Bitcoin Demand In Japan Behind Recent Price Surge?

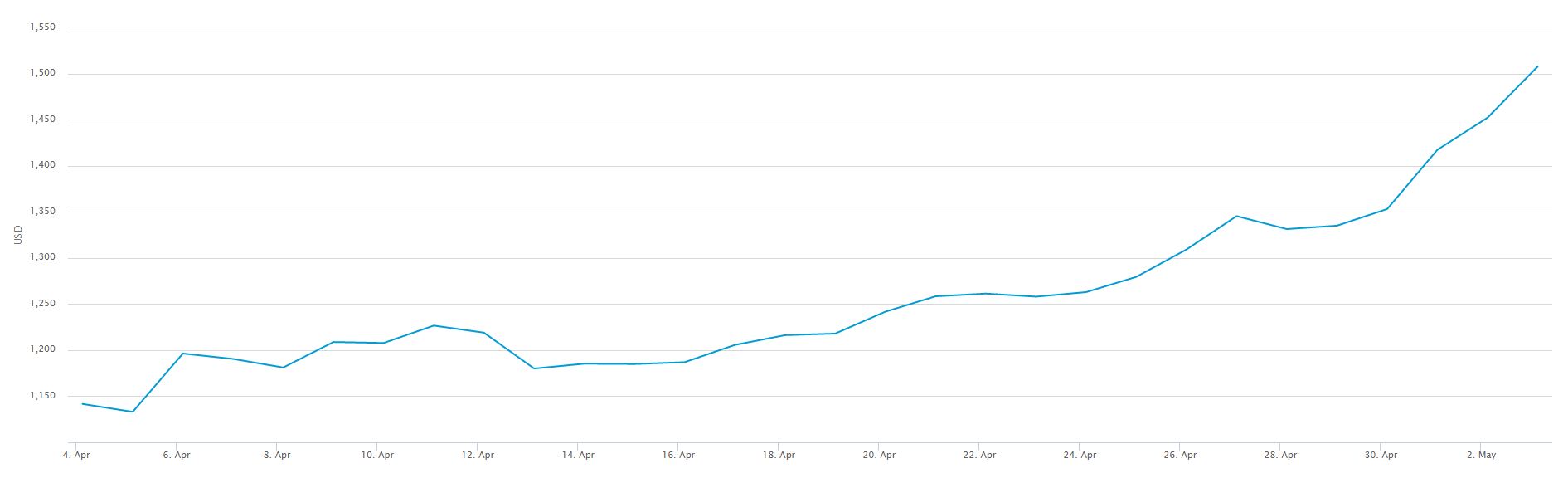

Recently, bitcoin has been establishing new all-time highs almost daily. This is probably due to the growing bitcoin demand in Japan. Bitcoin price, in fact, rose of about than 7 percent yesterday when – on May 3rd – the bitcoin spike registered on the exchanges reached a value of $1400. At press time, bitcoin prices reached $1529 USD. That is $100 more than the price registered yesterday on Kraken.

Bitcoin Demand in Japan Creates Upward Pressure

It seems that the most probable reason for this bitcoin spike is the growing demand within Japan. Bitcoin demand in Japan surged for several reasons. The main reason might be favorable bitcoin regulation in this country. Authorities declared that bitcoin is a legal method of payment in Japan. This could be the reason why we are now seeing all-time highs of above $1,500 USD.

Evidence Supporting Price Hikes are Correlated with Bitcoin Demand in Japan

It is not possible to know with a great degree of certainty that bitcoin regulation was the precursor to higher bitcoin demand in Japan. Nevertheless, there are indicators that bitcoin demand in Japan could indeed be driving prices to new all-time highs. According to data provided by Crypto Compare, during the last 24 hours, more than 50% of bitcoin trading was denominated in Japanese yen.

On May 2nd, the greatest part of world bitcoin demand came from Japan. BitFlyer was the exchange that recorded the greatest number of trades, accounting for 52% of worldwide transactions in one day. This help set a new bitcoin price record. In contrast, only 28% of bitcoin trades were denominated in U.S. dollars on that day, even when the USD is the perennial global reserve currency.

Bitcoin Prices in Japan

As I was writing this article, the price of bitcoin denominated in Yen is ¥ 8,632.27. This reflects a 2% growth in price over the last few hours. This shows that Japan is an emerging bitcoin market and a country where new bitcoin regulation seems to have opened the floodgates of demand for the cryptocurrency. It is safe to assume that when the Japanese government brought exchanges under anti-money laundering – AML – and know-your-customer – KYC – rules, while also defining bitcoin as a kind of prepaid payment system, it created the right conditions for demand to surface. Bitcoin demand in Japan might have been present for a long time, but people might have been reluctant to buy until they knew the ground rules well.

Thank Mt Gox

This is especially true after the Mt Gox collapse gave bitcoin a bad name in Japan and elsewhere. In the wake of the Mt Gox collapse back in 2014, the Japanese government engaged in rigorous review of this cryptocurrency. After long deliberations, it finally decided to pass this bitcoin-related law that went into effect from April 1st. It seems that it took the Japanese market a month or so to ramp prices up, but there were already early indicators in April.

The Spillover Effect

Japanese retailers also jumped onto the bitcoin bandwagon. Many decided to accept the digital currency as a payment option as soon as it became legal. This was the case of GMO Internet Group, Recruit Lifestyle, AirRegi and Bic Camera to mention a few. While it is impossible to determine that bitcoin demand in Japan is squarely behind recent price rises, all the data seems to point in this direction. With retailers becoming early post-regulation adopters, and regulation itself giving people peace of mind they needed to buy bitcoin at record rates, it seems that bitcoin demand in Japan is one of the main reasons why prices are surging.