Ethereum Is About To Fork Again

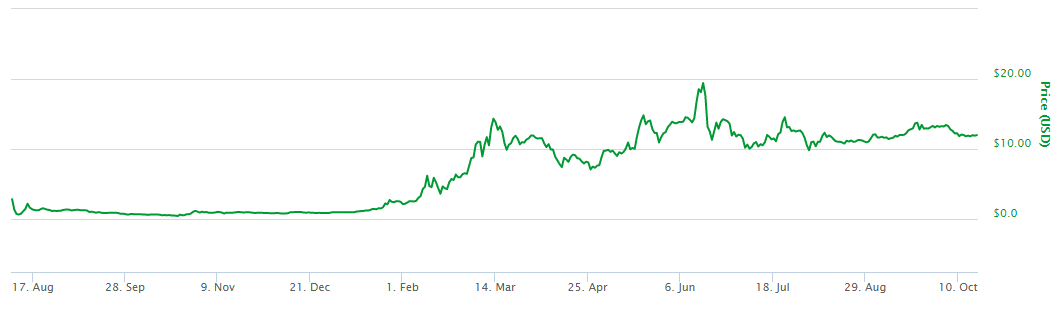

Ethereum has faced numerous DDoS attacks on its nodes over the past month. Although these attacks do not constitute a threat to the integrity and existence of the Ethereum network, they have succeeded in making transactions sluggish. As a result, there is a backlog of about 12,000 transactions, according to reports on various news outlets. This time around there will be no opposition to Ethereum’s decision to fork. Nevertheless the markets have punished Ether for the technical issue, showing that perhaps technical shortcomings that lead to forking can make cryptocurrencies unattractive, even if it is just temporarily.

Closing Ethereum’s Security Gaps

The market reaction to Ethereum security gaps is reasonable. Beyond transaction hindrances, investors and users might also be worried about all the Ethereum shortcomings that hackers are yet to uncover. In fact, investors and users have to factor the potential for unforeseen security gaps in the network. The extent to which investors and users can take these risks into account, should help Ether prices recover after the fork is completed – if it goes through smoothly.

Will Markets Punish Ether for Future Hard Forks?

Despite the uncertainty about future security gaps, it is clear that this fork had a much more moderate impact on the price of Ether than the last one. This is largely because unlike the hard fork following the DAO attack, this time there is no controversy. As a result, markets might also be less harsh on the value of Ether if future security gaps arise even if Ethereum needs to fork yet again. After all blockchain projects such as Ethereum are highly complex and not all their aspects can be tested before a critical mass of users adopts them and uses them for a period of time.

Patience in the Markets is always in Short Supply

Cryptocurrency markets just like stock markets are very sensitive to change. This guarantees that if Ethereum faces any other security problems that require a hard fork to overcome, the market will react negatively. The magnitude of the reaction will depend on how controversial and how complex the change might be. Patience in the markets is always in short supply, but technology and especially blockchain projects require a lot of work over time in order to overcome these gaps. The fact that these fluctuations take place might be an unavoidable characteristic of blockchain and cryptocurrency projects. The best hope is for these forks to go through smoothly so that the project may become attractive to investors and users once more. It seems that this will be the case with Ethereum’s fork this time around.

Click here for more information about the hard fork.