80,000 Stores In Europe To Enable Crypto Payments Through Coingate

More merchants in the cryptocurrency sphere means more mainstream adoption and less fiat outflows from the markets, at least in theory. This could be a boon for battered cryptocurrency markets

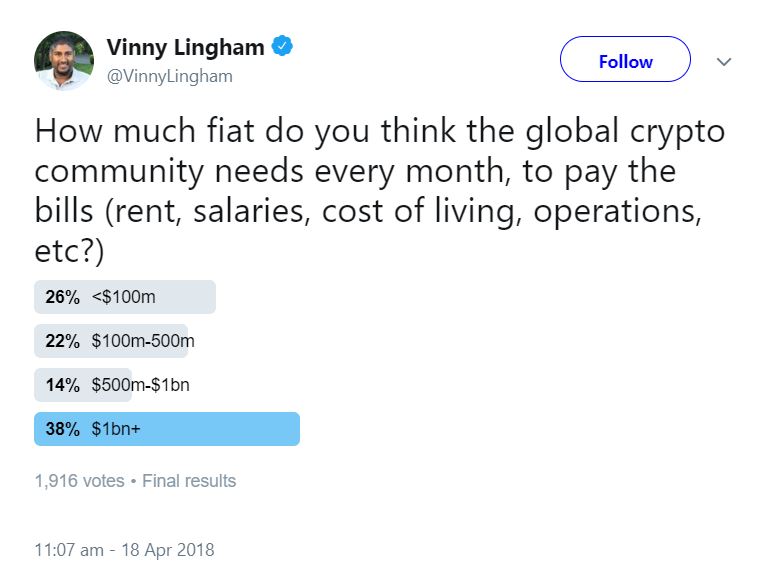

Vinny Lingham posted a poll on Twitter recently. The question was “How much fiat do you think the global crypto community needs every month, to pay the bills (rent, salaries, cost of living, operations, etc)?” Although this question was geared towards understanding if fiat outflows from crypto were greater than fiat inflows, it can also drive us to focus on adoption. In theory, there would be fewer outflows if those getting paid in crypto would be able to spend their coins directly to acquire the goods and services they need on a monthly basis. Now, in Europe, it seems cryptocurrency enthusiasts will need to sell less coins – albeit marginally – to buy what they want or need. Coingate partnered up with Prestashop, bringing 80,000 merchants into the cryptocurrency sphere in Europe.

Wider Adoption in Terms of Merchants and Cryptocurrencies Supported

Coingate supports 50 cryptocurrencies, bringing an even wider scope of adoption. This can also have a marginal effect on the flows of altcoins into Bitcoin, adding another layer of complexity to Lingham’s question. Furthermore, it can encourage more people to start viewing cryptocurrencies as a medium of exchange and not just as a speculative asset or a hedge against centralized, government-issued fiat. That is an advantage for the space.

Similar Events and Bitcoin Prices

Cryptocurrency markets have benefitted from these integrations in large, developed economies before. A little over a year ago, Japan came out with Bitcoin regulation that allowed merchants to understand how to manage cryptocurrency payments clearly. Reports back then pointed towards more than 20,000 merchants in Japan that were slated to adopt Bitcoin payments. Despite looming forks and uncertainty, this change in Japan triggered demand for Bitcoin, which buoyed prices and jump started one of the most significant bull markets in the history of Bitcoin.

Merchants in Europe can Provide a Boost

The news about the Coingate-Prestashop partnership come just as Bitcoin and other cryptocurrencies are climbing out of a bear market. Therefore, the news could provide a boost to cryptocurrency prices, just like a year ago Japanese markets helped strengthen the demand for Bitcoin. Going back to Vinny Lingham’s question, it would be interesting to see how much fiat the global cryptocurrency community has needed over time. As merchant adoption increases, those who get paid in Bitcoin and other cryptocurrencies will require less fiat. The effect could be exponential given that those merchants and their employees can create more pressure to pay their bills and get their salaries in crypto, contributing towards a more robust crypto-economy.