The Not So Strange Yet Cynically Comical World Of The Useless Ethereum Token UET

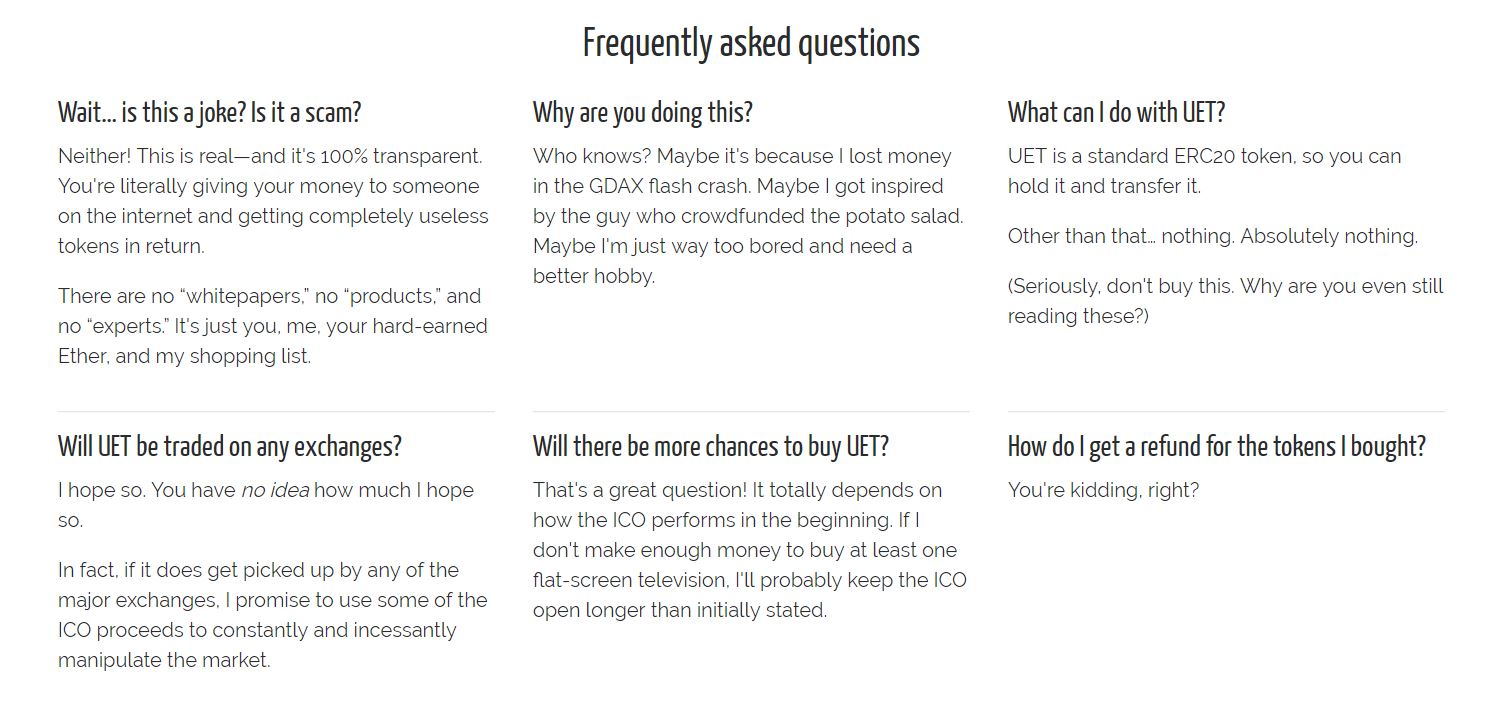

When it comes to cryptocurrency markets, the ICO is the new black. Nevertheless, apart from a few black swans, we have seen how so many ICO investments quickly turn into pump and dump schemes. Some might say that the euphoria is completely out of hand; some others are determined to prove it while they profit from it. The Useless Ethereum Token – UET – is probably the most cynically comical token to show how easy it is to raise money in this market. The UET case also shows some other ICO market phenomena, which accentuates the perils of the world we live in.

How Long can a Token like UET Stay in the Black?

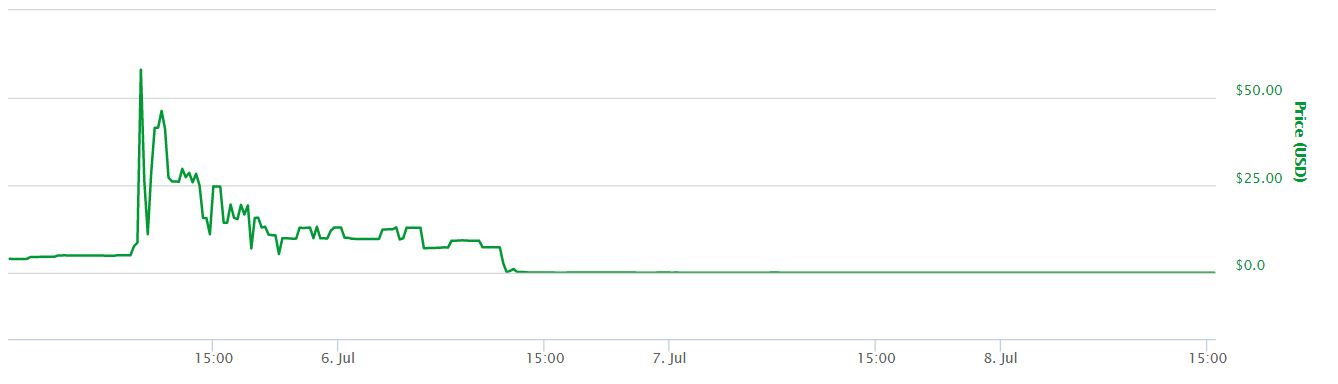

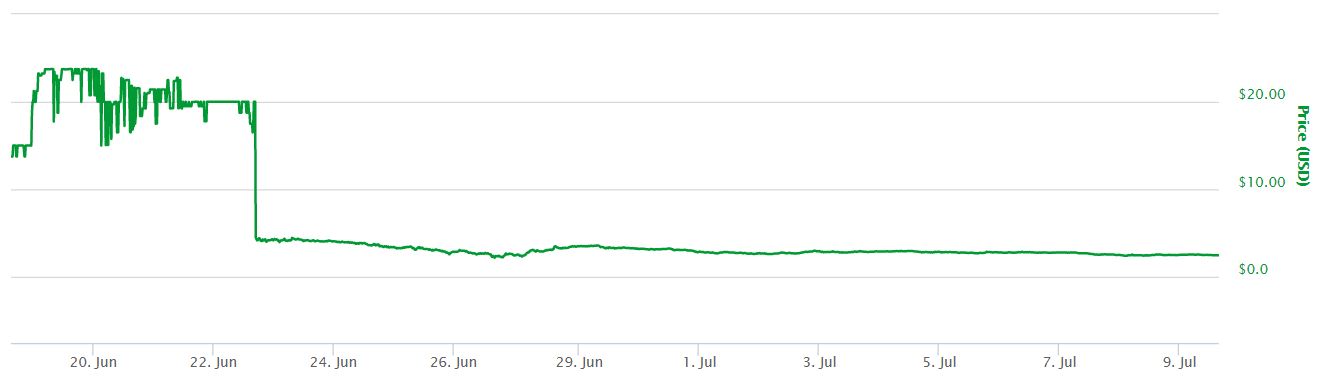

One of the most striking phenomena that the Useless Ethereum Token shows is that these new tokens rarely stay in the black for long. The pump and dump starts early on, and it seems that most investors are interested in these ICOs because they can take advantage of FOMO in the secondary market. What the project is about, who is behind it and whether it can deliver or not, seems to be less important.

The $51 Million USD Attack

ICO markets are showing us that anyone with deep enough pockets and a sharp mind can make a killing in minutes, and take advantage of FOMO effectively. These ICOs show how cryptocurrency markets shifted from fearing the 51% attack to euphoria over the $51 million USD attack – although some would say that we should not classify tokens as cryptocurrency at all. This makes it potentially easier for projects like the Useless Ethereum Token to find investors, despite being utterly ridiculous, while legitimate projects might sink due to the pump and dump schemes.

The True, the Deceitful and the Ugly

The Useless Ethereum Token and the nature of these $51 million USD attacks on ICOs expose another paradoxical phenomenon. It seems that truth and deceit in ICO markets are intertwined in such a way that investors can no longer find the line that separates the rational from the irrational. The Useless Ethereum Token mocks the way ICO markets value honesty. Despite telling us that the UET is as useless as the most useless token could ever be, the creator of the contract raised over 250 ETH – more than $60,000 USD – so far. This shows how investors are still willing to deceive themselves when someone tells them the truth, or how shrewdly rational they are to capitalize on the irrationality of FOMO in secondary markets.

The aim of the creator of the Useless Ethereum Token was to show the degree of irrationality in the ICO markets. UET’s success is a monument to ridiculous investment choices, and a testament to the degree with which people out there value the truth. Many ICOs out there make promises that are as ridiculous as the choices of a sizeable number of investors – judging by the movement of these tokens in secondary markets. Interaction between truth and deceit is turning ugly.

How to Distinguish the Random Useless Ethereum Token from the Useful ICO?

The Useless Ethereum Token delivered on every single tongue-in-cheek promise it made; other tokens cannot possibly deliver on the seemingly serious promises that their creators pledge to. Valuable ICOs that have a chance of delivering on their goals, are somewhere in the middle. The challenge is to be able to tell which can deliver and which can’t within that spectrum, or maybe not. Maybe ICO markets in general, and the Useless Ethereum Token in particular, will succeed in proving that the only thing that matters is how far certain ICO investors can pump until they dump on irrational investors willing to throw their money away because they cannot control their FOMO. Investors beware: you are living in the not so strange yet cynically comical world of the Useless Ethereum Token and its derivatives. Make sure you stay in the black!