Is Kim Dotcom’s $2000 USD Bitcoin A Pipedream?

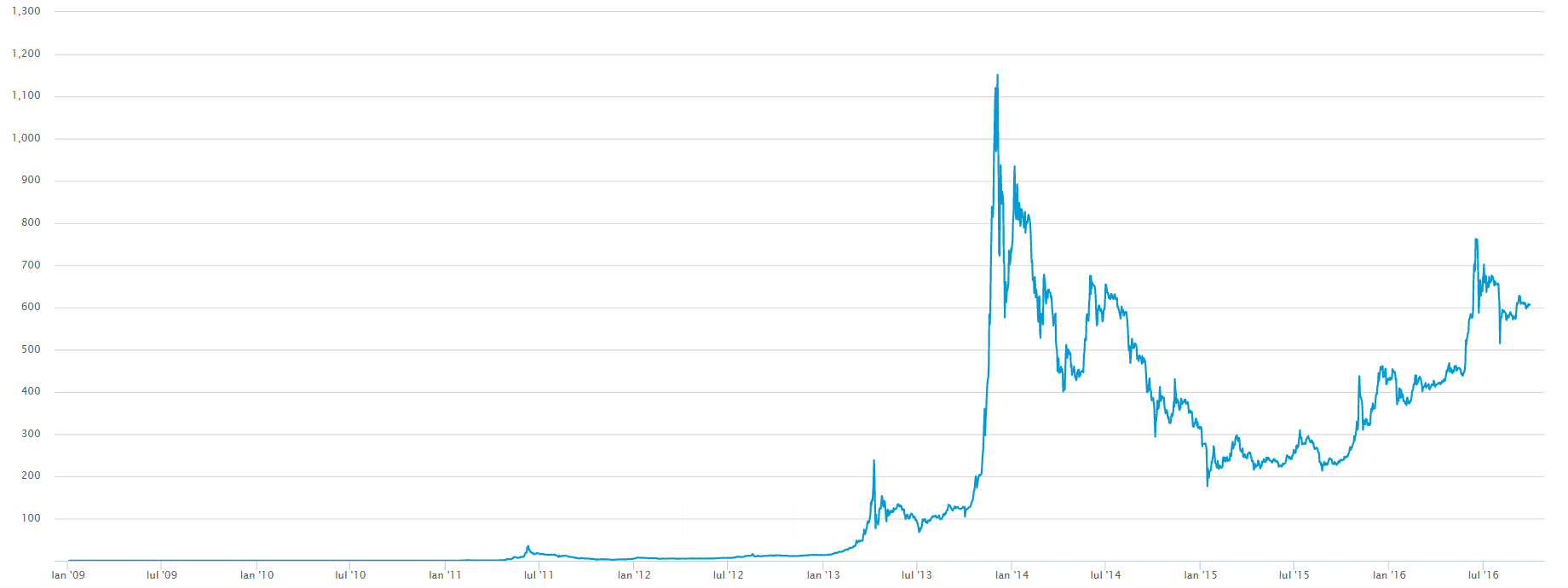

For some it would be difficult to believe that bitcoin commanded more than $1,200 USD at some point in time, but it did. The pioneer of the P2P internet money revolution reached that mark in November 2013. With bitcoin garnering about half of that amount now – even after the most recent halving – some of those who saw it balloon north of $1,200 USD, would like to believe that it will go back up to or above that value. Even Kim Dotcom recently tweeted that bitcoin will grab $2,000 USD within the next 2 years. History however, has proven otherwise, and bitcoin is not the only cryptocurrency that has so far failed to match or surpass previous peaks.

Cryptocurrencies Skyrocket

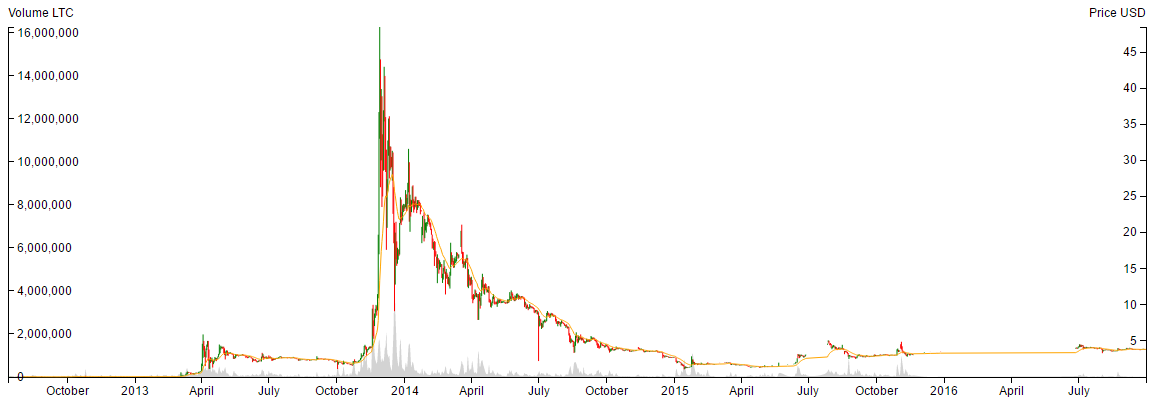

In fact, almost all – if not all – cryptocurrencies have seen similar boom-bust-smaller boom patterns, with varying degrees of success after landing. The biggest names on the list have all gone through it or are potentially going through it now. It happened to Litecoin and Dogecoin; some would even argue that it is happening to Steem, Ether, Ether Classic and even Monero right now. Most of the latter cryptocurrencies are still in their infancy, so it would be unfair to compare them to more mature ones, but they could well be displaying the same kind of behavior. Only time will tell.

Cryptocurrencies Crash-Land

In the meantime the two glaring examples, which have been around the longest and might provide evidence to support this boom-bust-smaller boom pattern, are Bitcoin and Litecoin. The following graphs serve to illustrate the point:

Will Bitcoin, Litecoin or any other Cryptocurrency Return to its Peak?

In cryptocurrency markets like in almost any other field or sub-field, hindsight is 20/20. Foresight however, could well fall into the realm of the (almost) impossible. This means that there is probably no one out there who can assert that any cryptocurrency will go back to its glory days. On the flip side, many would argue that hindsight really blurs our ability to assess the future, given that those historical peaks are points of reference that could well be shattered. In fact, historical analysis of different assets shows that peaks which seemed to be unsurmountable, were later dwarfed against every expectation.

Final Thoughts

Therefore it is difficult to assert that these digital assets will not climb back to and beyond their previous peaks. The evidence shows that so far, they haven’t been able to. As skewed as this perceived vantage point might be, it is helpful to contextualize it in order to gain a better understanding of the situation. Ever since bitcoin hit the $1,200 USD mark, cryptocurrency markets have exploded. The applications of blockchain technology have mutated and blockchain permeated industries in a way that few could have imagined back when Satoshi Nakamoto published his (her, their) white paper.

This means that projects like bitcoin may now face competition – or even technical/organizational/political difficulties – that will prevent them from climbing back to their previous peaks, despite Kim Dotcom’s optimism. Even Ether could well be trapped below the $20 USD mark due to the advent of competing projects – chief among them Ethereum Classic. So this boom-bust-smaller boom pattern may well hold true, at least beyond the 2 year horizon that Kim Dotcom has drawn in the sands of his hourglass.