SEC Rejects The Winklevoss Bitcoin ETF

The world of cryptocurrency has been waiting for an SEC decision on the fate of the first of three proposed bitcoin ETFs. The Winklevoss twins, who gained notoriety for their involvement in the advent of Facebook and later for their bitcoin ventures, saw their ETF proposal crumble today. The SEC rejected the Winklevoss bitcoin ETF on the grounds that “the Commission believes that the significant markets for bitcoin are unregulated” according to a Business Insider report.

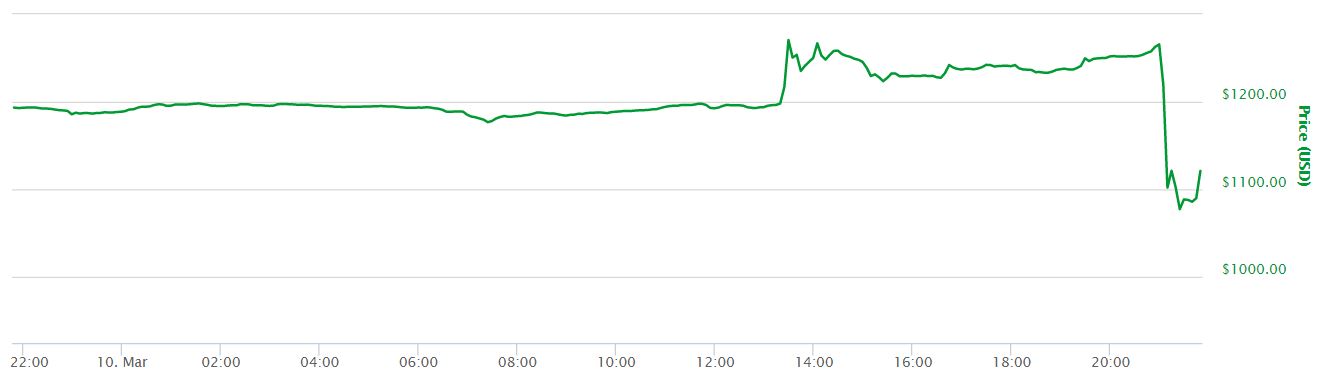

Price after the SEC rejected the Winklevoss Bitcoin ETF

Bitcoin prices immediately stumbled to a low of $1,022.68 USD, after reaching a high of $1,289.68 USD on March 10th, 2017. There is no doubt that there was a lot of optimism in the market regarding the outcome of the decision on the Winklevoss bitcoin ETF. The SEC decision clearly took bitcoin markets by surprise, but the drop was far away from the doomsday scenarios that some analysts were expecting. Many had bitcoin going as low as $850 USD if the SEC didn’t approve the ETF.

Is there hope for a Bitcoin ETF still?

There might be good news and bad news for investors who are interested in a bitcoin ETF following this SEC decision. The good news is that the asset itself is showing higher than expected resilience. This is the second time this year that a government or government agency has made a decision that influences bitcoin prices negatively. Nevertheless, the digital asset is still above the $955 USD mark with which it ended a record year in 2016.

The bad news is that after the SEC rejected the Winklevoss bitcoin ETF because “the significant markets for bitcoin are unregulated,” there is little hope for the other two bitcoin ETF filings that the SEC will review. Market regulation for bitcoin might not be able to change as radically as it would need to, to get the SEC to approve any other bitcoin ETF. The characteristics of this digital asset do not allow for the degree of regulation that other commodity markets around the world enjoy.

Invest in Bitcoin Anyway

Other regulators around the world may not be too keen to approve an ETF that the SEC rejected. Nevertheless, there is a remote possibility that regulators in other countries will consider the opportunity. In the meantime, investors can still choose to pour their funds into bitcoin anyway. Anyone can buy and sell bitcoin easily through the myriad of cryptocurrency exchanges that have been established in the last few years. In fact, investors might be better off buying bitcoin directly from trusted or even regulated bitcoin exchanges. If they do so now in any case, they would be buying the same resilient asset they wanted to invest in through the ETF, at a discount. They might even get away with paying lower fees than they would have, had they bought shares in the Winklevoss bitcoin ETF.

Click here to read the Business Insider report.