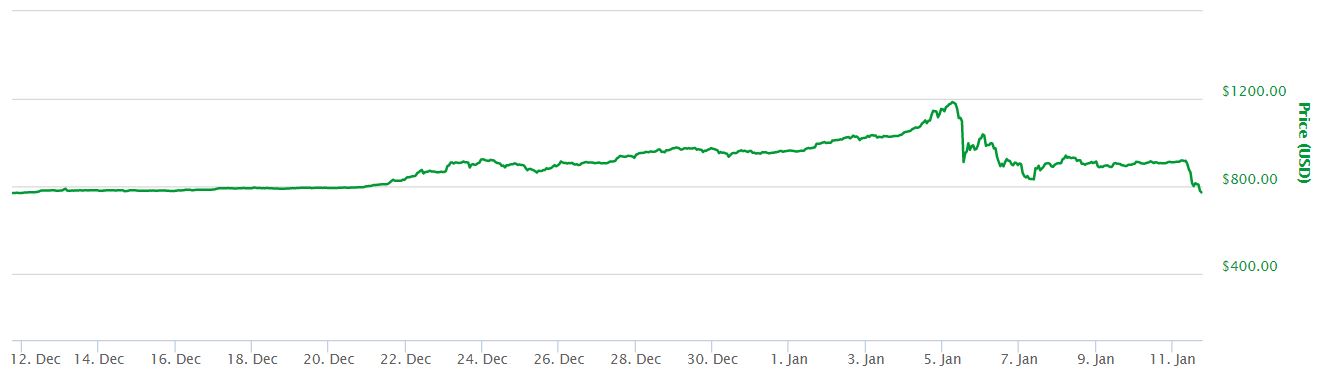

China Cracks Down And Bitcoin Prices Suffer

Cryptocurrency markets had an incredible run leading up to the New Year, but just a week into 2017, boom turned to bust. Bitcoin prices are now trending downward, on news that the Chinese government is tightening its anti-laundering and license inspections on exchanges. This coupled with some other economic indicators from China, brought demand for cryptocurrency down. This is due to the fact that the Chinese government could potentially go after buyers individually once it gets critical information from exchanges.

The Influence China has on Bitcoin Prices

This serves to show the influence that events in China have on the price of bitcoin. The Chinese market drives most of the demand for bitcoin, and the country hosts up to two thirds of bitcoin mining power. Many mainstream news outlets like Bloomberg have highlighted this fact in their recent reports about the price of bitcoin.

The importance of Chinese demand on the cryptocurrency market should not be a surprise to anyone. From Mike Hearn’s blog post on why he quit bitcoin going through a wide variety of reports from other sources, the fact that China plays a central role in the bitcoin economy is widely known. After all, the second largest economy in the world, which is also the most populous one, has enjoyed break-neck economic growth for the better part of the last decade. This coupled with the capital controls that China placed on its citizens, subsidized electricity, a wealth of tech savvy citizens and relatively cheap labor makes it an ideal spot for bitcoin activity of all kinds.

Digital Commodity

Analysts should not take the whole issue with Chinese government inspections of bitcoin exchanges so narrowly. After all, China is a central player in the world economy and a major force in the commodity markets. When economic growth slowed, Chinese demand for commodities plummeted and entire economies based on the production of those commodities suffered. Currencies like the Chilean Peso felt the effect. As long as analysts look at bitcoin as a digital commodity, these abrupt price drops due to changes in Chinese demand or policy, should not come as a surprise. But looking at bitcoin as a digital commodity, might lead to some interesting observations about its future possibilities and its behavior due to demand from other markets.

Proportion

Recent bitcoin price drops also serve to question recent theories about the power that demonetization in countries like India or global political instability, have on the price of bitcoin. It seems that as much as all these exogenous factors may have an influence on bitcoin prices, Chinese demand dwarves them in magnitude. Taking this into account, it would be better for the Bitcoin community to push for decentralization of mining activities and continue promoting the benefits of bitcoin use around the globe. Unlike traditional commodities, this digital commodity has the necessary attributes to shift its demand elsewhere swiftly.