Are Bitcoin Bulls Back To Stay?

Bitcoin prices are rebounding after more than a year of declines. There is just no way of knowing how sustainable this market rally is, so here are a few key indicators that might shed some light on the future of Bitcoin prices

After reaching its peak in December 2017 just to face a sharp drop-off that continued into the first months of 2019, Bitcoin is finally making and sustaining its gains. The next milestone – the $6,000 USD mark – is well within reach. Recent price dynamics have given the bulls a good reason to smile, but is this going to last?

Positive Indicators

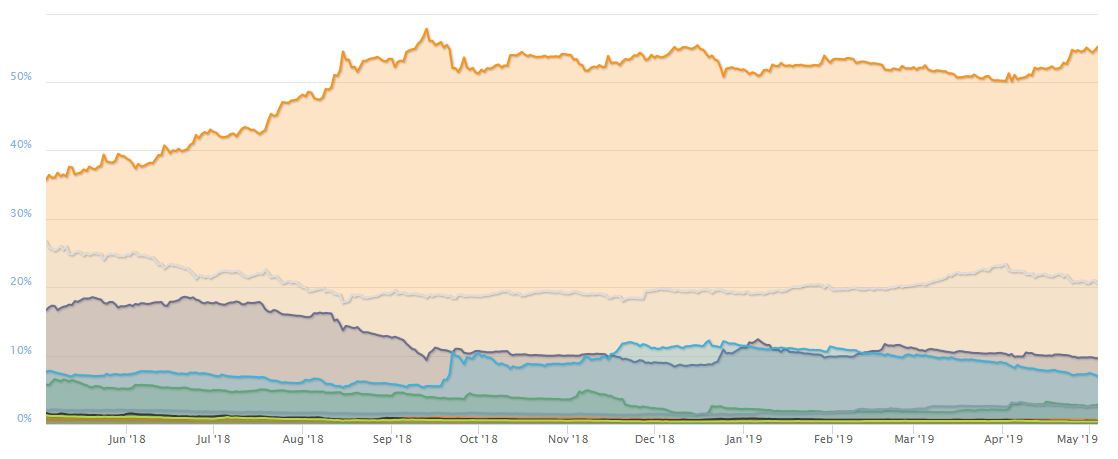

There are some positive indicators that point towards the possibility of sustained price growth. The most important one is perhaps Bitcoin’s dominance – that is the percentage of fiat value invested in Bitcoin as compared to cryptocurrency markets in general. Bitcoin dominance has climbed from 51.8% at the beginning of the year, to 55.2%.

This means that Bitcoin prices are moving not just as a result of speculators moving into the market from fiat positions. Bitcoin prices are also being supported by people who are already in crypto and are consolidating their positions by moving out of other cryptocurrencies and back into Bitcoin. The clearest example of this is the price differential on Bitfinex, where Bitcoin prices climbed to the $6,000 USD mark. The additional demand within that exchange comes as investors move out of Tether – due to the recent revelation that the stablecoin is not really backed by USD on a 1 to 1 ratio.

Speculators Still Behind Bitcoin Price Rise

Nevertheless, when prices start rising again, speculators will inevitably flock back in. This is a double-edged sword insofar as price is concerned. When speculators move into Bitcoin, prices rise faster and go higher, but once these speculators have realized their fiat gains, prices fall equally fast again.

The fiat game on Bitcoin will be the key factor in any significant price rally, especially because those looking for fiat gains, do not necessarily believe in Bitcoin as a long-term value asset. This creates a “greater fool” game in which fundamentals, technology and core value do not matter at all; price becomes a function of selling the hype to the next person in line and realizing those fiat gains. Eventually, the line runs out of people and the downturn sets in again.

So, How Long Will This Bull Run Last?

Since Bitcoin prices belong to the biggest speculators out there who can come in early enough to capture their profits at the expense of other speculators, the game is purely psychological. Trends, graphs and statistics can merely provide an indication on how the crowd has behaved historically, but will it stick to its previous patterns of behavior this time around? No one knows.

Has the wider public learned enough about Bitcoin to understand the true value behind it this time around? Only time will tell. In the meantime, it seems that the hype is gathering steam and so the bulls are back. They might also choose to stick around, but no one knows.