World Follows In SEC Footsteps Training Sights On ICOs

Ever since the SEC came out with its study of The DAO, other regulators around the world have been following suit, training their sights on the ICO industry. Warnings from regulators in China, Canada, Israel and other countries followed. The situation might be getting tighter than many think for ICO projects. The SEC has reportedly moved beyond words, playing a role in the shut down of a little known ICO called Protostarr. But SEC and regulation are not a guarantee. History has shown as much.

SEC and Other Regulators Have a History of Failure

If the aim is to protect the public from scams, regulators focusing on ICOs are wasting their resources. The ICO industry is way too small to attract that much attention, and in many cases, it works just as the crowd-funding industry does. ICO heists certainly pale in comparison to all the white-collar crime that goes on around the traditional banking industry, where the heists seem to have the government’s blessing. It is hard to forget that a mere 9 years after the last economic melt-down was triggered by legal yet highly dangerous financial products, the people responsible for it are still roaming freely. The pensions of those who lost everything, are gone, but the SEC and other agencies would much rather focus on the ICO industry.

Following the SEC

But the SEC, as powerful as it is, cannot reach every corner of the world. Nevertheless, it does have enough influence to sway regulators in other key jurisdictions. Canada, China and now Israel, have joined a growing number of regulators around the world targeting the budding ICO industry. Scholars call this harmonization, but it is mostly the spread of fear mongering and a distraction from the real problems that those regulators should be working to solve.

Exploring the Facts

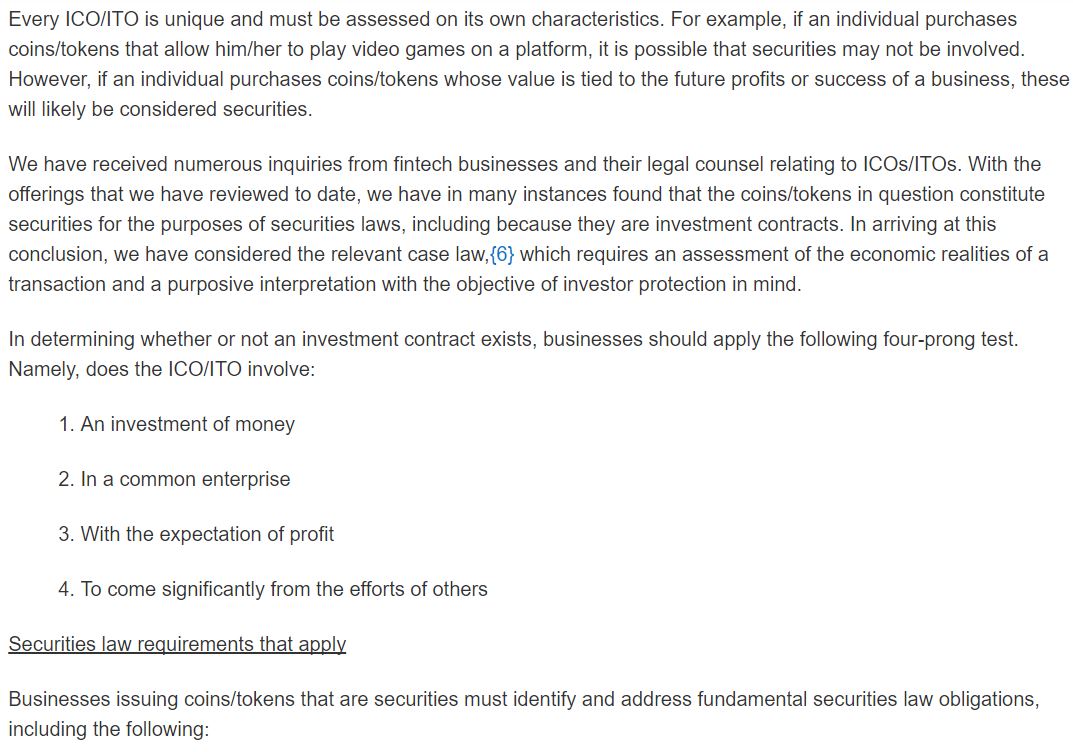

This process of ‘harmonization’ in other jurisdictions may serve to choke ICOs altogether. If ICOs have to apply for licenses, go through the scrutiny of regulators and hire an army of lawyers just to see their crowd-funding through, they will become expensive, slow outfits that will not be able to operate like they should in the 21st century. There is no doubt that some ICOs are scams. Others are not, but they fit the definition of a security. However, there are many that do not fit into either category. Those are the ones that have a chance to bring dynamic new services and products into the market.

Regulators should not be stifling them. But in the end these regulators will only harm the jurisdictions they operate in. ICOs are nimble, and will continue to look for the right jurisdictions to base themselves out of. Instead of following in the SEC’s footsteps, smart regulation agencies should be playing the opposite game. Instead of harmonization they should be countering the SEC’s footsteps, and instead of making blanket statements after analyzing The DAO or following regulation agencies that do, they should be looking at the industry as a whole before they issue warnings, draw conclusions and start targeting the most dynamic tool to raise funds we have ever seen.