Bitcoin Gold Price Plummets A Day After Launch

If the Bitcoin Cash fork was supposed to set an ICO-busting precedent, then the Bitcoin Gold fork should have yielded a new altcoin with rising prices, which would have landed softly eventually. But not all forks are created equal. Bitcoin Gold price came crashing down merely one day after the launch. The crash could serve as a stark warning to future fork proponents, or to those who wish to launch an ICO by other means. It seems that the market is finding the limits of its appetite for forks.

Factors Influencing the Bitcoin Gold Price Crash

This could be due to a number factors, some of which are more obvious than the others. Looking at cryptocurrency market caps, the Bitcoin Gold project individually and media reports, might allow us to gain a better understanding of what is happening with the Bitcoin Gold price. Here is a brief list of factors to keep in mind:

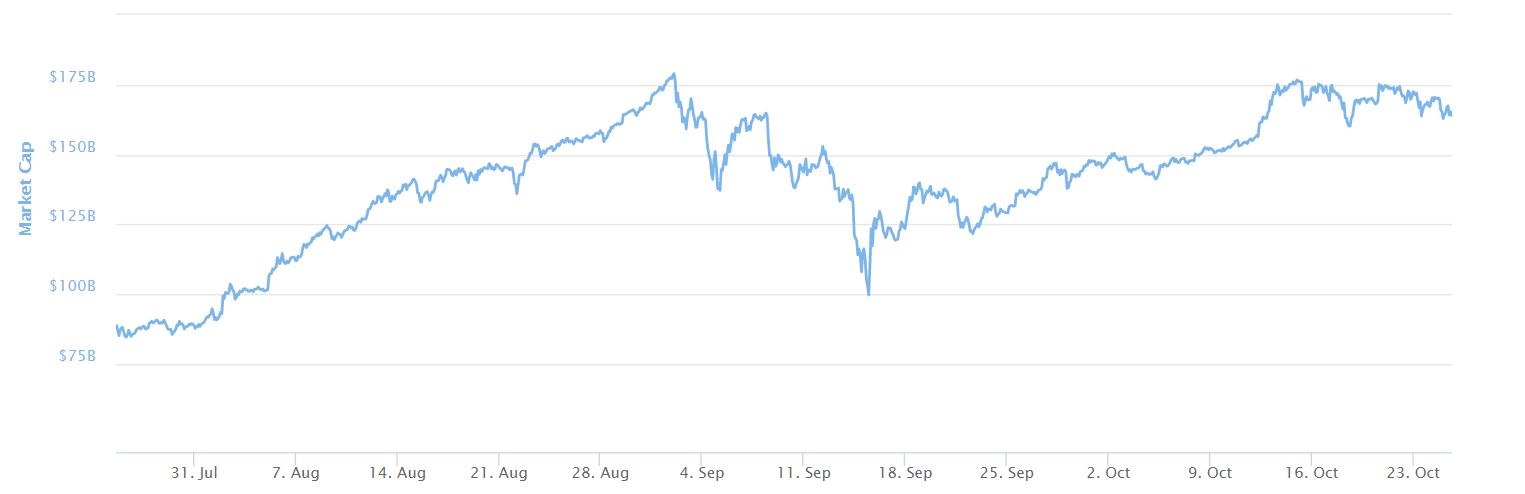

- Total cryptocurrency market cap peaked on September 1st. It came close to that all time high since, but has not managed to match it.

- The market cap trend seems to be going against altcoins, with a greater proportion of the market cap going back into bitcoin – BTC dominance has been on the rise for the last 5 months.

- Investors are taking profits, keeping total market cap between $160 billion and $175 billion for the past 2 weeks.

- This is a much more restrictive environment than the one Bitcoin Cash was launched in, creating downward pressures for Bitcoin Gold.

- Bitcoin Gold faces other issues, like the reported DDoS attack against it, less support from key companies in the ecosystem and criticism of its codebase – Trezor called it “incomplete” in an email to its subscribers.

Bitcoin Gold Price in Context

It is also true that all the major cryptocurrencies have been shedding gains over the last week, with bitcoin finally joining the downturn shortly after the Bitcoin Gold fork. That puts the Bitcoin Gold price slide in context. However, there are a few factors that might depress its price even further. For instance, not all the coins that were split at block 491407 are currently on the market. Some wallets have delayed the deployment of their splitting tools, which means BTG availability in the market should be expected to increase in the near future.

A Warning for Future Forks

This serves as a stark warning to those who would like to engage in forking off major cryptocurrencies to create their own. These hard forks don’t necessarily create a coin that is worth something automatically, even if it is based on sound reasoning, enjoys solid marketing or has a great community of developers behind it. Markets are fickle, and it seems the appetite for more forks is waning. Although some forked altcoins might be organically stronger than others. From the small sample size available, we saw a somewhat soft landing with BCH and now a hard landing with that Bitcoin Gold price nose-dive. Maybe an upcoming SegWit2X fork will yield the third data point we are all looking for to draw a line on the cartesian plane, and determine for once and for all, how profitable the ICO by means of a fork really is.