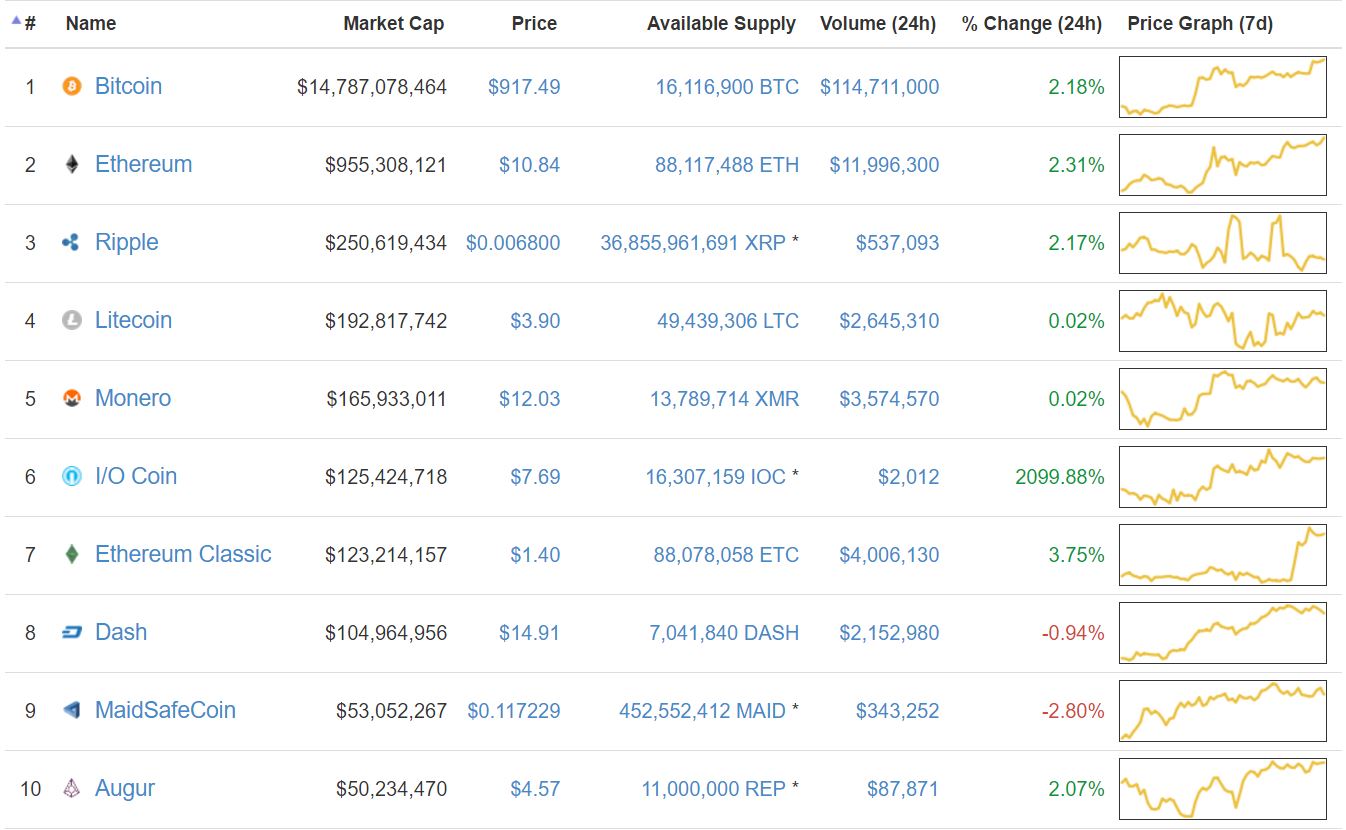

Pump And Dump Hits I/O Coin

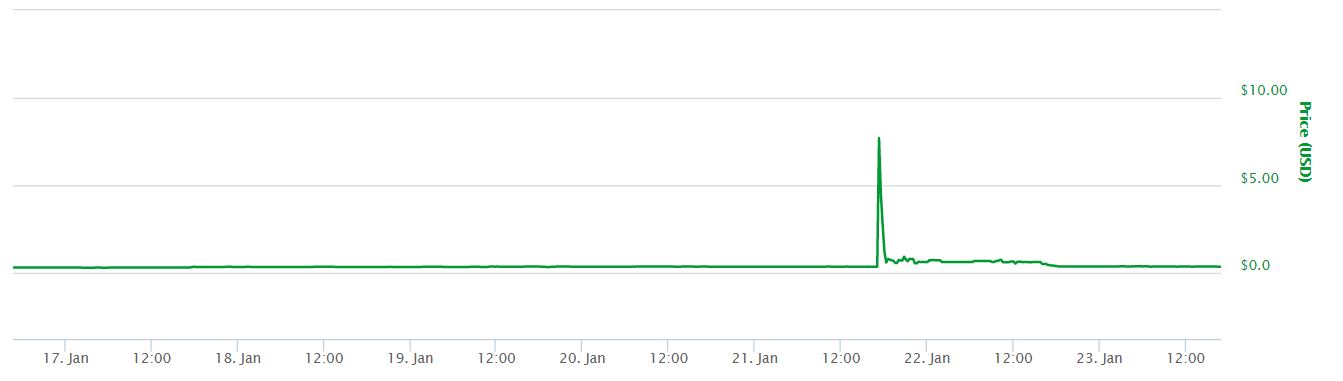

Cryptocurrency markets have seen their fair share of pump and dump schemes. Few make it into the headlines. This weekend, markets witnessed a spectacular pump and dump on I/O Coin that captured the attention of enthusiasts all around. Despite the sudden rise and subsequent normalization of I/O Coin prices, the brief hype served to highlight the attributes of an interesting blockchain project. This serves as a warning to all cryptocurrency enthusiasts out there. No matter how sound a project is, investing often carries a high degree of risk, especially since no one is fully aware of the intentions of big, anonymous investors.

I/O Coin beyond the pump and dump

Part of what makes these pump and dump schemes so profitable for those who understand how to make them happen and have the resources to do so, is because they are often based on investments in promising projects. This is definitely the case of I/O Coin, which at a glance displays features that are likely to attract the attention of the average cryptocurrency enthusiast out there:

- I/O Coin experimented with a switch from PoW to PoS. Miners mined for a period of time with a PoW system, and then launched the coin under a PoS scheme.

- This blockchain project claims to be more energy efficient than bitcoin.

- I/O Coin holders may also get interest on their balance in their wallets.

- HTML5 wallets and a system of avatars that lets users send funds to other users by using the name of their avatar instead of the cumbersome public address, enhances the user friendly nature of cryptocurrencies.

Attractive value-creating attributes coupled with price rises

All these I/O Coin attributes do have the potential to create real value in the world, but how much? When it comes to the behavior of the markets, there is a point in which that doesn’t matter. Investors see an asset’s price is rising, and the binge buying starts. Soon enough people start buying just because others are doing it, expecting the price of the asset to continue rising. Everyone loses track of the real potential value of the asset, except for those who gave it an initial push.

Pump and dump experts

The investors who get all the hype started, often have deep pockets. They start buying considerable amounts of the asset they want to pump – I/O Coin in this case. Then they suddenly stop buying, seeing that other investors are joining the binge. Some pump and dump experts also recur to forums and chat rooms to drive the hype around an asset even higher, prompting more unsuspecting investors to pour funds into it. Then once they made enough money, and they know there are enough people out there eager to put their hands on the asset they hold, they start the fire sale, dumping everything they have before it is too late.

I/O Coin pump and dump lessons

In the case of I/O Coin and any other cryptocurrency, pump and dump schemers enjoy several advantages:

- Cryptocurrency markets never sleep. They are really open 24/7.

- Many cryptocurrency enthusiasts are tech savvy and know their math. They can build trading algorithms and automate the whole pump and dump scheme.

- Cryptocurrency traders enjoy additional layers of anonymity when they trade in comparison to traditional asset traders. This makes it more difficult to identify trends that could be used as a future warning.

- Altcoin markets are thousands of times smaller than those of traditional assets, making it easier to pump with a smaller amount of funds available.

This means that cryptocurrency investors, like those who bought I/O Coin close to its peak, didn’t have many warning signs to alert them about what was about to happen. The greatest lesson they can learn from this case is to keep the focus on the real potential value of the asset. Investors should ask themselves if variables such as adoption/usage rates for the altcoin they are investing in, justify the current price.

Satoshi Nakamoto’s wisdom

In other words, Investors should internalize Satoshi Nakamoto’s words in order to avoid pump and dump schemes: “A rational market price for something that is expected to increase in value will already reflect the present value of the expected future increases. In your head, you do a probability estimate balancing the odds that it keeps increasing.” Pump and dump schemes almost always look like they are irrational. I/O Coin definitely displayed an irrational price pattern. Despite its promising attributes, the odds that its price would keep increasing were slim to none.

Click here to read more about the I/O Coin project.

Investors bear all the responsibility over the outcome of any investment made on the basis of the information presented by this article. Bitcoin Chaser and the authors of this article have no intention of encouraging or discouraging investment in any cryptocurrency nor are they endorsing I/O Coin in any way.