Cryptocurrency Markets Celebrate The SEC Decision On Bitcoin ETF

On Friday bitcoin fell quickly following the SEC decision on the ETF. After hitting a low of $1,022 USD it quickly recovered. Other altcoins rose as well following bitcoin’s recovery. This phenomenon and the continuing rally, may well cause a shift in how analysts approach cryptocurrency prices. Analysts and experts argued that bitcoin price could go down if the SEC would have decided to reject the proposal that the Winklevoss twins made four years ago. Nevertheless, most failed to predict how far down it would go, how other cryptocurrency markets would react and how low bitcoin prices would go.

Some Experts Provide Answers Through Social Media

The market reaction shows how cryptocurrency fluctuations can take analysts by surprise. There is no doubt that human beings are not good at predicting the future, so these surprises are somewhat expected, but there are some experts that may give us a helpful hint to re-arrange our analytical paradigms. Social media was buzzing with these hints following the SEC decision. Among these, one published on twitter by Andreas Antonopoulos provides the biggest insight of them all. Antonopoulos said “If you measure bitcoin’s success by the approval of the incumbent and obsolete industry it replaces, you’re doing it wrong”.

No ETF, No Problem!

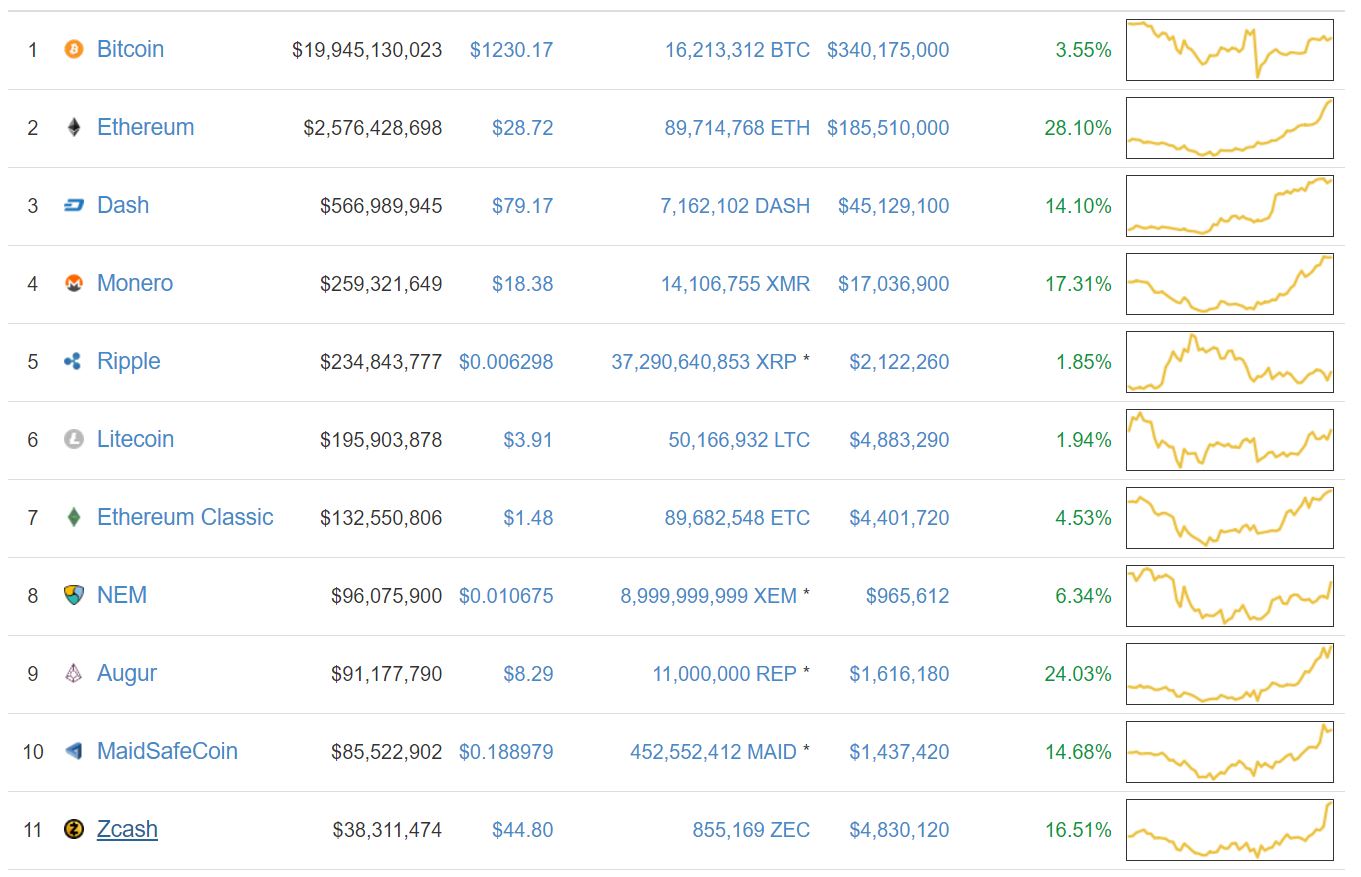

Antonopoulos’ remark should be obvious to most, but many analysts and experts just didn’t take this fundamental variable into consideration. Cryptocurrency markets are indeed the “anti-market”. This means that the SEC decision may well have an effect opposite to the one expected on the markets. This is probably the main reason why altcoins soared across the board following the decision, even when bitcoin prices were reeling. Immediately following the report about the SEC decision, leading cryptocurrencies grew:

- Ether went up by 10%.

- Dash registered a 39% increase in price.

- Zcash gained 8.30%.

Conventional Cryptocurrency Wisdom

Cryptocurrencies also seemed to briefly break away from conventional wisdom. Experts and analysts have seen a pattern in which a rise in bitcoin prices would lead to a rise in the prices of other altcoins. During the last few weeks, the crypto community seemed to be sure of that the SEC would approve the bitcoin ETF. This led to the recent all-time highs in the prices of other digital currencies such as Dash and Ether.

A New Paradigm for Cryptocurrency Markets is Born in an Environment of Higher Volatility

On the other hand, volatility in cryptocurrency markets might be higher than usual at this point. This is however, the first time that other cryptocurrencies experience considerable decoupling from bitcoin, while the latter is still climbing back towards its previous all-time high. It almost looks like a new paradigm is galvanizing: When the conventional economy experiences times of crisis, people invest in bitcoin. When bitcoin is in crisis, investors buy into other altcoins. To take Antonopoulos’ logic further, anyone who measures the reactions of cryptocurrency markets by the logic of ‘panic selling’ present in incumbent and obsolete markets, might be doing it all wrong!