

Thaler.One Co-founder and CEO Will Andrich says:

“The rise of blockchain technology and cryptocurrencies presents an opportunity to reinvent the traditional real estate investing experience. Thaler.One offers unique opportunities to capitalize on dynamically growing asset classes, including co-work, co-live and healthcare-related properties by adopting blockchain technology to ensure borderless, transparent and secure transactions.”

Thaler.One’s strategic goal is to allow anyone to invest in real estate, historically a less volatile and less risky investment asset class than stocks or gold, a more predictable source of income. By design, the decentralized investment platform cuts out the ‘middleman’ and allows small investors to buy into real estate outside of their country of residence and manage their assets in a cost-effective and independent manner. The fund acts as an investment vehicle powered by Thaler tokens, blockchain-secured and backed by real estate assets, predominantly located in the European Union and the UK.

Thalers are security tokens issued in compliance with EU regulations and Regulation D in the US. The fund will open its first pre-sale of Thaler tokens in early April of 2018.

For more information, visit http://thaler.one/

Join the Thaler.One Telegram group by clicking here

About Thaler.One

Thaler.One is a decentralized investment fund founded by industry veterans with more than 100 years of combined experience in investment banking, real estate, financial services and IT. Will Andrich, the fund’s Co-founder and CEO, a professional investment banker, has held leadership positions at Morgan Stanley, LCF Rothschild and Astor Capital.

The Thaler.One Advisory Board includes Michael Lange (Managing Partner at ACG, Former Chairman of the Board at JLL), Mattia Rattaggi (Swss Crypto Valley Association, former UBS Group executive), Saydam Salaheddin (Head of EMEA Real Estate, Credit Suisse), Stephen Inscoe (Founder of many real estate tech start-ups).