Litecoin Prices Surge Surprising Cryptocurrency Markets

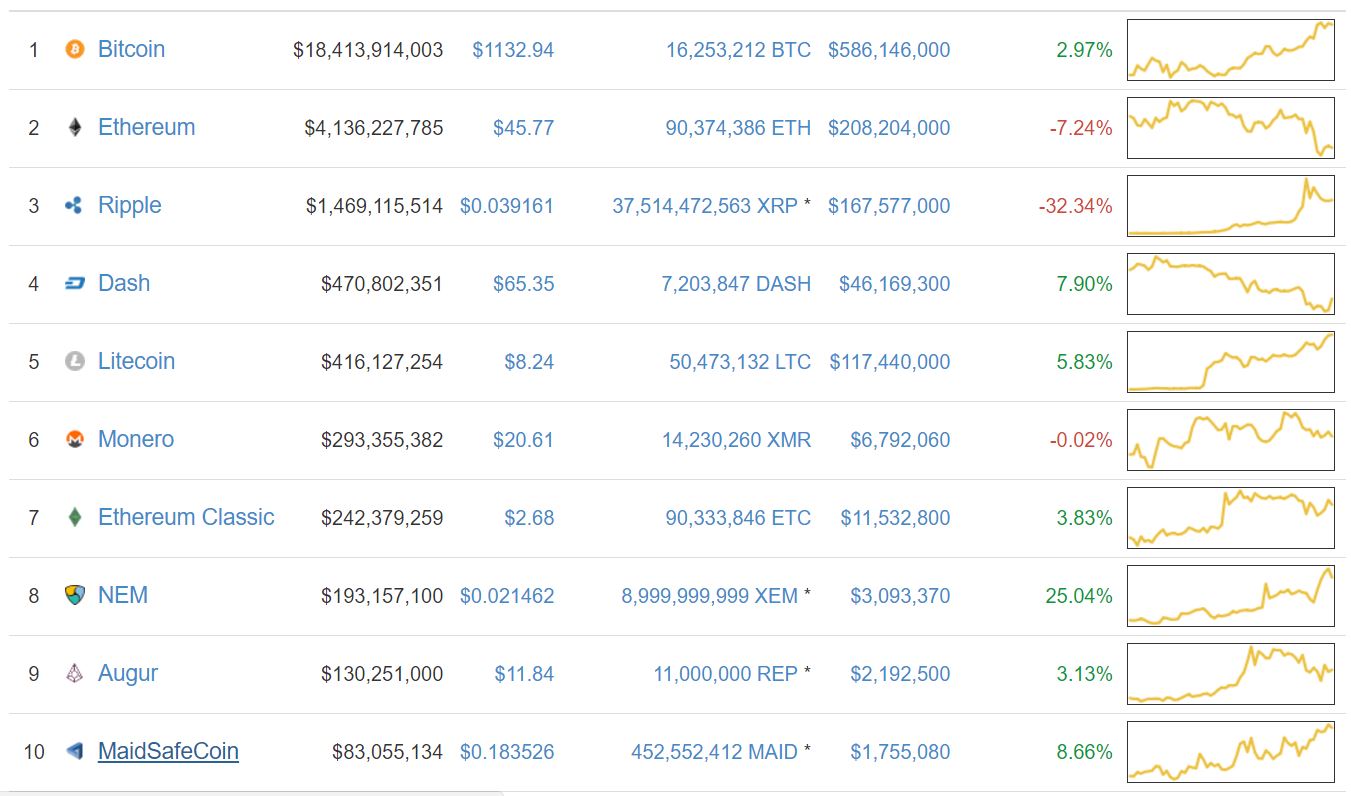

Cryptocurrency markets have been going through a wild ride for a few weeks now. The threat of a bitcoin hard fork together with PoS expectations on Ethereum and the rise of zero-knowledge have rocked the markets. Investors flocked into Dash, Ether, Monero and other lesser known cryptocurrencies, abandoning bitcoin and overlooking Litecoin. That changed over the weekend, when Litecoin prices surged suddenly to above $8 USD. No one can say with certainty why this happened, but there are a few plausible explanations.

Litecoin Prices Surge Due to SegWit Adoption

The first and most obvious explanation about why Litecoin prices surged lately, has to do with reports about SegWit signaling on its network. Litecoin works in a very similar way to bitcoin, which means it also faces some of the transaction issues that bitcoin faces. Although Litecoin transactions are supposed to be at least 4 times faster than those on the bitcoin network, because a new block takes ¼ of the time to mine on this network, SegWit can accelerate transactions over the Litecoin blockchain even more.

This means that if Litecoin adopts SegWit soon (signaling is near the 75% threshold), it could outflank bitcoin in terms of day to day micro transaction functions. This, combined with the fact that Litecoin is the closest bitcoin substitute in the market, could add a lot of value to this cryptocurrency. Under this logic, it is easy to claim that Litecoin is in fact undervalued even after the most recent surge. This should give its price more room to grow at least in the following days.

Chinese Investors Flocking to Litecoin Push Prices up

The other possible explanation for the recent rise in Litecoin prices could be related to SegWit signaling. Reports have pointed to Chinese investors pouring more funds into Litecoin lately. Chinese investors could be positioning themselves to gain from the value that SegWit adoption can bring to Litecoin. It is also possible that they would like to put their money in a cryptocurrency that up until now has not attracted the same degree of attention that bitcoin has, due to crackdown threats from local authorities.

Investors Look for Stability

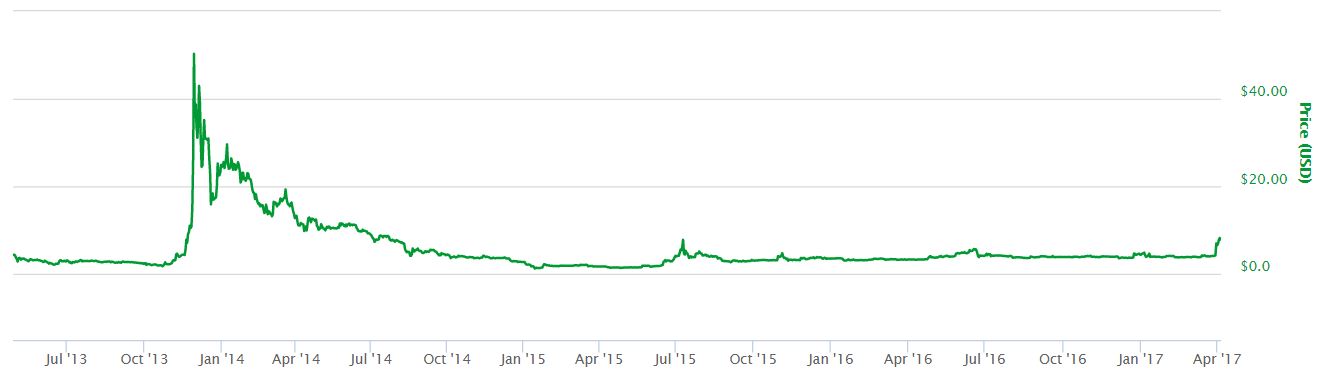

Apart from the SegWit and China angles, there are some other reasons why Litecoin might be pulling up now. Investors might be looking for stability. This sounds like a simple explanation to a puzzling phenomenon. Litecoin prices have been some of the most stable – if not the most stable – cryptocurrency prices for a long time. But then, the question would be why did investors wait until now to seek refuge in a more stable asset?

High risk/high reward moves based on unique information might be the answer to that question. While the markets were in turmoil and bitcoin dipped to just over $900 USD, investors made aggressive moves into other cryptocurrencies that have some innovative or exciting characteristics. Investors moved into zero-knowledge assets and assets that power smart contracts. Moving away from a bitcoin-like asset was the right move back then. Once the market was saturated, it was time to capitalize and move back to a bitcoin-like asset that doesn’t have the kind of political problems that bitcoin does. An asset that fits that description provides some degree of stability, and its name is Litecoin.

The Next Step for Litecoin

Now Litecoin must solidify these gains. It must go beyond a “the closest to bitcoin” tag and carve its own niche in the market to sustain its gains. The potential is there. Of all the major cryptocurrencies, Litecoin is the only one this year that has not surpassed its previous all-time high – around $50 USD. SegWit adoption will probably take Litecoin prices a step closer to this goal, but greater consumer adoption will be the key factor going forward. Without it, every possible explanation for Litecoin’s recent rise will become an explanation about why its price enjoyed a brief moment in the sun after walking in the shadow of bitcoin for years.