Dimon Belittles Bitcoin And Cryptocurrencies Once Again

It seems that the CEO of JP Morgan is not done disparaging bitcoin and other cryptocurrencies. In a recent interview with the Economic Times of India, Dimon belittled bitcoin further, claiming that it is created out of “thin air” among other bewildering comments. We chose to deconstruct those comments for everyone to understand how some of bitcoin’s basic features really work. While Dimon belittles bitcoin, we will debunk his false claims one by one and show our readers the other side of the coin.

Dimon’s Recent Comments

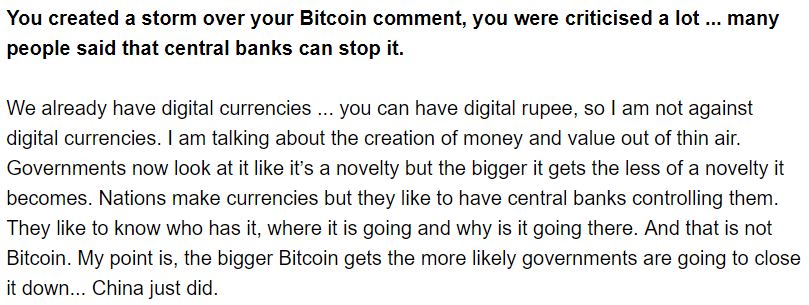

Let’s start by analyzing the arguments that Dimon gave the Economic Times of India one by one. Below is a screen shot from the interview:

Argument #1: “I am talking about the creation of money and value out of thin air.”

The CEO of JP Morgan starts out by saying that he is not against digital currency, but that he is against the creation of money out of thin air. That argument is fallacious for 2 reasons:

- Government backed digital currency already exists, but it is created out of thin air. Fractional reserve banking and recent bouts of quantitative easing added digital money to accounts out of thin air.

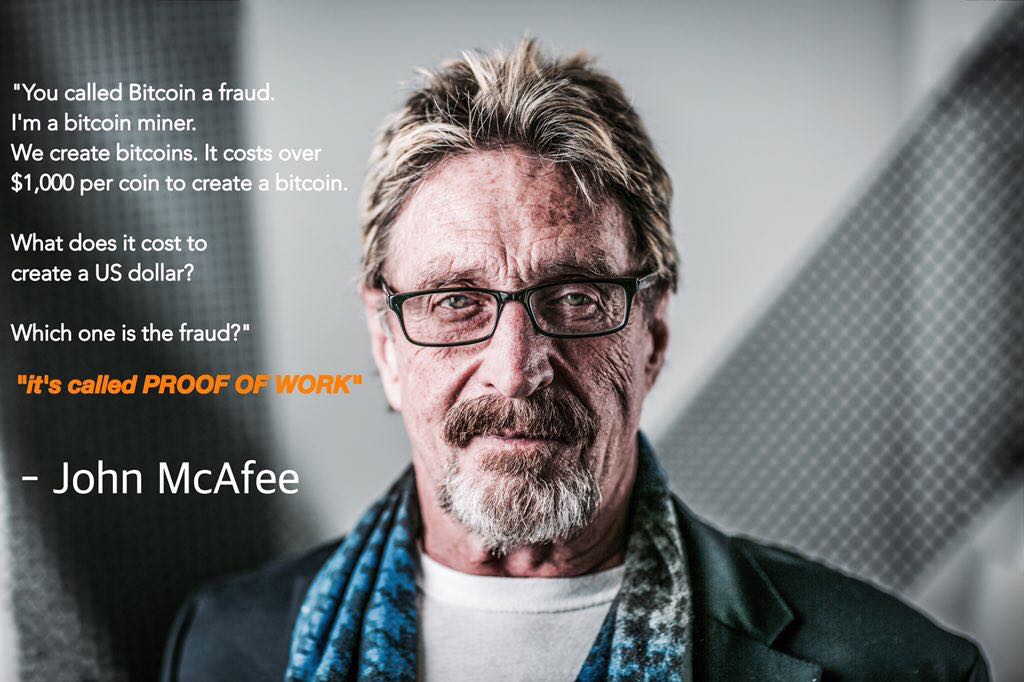

- Cryptocurrencies such as bitcoin, are not created out of thin air. There is a fixed supply of coins in bitcoin’s case. Computers must prove their work to ‘unlock’ those coins. That takes quite a bit of investment in capital, energy and services, effectively creating a solid economy behind the currency.

Argument #2: “They like to know who has it, where it is going and why is it going there.”

Dimon belittles bitcoin further by hinting that government and central bank control over currency flows, equals control over what is done with money. The corollary to this argument is that cryptocurrencies cannot be followed. Both are false claims:

- Governments don’t know who has their money, where it is going and why it is going there. That is why they recur to KYC policies at banks and financial institutions. It is also the reason why they are so interested in getting rid of the cash that they underwrite. Cash transactions are absolutely untraceable!

- Bitcoin is. At any given point in time the whole network knows where all the coins in circulation are or where they are going. There is also an unchangeable ledger that serves as evidence. Users are merely protected by a pseudonymous address on the network.

- Banks, auditors, companies, accountants and individuals can “cook the books” when it comes to government-backed money even when electronic transfers are involved – Enron is a salient example. On the distributed ledger, it is impossible to “cook the books”.

- If governments could really control currency and know who has it and why, then historical events like the war on drugs, in which the US Dollar played a leading role, would be moot – unless governments are actively involved in the drug trade, which would raise a whole host of other questions.

Argument #3: “The bigger bitcoin gets the more likely governments are going to close it down…”

The final fallacious argument Dimon recurred to, was to suggest governments can shut bitcoin down. While Dimon belittles bitcoin with this argument, people who understand what bitcoin is and how it works, laugh:

- Andreas Antonopoulos argues that in its most essential form, Bitcoin is nothing more than a protocol. The Bitcoin network is used to transfer data with certain characteristics that allow it to be a medium of exchange. Democratic countries would find it extremely tough if not impossible to shut that down. They haven’t been able to stop terrorists from transferring data through the internet even!

- Even authoritarian regimes struggle to stump bitcoin out. China is trying, and it may succeed to a certain degree, but P2P transactions over various platforms, would be difficult to stop. Even a stranglehold on internet connection can’t stop bitcoin. Recently Blockstream claimed that it could enable satellite-powered bitcoin transactions, circumventing internet connections with a relatively cheap alternative.

Dimon Belittles Bitcoin, So What?

So, there you have it. Dimon belittles bitcoin, but he does so in a fallacious manner. In some cases, Dimon goes beyond fallacy and into the realm of hypocrisy. The currencies that are created out of thin air, are fiat currencies that are only backed by government promises. After the 2008-09 economic meltdown and subsequent government bailout programs, the perils of fiat currency were widely exposed. The kind of instrument that will allow people to hedge against a repeat, is precisely a cryptocurrency like bitcoin. That is the ultimate argument for bitcoin, and against the excesses of people like Jamie Dimon, who wouldn’t think twice if they had another opportunity to capitalize on the weaknesses of the fiat currency system. Maybe this is why Dimon belittles bitcoin after all.

Click here to read the full interview on The Economic Times of India.