The Bitcoin Price Index (BPI), also known as the CoinDesk Bitcoin Price Index (XBX), shows the price of Bitcoin against a number of other crypto and fiat currencies.

The BPI is a method of tracking the performance of Bitcoin (BTC) against one or more altcoins. It was a standardized measurement created by Coindesk so as to counter the problem of price discrepancies against various cryptocurrency exchange platforms. It was based on taking the pricing data from the most reliable exchange platforms and calculating the median price for all cryptocurrencies. This median price is then shown in a USD-denomination so that it can be easily understood by investors. The algorithm is set to adjust in real-time, to provide the most accuracy.

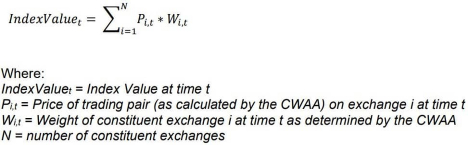

The calculation formula used by Coindesk is called the Constituent Weighting Adjustment Algorithm (CWAA) and works as follows:

What are the criteria for being added to the Coindesk BPI?

Quoted directly from Coindesk’s Single Digital Asset Price Indices Methodology, the exchange eligibility criteria are as follows:

- Prior three-month trading volume (as measured by base currency) on the exchange must represent a target minimum percentage of total trading volume across all eligible exchanges for the trading pair as follows:

- For constituent exchanges, the minimum percentage is 5%.

- Non-constituent exchanges with a minimum percentage of 5% will not be eligible for the current rebalance but will be placed on a watchlist to be considered for the next reconstitution.

- For exchanges on the watchlist, the minimum percentage is 6%. Watchlist exchanges that drop below 5% will be removed from the watchlist.

- Must support USD-denominated trading for the single asset.

Which exchanges are included in the Coindesk BPI?

The original three exchanges from 2013 were Bitstamp, BTC-e, and Mt. Gox, as they comprised of 30% of all USD-denominated trading at that point. Since then, Mt. Gox went bankrupt after it was hacked and its users’ cryptocurrency stolen. However, over the years many other exchanges have been added, including Bitfinex, Binance.US, BitFlyer, Bitstamp, Bittrex, Coinbase Pro, ErisX, FTX.US, Gemini it, Bit Kraken, LMAX Digital and Okcoin.

What is the purpose of the Coindesk BPI?

The BPI’s function is to provide a standardized exchange value for cryptocurrencies across all cryptocurrency exchange platforms, so that cryptocurrency holders will have an accurate idea of their cryptocurrency’s value. In this way, cryptocurrency investors will be less likely to fall for scams.