Markets React Positively To Ethereum Classic

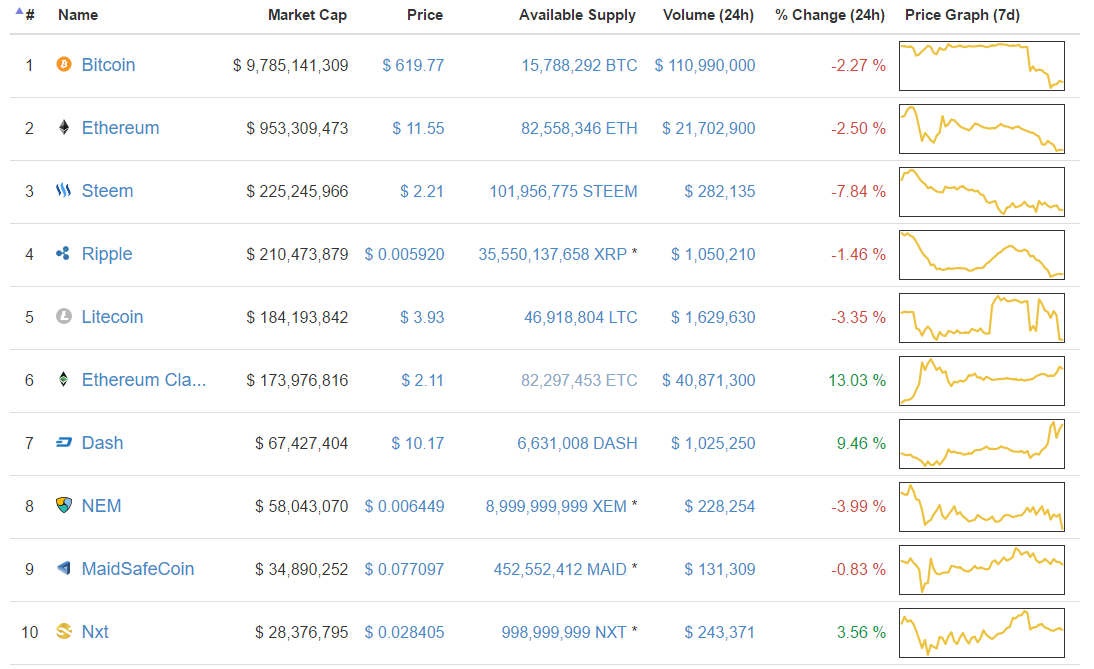

From the perspective of cryptocurrency markets, it was a long shot. Cryptocurrency enthusiasts all over navigated between all the possible scenarios. None of these would have given Ethereum Classic a high probability of cracking the ranking of the top 10 cryptocurrencies by market cap in such a short time. Nevertheless, with a sudden surge over the weekend, Ethereum Classic became a living example of how much value can be generated through blockchains that stick to the principles of decentralization censorship-resistance and immutability.

Ethereum Classic and the Hard Fork Experiment

It is still too early to tout this initial surge as a comprehensive victory for Ethereum Classic. Ethereum’s hard fork created one of the most interesting experiments for blockchain technology adoption so far, and Ethereum Classic will have to solidify its gains before it can be declared as a success. Since both Ethereum and Classic offer the same service, from the purely functional perspective of Dapp creation, solidifying these early gains might all boil down to how each can shape the public’s perception of blockchain projects.

Public vs Private Blockchains

One of the most interesting prisms through which this experiment can be analyzed, has to do with the perception of blockchain ownership. Technically, both Ethereum and Ethereum Classic are public blockchains. Nevertheless throughout the whole ‘to fork or not to fork’ debate, significant sectors within the cryptocurrency spheres, successfully framed the hard fork solution as an example of how Ethereum will be ‘owned’ by corporate interests. This could have blurred the line between public and private ownership enough to help Ethereum Classic brand itself as the truly public blockchain option between them.

This translates directly into the realm of value generation. Although technically any individual can generate value on both blockchains, Ethereum Classic can never be hijacked by private interests. This appeals to certain users who are looking for the kind of clarity, stability and immutability they need to develop independent projects, without taking the risk of being overruled by an elite. These users will likely opt for Classic. Corporate users with well-established financial backing, looking for a blockchain on which to develop their products that can limit their risks, – assuming the DAO bail out was not an exception – will probably chose Ethereum.

One Size does not Fit All

This dichotomy in general, and Ethereum Classic’s initial success in particular, seem to indicate that the market for blockchain projects is maturing to the point at which two blockchains that offer almost identical services, can coexist and grow simultaneously by catering to different types of consumers. In any case it is necessary to keep on following the development of Ethereum and Ethereum Classic after the fork, while keeping the context in mind. After all, Ethereum Classic did benefit in part from the strength of the Ethereum brand, so its value creation proposition had a good head start. Nevertheless, there is no doubt that the rigor with which the Ethereum Classic community follows its principles, has great value creation potential. The recent surge in valuation clearly shows this.