Ethereum Flips The Coin, Reaches $1 Billion Mark

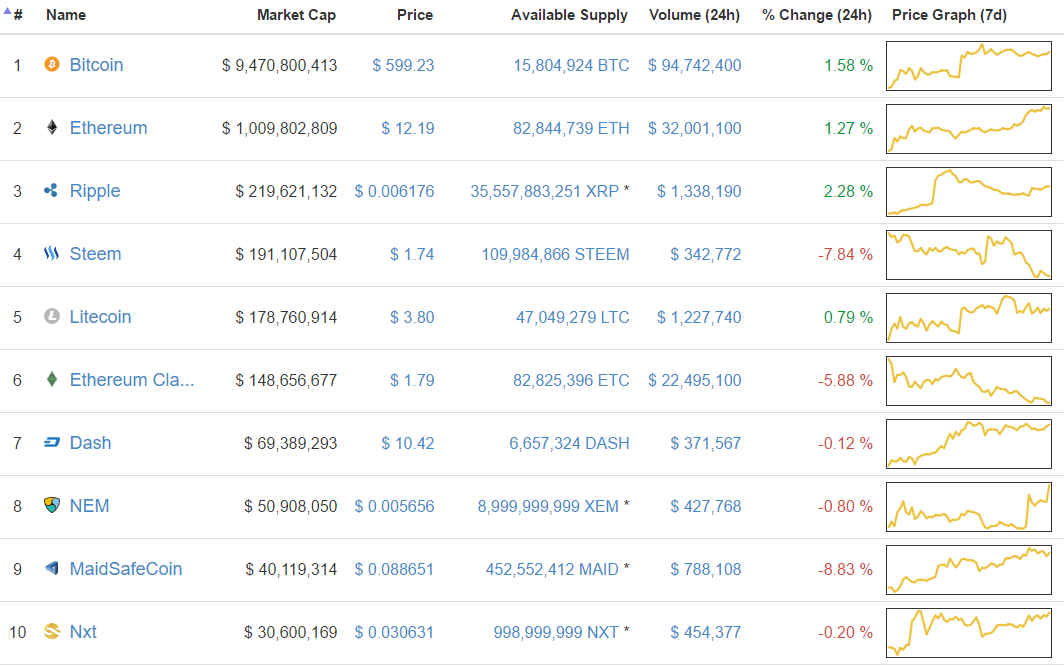

Only a week ago, Ether was in shambles. The price went as low as $8.57 USD on a combination of factors that appeared to be overwhelming the Ethereum network’s value. But its potential for value creation despite numerous setbacks and exogenous impacts, managed to attract enough investor confidence. Now, although Ether is still about 40% lower than its all-time high, its market cap is back over the $1 billion mark. This may signal that some of the fears that users and investors had surrounding the future of Ethereum, could have dissipated.

From the DAO to the Bitfinex Hack, Through a Hard Fork

Ethereum has managed to face all the challenges and survive in a surprising manner. Surviving a an attack like the one the DAO suffered, to implement a hard fork and then get hit by the fears that an attack to a cryptocurrency exchange generated, is nothing short of amazing. There is no doubt that Ethereum weathered storms that went way beyond what has become the usual rite of passage (some kind of hack) for blockchain projects, but its resilience must be taken with a grain of salt.

Ethereum’s Code shows no Failures

Investors, analysts and cryptocurrency enthusiasts must remember that through all of these attacks and changes, Ethereum’s code has not once been at fault. In fact, Ether’s value has suffered due to attacks that were never directed to the Ethereum network. Nevertheless as a result of one of these attacks, the network was forced into making a crucial change that could have undermined its long term credibility. So basically Ethereum’s weakness – if it has any at all – has more to do with the probability it will step in in the future to rescue any programmer or entity that makes a costly mistake on the network.

Long Term Growth Depends on Direction

For obvious reasons, the question about the bail out philosophy on Ethereum moving forward, will largely determine how Ether moves in the future. One way of looking at it is to attribute an increasing cost to subsequent bail outs, should the case arise. Only certain type of users may stand to benefit the most from discretionary bail outs. The degree to which the benefit of these organizations will be able to drive or at least maintain the price of Ether, doesn’t look strong.

Can Any Lessons be Learned?

In the meantime the DAO bail out with the hard fork, has been well received by the markets. Should anyone assume that a similar move in the future will yield similar results? Definitely not. In fact, it is likely to have the opposite effect despite the fact that it succeeded once. In the meantime, Ether has made a spectacular recovery from its low a week ago and has regained its second place in terms of market cap. These are great achievements to build up on, and they show just how volatile and unpredictable cryptocurrency markets can be. Despite all the analysis and all the energy dedicated to understanding them, users and investors will have to make their moves in an environment dominated by uncertainty.