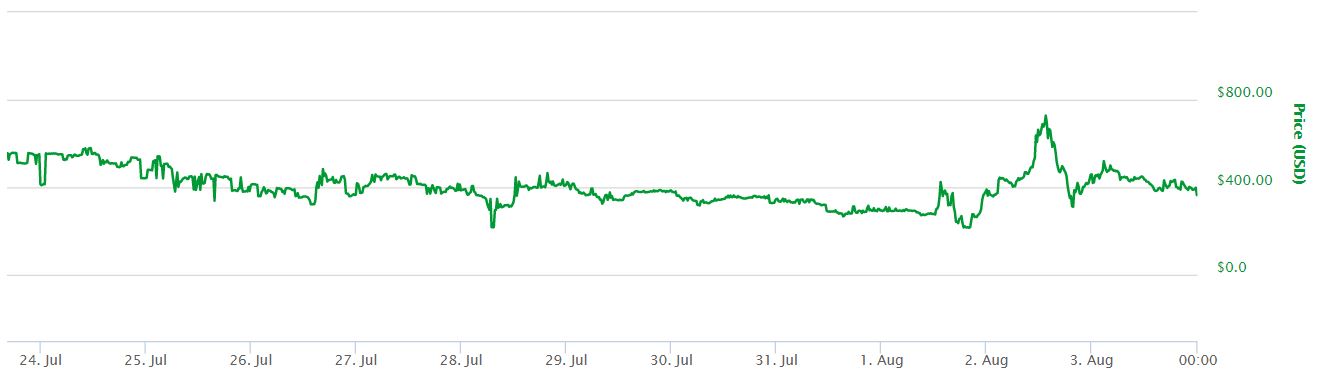

Bitcoin Cash Crash Due To Sellers Flooding Markets

Since before the fork, a Bitcoin Cash crash scenario always lingered in the background. The crash finally came yesterday, after it seemed like Bitcoin Cash was gaining ground over the first 2 days after the fork. The reason for the Bitcoin Cash crash was basically due to sellers flooding the markets. More exchanges started opening up BCH trades and the newly forked coins started flooding in. It seems that coins from Trezor devices were the main trigger, according to the experts on the World Crypto Network channel.

Trezor Users Trigger Bitcoin Cash Crash

The theory about Trezor users emerged during the Bitcoin Cash crash, when experts on the World Crypto Network discovered that Trezor did a private key sweep on its beta BCH wallet. Apparently, the beta Bitcoin Cash wallet on Trezor devices had a bug. Those who claimed their coins on that wallet, could only claim the coins and send them to an exchange. This apparently triggered a flood of transactions into exchanges, which together with other problems on the Bitcoin Cash change, fueled the cascade.

Bitcoin Cash Crash and Blockchain Issues

Transactions on the Bitcoin Cash blockchain were also impaired because of mining and difficulty issues. Apparently, it is taking hours for miners to discover new blocks on the Bitcoin Cash blockchain. With the size of the blocks on this blockchain, there are also many more transactions per block, so when those come through, exchanges are suddenly flooded with Bitcoin Cash. Experts on the World Crypto Network pointed out that:

- There were Bitcoin Cash blocks coming in with as much as $90 million USD worth of BCH into exchanges.

- As a result, exchanges could issue a requirement for a minimum number of confirmations on the blockchain, until they accept Bitcoin Cash on their users’ wallets.

- The fact that mining on the BCH chain doesn’t seem to be profitable, can make these transaction problems even more acute, which will prompt users to transfer more funds and sell them as quickly as they can, to avoid being swept by the Bitcoin Cash crash.

Don’t Count BCH Out Yet!

Despite all the Bitcoin Cash crash and all the problems on the BCH blockchain, the coin is not dead yet. It could recover. It is important for investors to keep on monitoring the situation to see how all these transaction issues develop. There might be opportunities for investors in Bitcoin Cash in the future, so it is important for everyone to open their minds instead of ruling BCH out completely at this point.