The Story Behind The Rise Of Dash

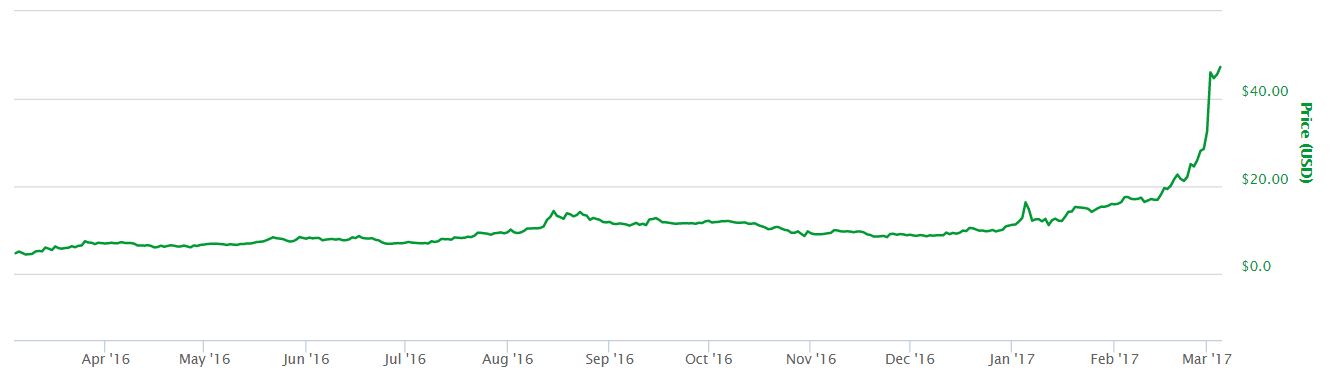

Dash prices have been rising steadily since the end of last year, but February and the first few days of March 2017, saw Dash prices sky-rocket. As a result the cryptocurrency is now the third biggest in terms of market cap, although prices seem to have found a more stable footing over the last 48 hours. As with any meteoric rise in cryptocurrency markets, some have raised suspicions about a pump and dump scheme. There is no doubt that pump and dumps are always a possibility, but Dash doesn’t seem to fit the typical pattern of a pump and dump scheme. The story behind the rise of Dash has many more nuances that should be considered.

Controversy Surrounding Dash

To understand whether or not recent price increases are indeed part of a pump and dump scheme, the first thing analysts need to focus on is the history of the cryptocurrency. In the case of Dash, there are some red flags. Dash critics will point towards the mining issues that the cryptocurrency went through back when it was called Darkcoin. Evan Duffield, the founder of Dash, was able to mine a significant quantity of the cryptocurrency within the first 48 hours of its creation. Some believe that this was due to a glitch in the code that Duffield proceeded to fix. Others think Duffield did this deliberately to enrich himself.

Ancient History

More than 3 years have passed since that “glitch” made Duffield the richest man in the Dash economy. The cryptocurrency went through a long period of price stagnation, even at a time when bitcoin was seen as vulnerable and Dash presented an alternative. Duffield and other fellow Dash developers cultivated a healthy community around the cryptocurrency. They rebranded the coin and took care of making it as useful as possible, connecting it to existing crypto products and services. It seems their efforts and the characteristics underpinning Dash have finally taken off. The markets seem to be rewarding Dash holders.

Criticism of Dash

Nevertheless that whole “glitch” at the beginning still casts a shadow over the coin. Accusations of “whales” pouring funds into it and generating hype abound and seem to be feeding pump and dump allegations. This coupled with criticism over the centralization of decision making within the Dash network, remain.

Nevertheless, this cryptocurrency seems to work. It looks like it is based on sound principles, and its critics might be over-stretching their arguments. The whole issue with the mining “glitch” is a perfect example. Taking bitcoin as a model – which Dash did, even offering some solutions to privacy, fungibility and transaction speed issues – it would be fair to judge Satoshi Nakamoto the same way that Duffield is judged. After all, Nakamoto mined bitcoin aggressively at the beginning, accumulating as many as 1 million coins. That is worth well over $1 billion USD at the moment. If Duffield did the same, critics should afford him the same treatment they afforded Nakamoto.

Dash Pump and Dump?

Apart from this credibility issue, the whole “whale” argument also seems to be over-stretched. Pump and dump proponents seem to think that Dash is vulnerable to huge investors buying significant amounts of the cryptocurrency to pump its price, generate hype, and then sell all their Dash assets at once.

Theoretically, an asset-class with a $300 million USD market cap – give or take – is susceptible to such schemes. Then again, so are other cryptocurrencies like Litecoin for example. Any “whale” can buy 10% or 15% of all Litecoin as easily as they could buy 30% of all Dash available before the surge and then dump it. Yet somehow it is inconceivable for someone to do that on such a mature network like Litecoin. Dash is also a mature cryptocurrency by now, having been in the markets for over 3 years. It would be much easier and much more profitable and cheaper to design a pump and dump scheme for any other new cryptocurrency than to pump and dump Litecoin or Dash for that matter.

Is the Rise of Dash based on Solid Market Foundations? Decide for yourself

Ultimately there is no way to determine if this recent rise of Dash is due to a pump and dump scheme or not. However, the story behind the cryptocurrency might convince some people to look at Dash more objectively. This cryptocurrency has been in the market for over 3 years, it has some interesting features and its prices could well keep on rising. Ultimately, only time will tell.

For more information on Dash, visit the Dash official website or our Dash Cryptocurrency Guide to learn more.