China Bitcoin Mining Crackdown Causes a Stir

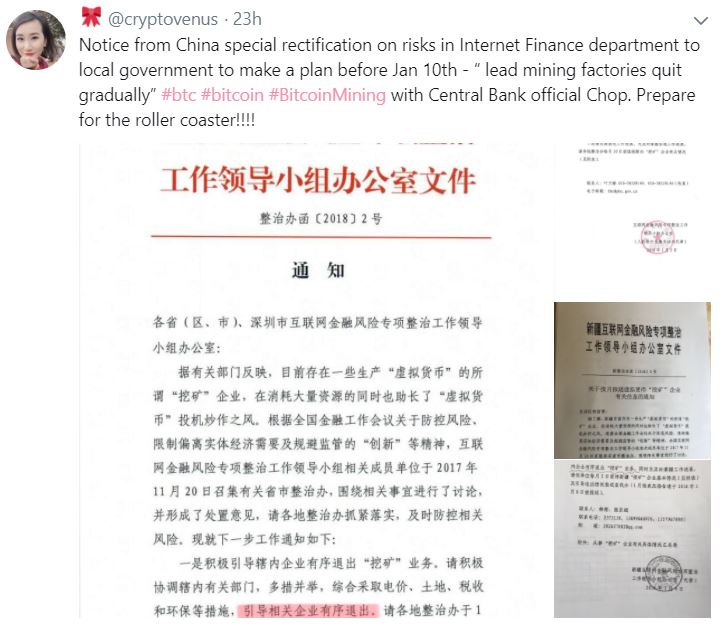

The Chinese government allegedly issued a statement calling for the shut down of mining farms that use government generated electricity.

China is a major player and contributor when it comes to Cryptocurrencies, especially Bitcoin. Recent network issues such as unsustainable transaction fees, alongside legislation and regulation there, have moved the markets in the past. Now, reports are pointing towards more governmental intervention in the industry in China. The central government there has reportedly issued a warning that it will shut down the operations of miners that are using government-generated electricity to power their mining equipment. This could spell trouble to ASIC-oriented SHA256 miners, who also mine Bitcoin Cash, unless they start producing their own electricity.

Why is China Planning to Rid Itself of Miners and What Impact Will This Have?

According to Bloomberg, a report recently stated that “Officials are planning to limit the industry’s power use and have asked local governments to guide miners toward an orderly exit from the business”. These words are not to be overlooked, since they’re most certainly a clear warning to those involved in Bitcoin Mining in China. Due to the country’s relatively cheap electricity and power costs, China has been acting as the Elysium of miners, increasing profit margins significantly when running power hungry ASIC miners – which are also predominantly produced in China.

Official Reports Can Give Bitcoin a Small Shock

This kind of news coming from an official body is damaging not only to the Bitcoin economy but the whole community, possibly encouraging a downward spiral. Bitcoin miners are responsible for time-stamping and organizing transactions within the ‘Proof-of-Work’ – PoW – consensus protocol. In other words, with already increasing transaction prices and costlier electricity elsewhere, if miners are discouraged, or banned, the Bitcoin network, and that of other profitable SHA256 coins, are bound to experience at least short-term pain as mining equipment is transferred to other locations and difficulty readjusts – in the case of BTC. Additionally, higher power bills might discourage miners from mining or might force miners to maximize their profits with higher fees.

Will Bitcoin be Replaced?

As much as this could be a short-term blow to Bitcoin – mainly due to difficulty adjustment conditions – and a nuisance for alternatives such as Bitcoin Cash, it is difficult to see this latest Chinese move generating a lasting impact on Bitcoin prices or cryptocurrency markets in general. New generation cryptocurrencies that work with different consensus mechanisms or are either partially or completely ASIC resistant, will have a chance to showcase their advantages until the ASIC-centric SHA256 ecosystem ships its mining resources abroad or starts generating the electricity required to keep the Chinese government off its back.

Scalability Issues Would Prevail

Nevertheless, these altcoins that could fill in the Bitcoin void momentarily, are not necessarily immune to scalability issues. Ethereum, one of the candidates to handle transaction volume while Bitcoin and Bitcoin Cash sort their mining issues out, has also faced scalability trouble – Crypto Kitties showed us as much. With a ton of newcomers such as IOTA, who uses tangle, along with Cardano ‘Ouroboros’ Proof-of-Stake (PoS) consensus algorithm to name a couple, there might be other suitable candidates that can withstand such a blow to mining more adequately. Their time has not come yet however; Bitcoin continues to be the cryptocurrency of choice to bring more fiat funds into the markets, and it will be hard for competitors to achieve the level of network effect it has in the period of time it will take to relocate mining power. In the meantime, the Chinese government, especially local governments, will have to think about the economic harm they will cause to themselves if the Bitcoin mining crackdown goes through.