Why Does the Price of Bitcoin Fluctuate So Much?

Most people think about Bitcoin as an investment. For them it is important to understand why Bitcoin prices fluctuate so much. Here are some explanations that will lead to a satisfactory answer.

By now, anyone who is thinking about their investment portfolio is aware of Bitcoin’s existence. As a prospective investor, a closer look at historical Bitcoin price fluctuations, signals high risk. Since understanding Bitcoin fundamentals and what it can be used for is a little abstract, many investors avoid buying Bitcoin altogether. But those who are interested, still ask themselves why Bitcoin prices fluctuate so much, and how they can take advantage of this to turn a profit. Here are some answers as to why Bitcoin prices fluctuate so drastically.

What do Bitcoin Prices Depend on?

Every price fluctuation tells a story. That story has two sides to it: demand and supply. With Bitcoin, the supply side is pretty clear. Bitcoin supply was designed to minimize price fluctuation, even if that was an inadvertent feature. There are a set number of coins that will be minted and the rate at which they are released into the money supply is set. The only possible unknown there is the number of coins that are lost and will never be transacted with again.

The demand side is a little trickier to understand. It is ultimately demand which makes Bitcoin prices fluctuate so much. Here are some factors that influence demand and therefore fluctuation:

- Bitcoin adoption

- Expanding use cases for Bitcoin

- Price Speculation

- A relatively small market in which small players can tip the scales pretty easily

- Lack of regulatory constraints

Price Fluctuation Depends on the Perception About what Bitcoin is For

Understanding demand for Bitcoin is almost impossible. This stems from its crisis of identity in the eyes of the investor. What is Bitcoin? Is it a currency, or is it a digital version of gold? Maybe both? The short answer is that Bitcoin was created as a currency but its deflationary nature and its key features – decentralization, immutability, P2P nature – all make it a desirable store of value in theory.

As such, its price fluctuations cannot necessarily be understood like those of a currency. Bitcoin has no interest rates, its inflation – deflation – rate is elusive, and its purchasing power is a function of demand since Bitcoin doesn’t have a national economy behind it.

Bitcoin Adoption as a Function of Demand

But even without a national economy behind it, Bitcoin can potentially draw all the advantages of being used worldwide for any kind of transaction. Therefore, adoption is a crucial metric to try to understand demand and through it, Bitcoin price fluctuation. If adoption increases, then more people will be able to use Bitcoin for their day to day transactions. This should push prices up, and it is part of the reason why Gavin Andresen launched the first Bitcoin faucet.

Bitcoin as Store of Value

Nevertheless, adoption is not such a straightforward metric. There are people who do not use Bitcoin as a currency. They rather see it as store of value. These people are Bitcoin adopters, but they are using the cryptocurrency essentially to hedge themselves form the traditional economy.

Recently, people in countries across the world are increasingly seeing the value of BTC as a store of value. Venezuela and Argentina are good examples of how Bitcoin can also be adopted to store value, hedge against calamity in the fiat world and overcome capital controls. More people are turning to it in the face of central banking crises and rising debt levels, but these people don’t necessarily spend their coins.

Speculation: The Main Driver of Bitcoin Price Volatility

Given that people who adopt Bitcoin as a currency use it for consumption and those who use it as a hedge are unlikely to spend it, then it should be easy to figure out why Bitcoin prices fluctuate that much. But that is not the case, because there is a third class of Bitcoin adopters: the speculators. These people don’t care about hedging or consumption. The only thing they look at is the price in terms of fiat.

Due to a lack of regulatory constraints and small market size, speculators can move Bitcoin prices to their advantage. Those who have been in the game long enough, or have observed the trends, know exactly how to play with volatility to come up with huge profits. They are the main reason why Bitcoin prices fluctuate so much.

Bitcoin Price Volatility on a Downward Trend

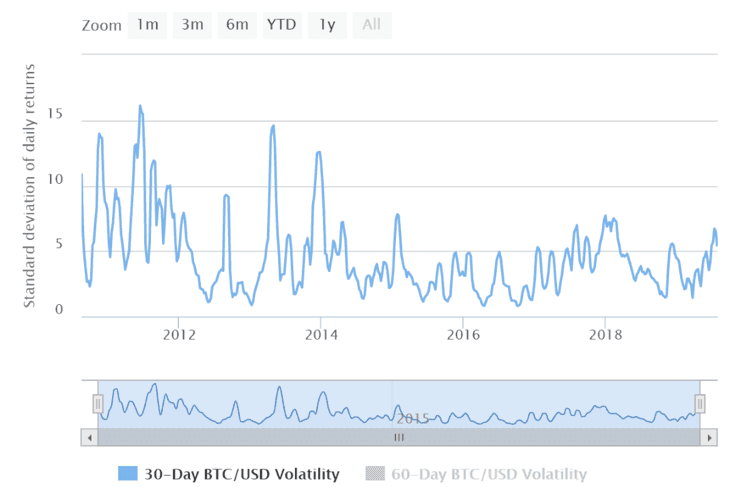

Even if speculators are mostly responsible for Bitcoin price fluctuations, lately we have seen a downward trend in this metric. It seems too many speculators now know too much, and so Bitcoin volatility has decreased. The chart below shows as much:

Bitcoin price volatility is still a long way away from the 2%-7% percent absolute monthly price change that gold, the ultimate historical store-of-value has displayed. But it is going down, which will probably encourage more investors with less appetite for risk to enter the markets. Paradoxically, a further reduction in Bitcoin price fluctuation can bring in more investors which given supply constraints, should push prices higher. This could be in part the reason why Bitcoin prices have steadily recovered since the beginning of the year. Hopefully, this trend will continue, and we will see healthier growth with more adopters coming in and staying in for longer.