Corporate World Joining The ICO Craze In 2018

Corporate ICOs will take over the market in 2018. Kodak and Telegram are reportedly ready to launch their ICOs, sclipsing the raises cryptocurrency markets saw last year.

Whoever thought that the record set in 2017 for ICO raises was set in stone, will have to reconsider once the high profile 2018 projects hit the market. This year, it seems the big corporate players – Kodak and Telegram so far – will be playing catch up, creating token sales that could eclipse the record raises we saw from Bancor, EOS, Tezos and FileCoin last year. Nevertheless, these ICOs will come with a drawback: They are more likely to be sold to accredited investors only, prompting questions about the spirit of these sales and their philosophy in a world in which Wall Street and institutional investors are finally catching up.

Ethereum Will Not be The Cool Kid of the Class Anymore

These corporate players have the necessary muscle to launch their own blockchains and they can command the kind of investment necessary to make it worthwhile. Therefore, Ethereum will probably cease to be the largest ICO platform out there; it will probably be replaced by institutional investor-powered blockchain projects worth billions. Telegram for instance, will be looking to raise $1.2 billion USD from accredited investors, according to reports. A $1.2 billion USD ICO on Ethereum, could make the price of Ether skyrocket beyond any point imaginable, but these corporate ICOs will not be launching on Ethereum.

The Crowd Will Not Provide the Funding and Will Not Enjoy the Benefits

This probably means that the crowds that gave Bancor, EOS, Tezos and FileCoin almost $1 billion USD combined, will be largely left out. They will not be able to enjoy the benefits that come with these huge corporate ICOs, unless they are willing to play the old game of setting up an investment account and paying the fees necessary to buy the stock of these corporations. Kodak stock holders for example, saw their investments skyrocket on news that the struggling former icon of the photography industry is planning to release a token to manage image property rights.

Will Mainstream Media Start Yelling “Bubble” When Corporations Join the ICO Craze in 2018?

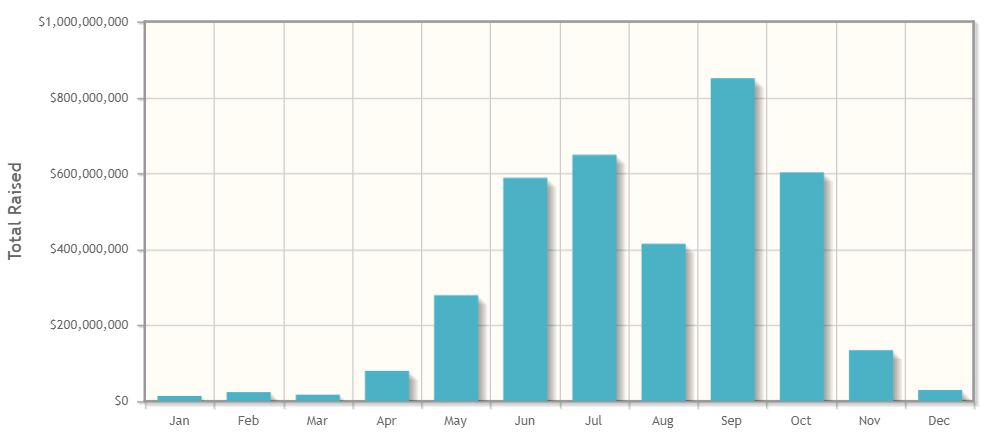

Telegram and Kodak ICOs combined, have the potential to match the amount raised by ICOs from January until August 2017, according to Coin Schedule stats. But will this prompt mainstream media to cry “bubble” just like they did with the ICOs in the space? Hopefully they will, especially because some of these corporate ICOs will inevitably fail to achieve their stated goal, while raising significantly larger amounts of money.

Bankrupt Corporations Launching ICOs

Kodak’s ICO in particular, can well become 2018’s canary in the coal mine. The corporation fell from its blue chip status years ago and its stock has been trading lower year after year over the past 5 years. Kodak has sold various assets to bigger corporations over the past few years to generate cash flow. Since it announced its iCO, Kodak’s stock rose above $10 USD for the first time in 6 months. If this ICO succeeds in raising a significant amount of funds, other struggling corporations could resort to the same avenue to save their businesses or shore up their stock, creating a real bubble in the market.

Private Blockchains in the Hands of Huge Corporate Actors

Even if corporate ICOs avoid bubble territory, they are far away from what blockchain technology was created for. Private blockchains in the hands of huge corporate actors will serve to centralize services, collect more data on consumers for additional corporate profit, and they will become a prime target for hackers, especially given the amounts of attention and money that they have the potential to raise.

Just a Matter of Time

Nevertheless, with the success of the ICO markets during 2017, it was only a matter of time until the corporate world joined the ICO craze. It seems they did it in 2018, sooner than many would have thought, although the writing was on the wall – pun intended! With CME and CBOE Bitcoin futures launching at the end of 2017, and more institutional actors being attracted to higher returns in cryptocurrency markets, ICOs were a logical next step. Hopefully they will not suck the air out of the cryptocurrency market ICOs, or change its spirit.