What If Ethereum Didn’t Fork After The DAO?

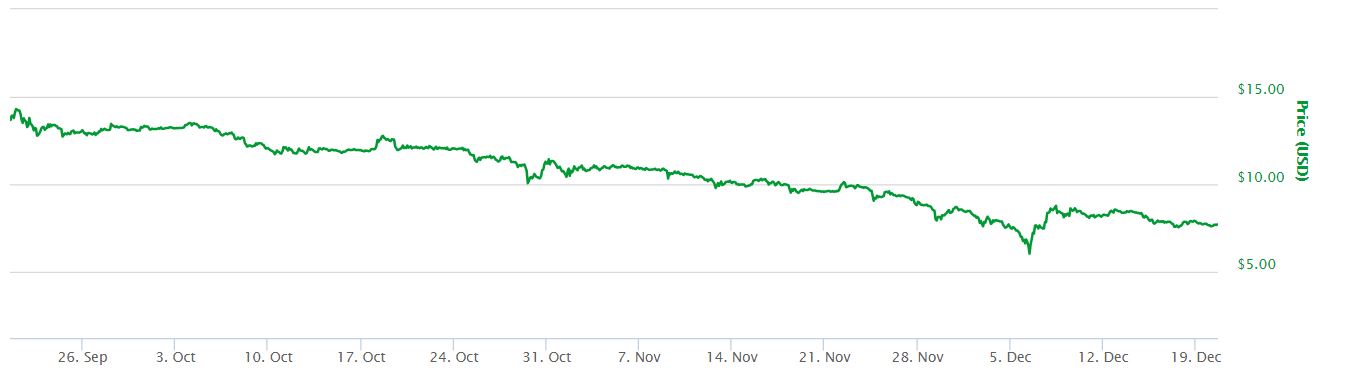

Just under a year ago, Ethereum was shaping up to be a revolutionary blockchain project with vast potential. About six months ago, that dream came crashing down as the implications of the DAO attack became clear. Suddenly Ethereum seemed vulnerable, and soon the project fell, living in the shadow of its potential ever since at least from the market value perspective. Ether is on a downward trend, currently trading below half of its pre-DAO highs. Many would wonder what would have happened if Ethereum didn’t fork after the DAO attack? It seems the markets have an answer to that question.

The Answer: Ethereum Classic

Although counterfactual thinking has its disadvantages, in the case of Ethereum analysts don’t need to engage in it as much to answer their ‘what if’ questions. That is because around 15% of the Ethereum network refused to fork and formed the alternative Ethereum Classic, keeping Ethereum’s original blockchain unchanged. Nevertheless, Ethereum Classic has been differentiating itself from Ethereum ever since the DAO fork, in many ways. The caveat is that the likelihood of seeing the changes that Classic has done on Ethereum even if it had not forked after the DAO attack, would be slim.

ETH vs ETC Markets

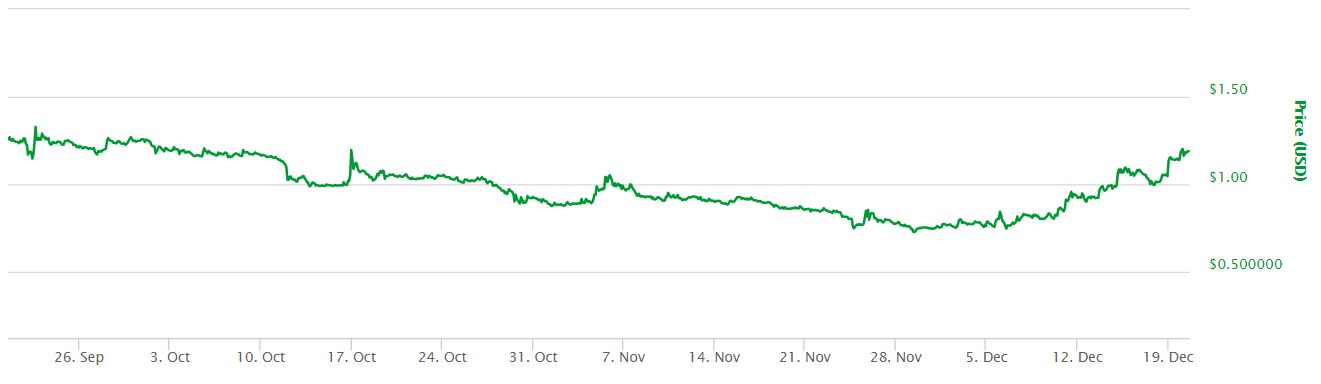

Despite the diverging philosophies behind each blockchain, and how Classic took a turn straight into the side of the purists, the markets are telling us to a certain extent, how Ethereum would have fared without the DAO fork. After all, Classic’s main move was to sustain the principle of immutability and continue with the old chain. Therefore analysts can use the price of Ether – ETH – and Classic Ether – ETC – as a proxy to measure the success of each project, to a certain extent.

Diverging Philosophies and Diverging Market Values

At the very core, both Ethereum and Classic offer very similar services in terms of dApp and smart contract creation. Immediately after the fork and for a few months, the prices of both ETH and ETC moved largely in tandem. Lately, ETC price trends started diverging from those of ETH. This is mainly due to the principles that underpin each project. It seems that the purist philosophy is paying off for Classic, while an interventionist Ethereum Foundation is taking a toll on ETH prices.

No DAO Fork, No Problem

The reasons why Vitalik Buterin and the Ethereum Foundation decided to fork after the DAO attack are clear. If the objective was to get Ethereum back on a path of growth after the DAO attack, Classic’s response is proving to be better. The markets are rewarding the classic laisses faire over interventionism. The Ethereum Foundation should have paid attention to critics who favor the forces of the market above all. Now they can get a glimpse into the ‘what if’ scenario without engaging in a lot of counterfactual thinking, thanks to Ethereum Classic.