Cryptocurrency Markets Wipe $200 Billion USD On First Week Of CME Futures Trading

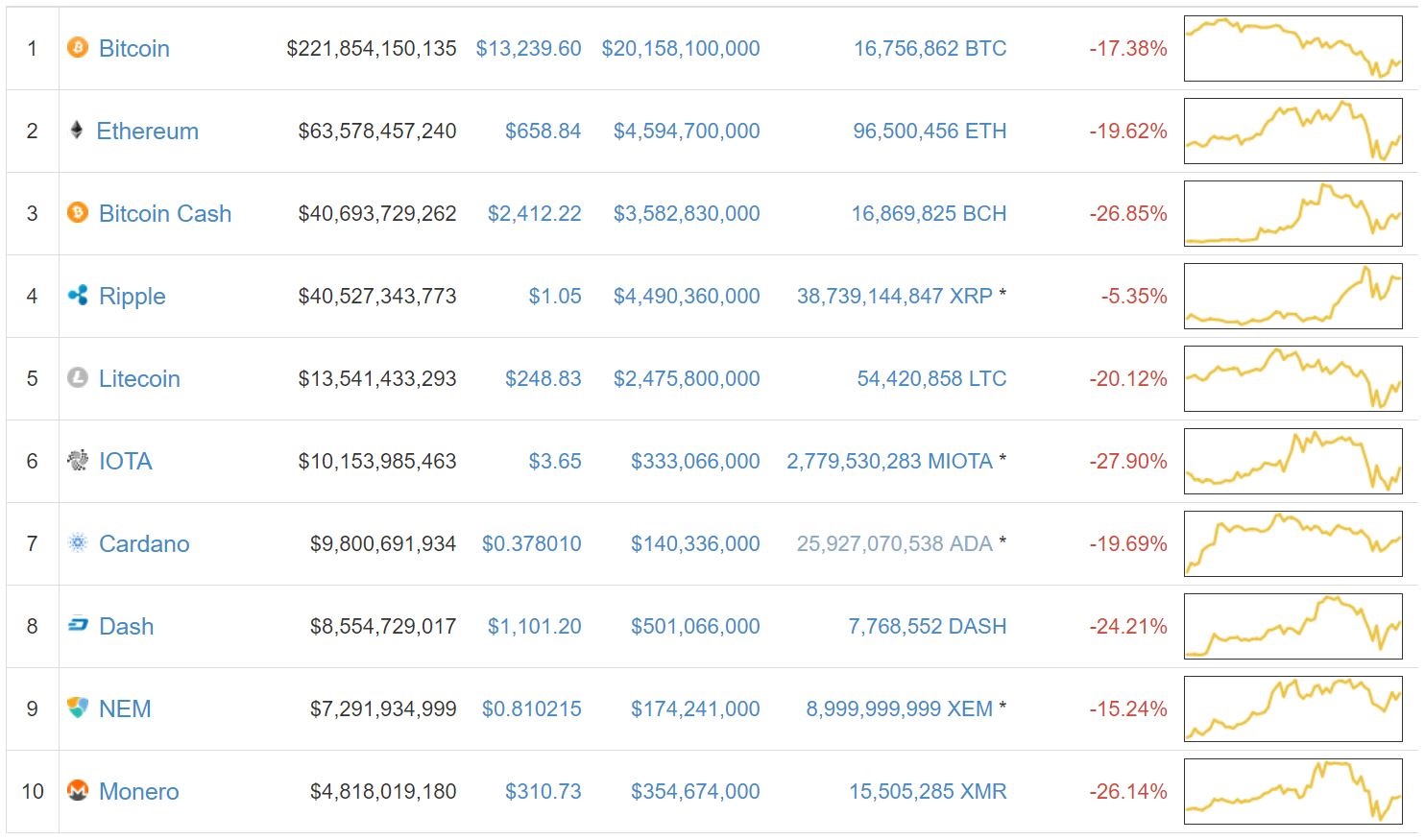

What amounts to “another day in crypto” for cryptocurrency enthsiasts, is a disaster for the mainstream. As CME Bitcoin futures trading opened, Bitcoin prices fell and cryptocurrency markets followed, wiping $200 billion USD

December 22nd, 2017, will go down as Crypto Black Friday. At least that is how mainstream media and critics will see it. Cryptocurrency markets tumbled, wiping more than $200 billion USD in less than 24 hours, which constitutes a monumental loss for those who are not used to these markets. What cryptocurrency enthusiasts might label as ‘another day in crypto,’ can generate a completely different reaction from institutional traders. On the first week of CME Bitcoin futures trading, these institutional traders got a taste of how cryptocurrency markets behave.

Bitcoin Prices Plummeting Since Sunday

Leading up to the CME Bitcoin futures trading hype, the price of the cryptocurrency advanced, touching the $20,000 USD mark on Sunday just before futures trading started. From the moment CME Bitcoin futures were launched, the situation changed, and prices started going down significantly. Bitcoin dipped below $12,000 USD before recovering some ground. The rapid decline triggered CME and CBOE trade halts.

CME Bitcoin Futures Traders vs Hodlers

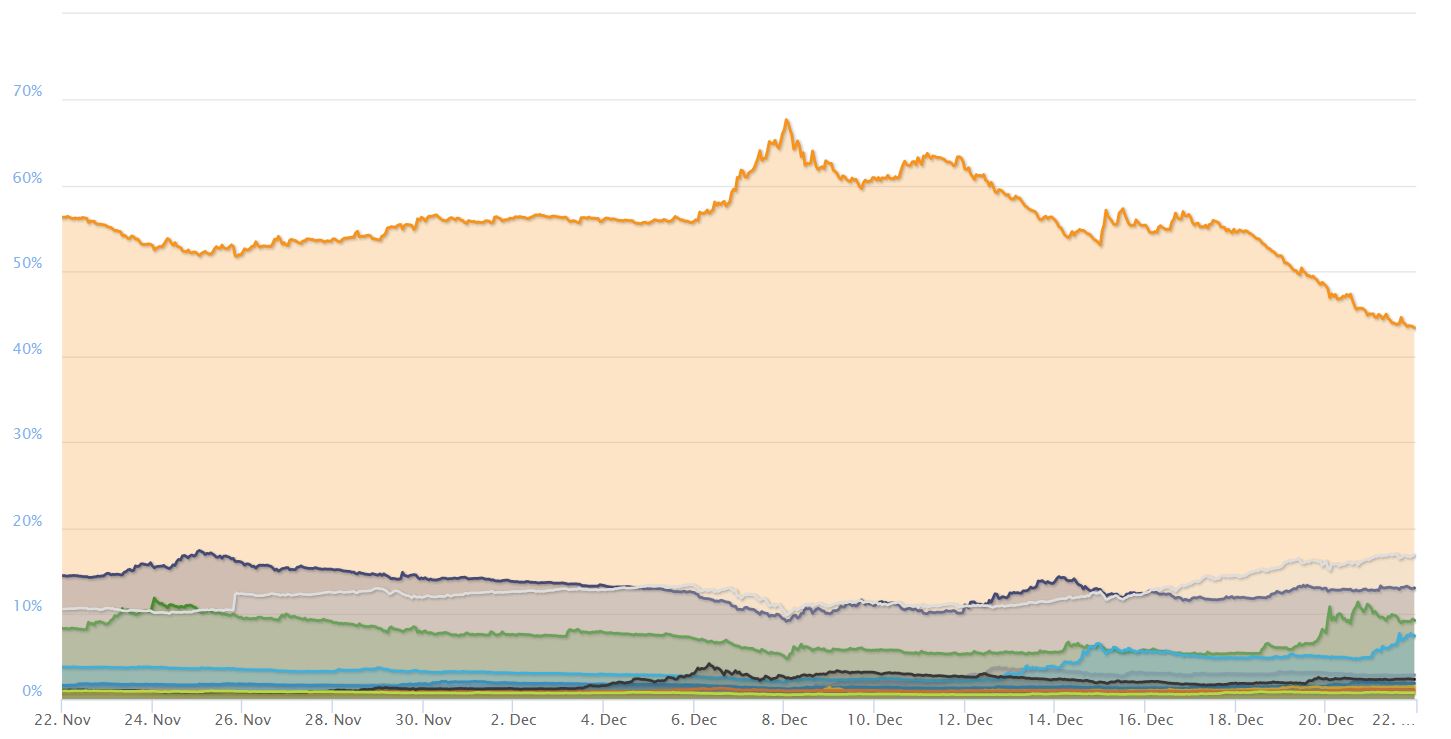

CME Bitcoin futures dropped by as much as 15%, highlighting the sharp differences between trading futures contracts and holding the underlying asset itself. CME Bitcoin futures traders can profit from prices going up or down, whereas Bitcoin holders have less tools at their disposal to short the asset and profit when prices go down. Cryptocurrency traders often resort to other cryptocurrencies to bet on lower future Bitcoin prices, which is probably the reason why Bitcoin dominance declined steeply as the prices of other cryptocurrencies rose. Bitcoin dominance is currently below the 45% mark for the first time in months.

CME Bitcoin Futures Depend on Exchange Prices

As much as cryptocurrency traders depend on other cryptocurrencies to profit when Bitcoin prices drop, they also make the CME Bitcoin futures markets. This is because futures traders get their prices from the trading on 4 different exchanges. This restores some of the strength that real market activity has, reigning in the kind of speculation mainstream markets are known for. Nevertheless, mainstream media and experts will continue to focus on how much Bitcoin prices have fallen recently, recurring to confirmation bias.

Bitcoin is as Strong as it Was When It Hit $20,000 USD

Bitcoin however, is as strong now as it was on Sunday when it hit the $20,000 USD mark. The only variable that has changed since, is the amount of transactions going through the network, which has slowed it down, highlighting scaling issues once again. Therefore, the focus on the recent fall in prices is misleading. Not only is Bitcoin still up about 1300% from the beginning of the year, but it has also solidified its base after the Bitcoin Cash fork and SegWit approval. As Bitcoin and other cryptocurrencies continue to evolve, upgrading their capabilities, their core value will remain high. When cryptocurrency markets tumble to $422 billion USD from a peak of almost $647 billion, it is helpful to focus on their $20 billion USD valuation at the beginning of the year.