Are Short Memories Responsible For Recent Ether Prices?

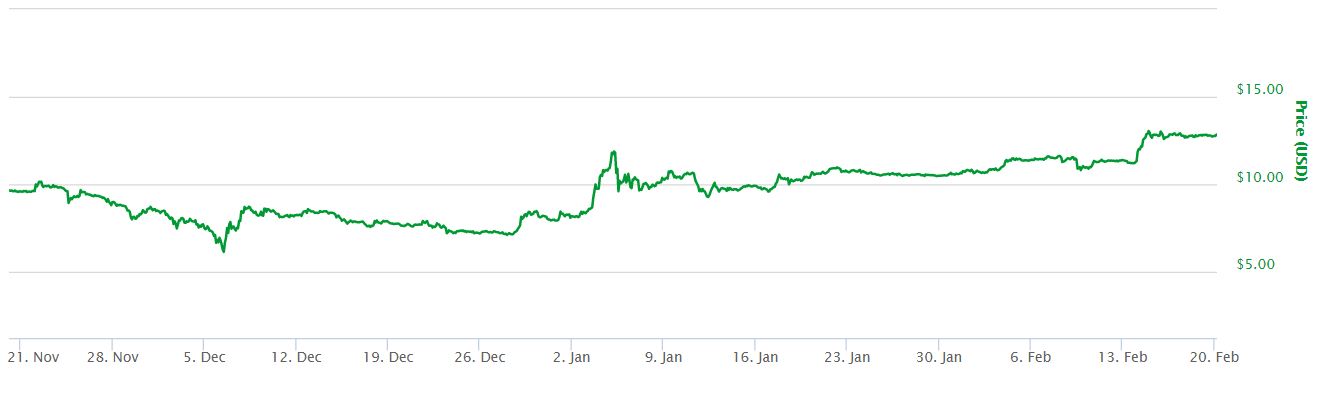

It seems that Ether prices are finding their footing. Over the last 3 months, Ether halted a decline that brought it to a low of $6.26 USD per coin on December 6th 2016, up to a high of $13.04 USD on February 15th, 2017. The price of this cryptocurrency has more than doubled ever since that low point towards the end of 2016, and it seems to have reverted to positive trends. Nevertheless, Ethereum governance has not undergone any fundamental changes; the questions about the legitimacy of the DAO fork still linger, but it seems that investors don’t care too much.

Ether Prices Show People have Short Memories?

It is quite remarkable for a network like Ethereum to manage to get investor confidence back up to this point after the DAO fork exposed its vulnerabilities. After all, it would be difficult to find people who are willing to invest in a project that has no clear procedures to deal with the aftermath of an event such as the DAO attack. However, Ethereum did show resilience in the face of the attack. It acted fairly quickly to protect investor funds, which might encourage the bigger investors to keep investing in it. Additionally, the attack showed that Ethereum itself enjoys sound programming, since the vulnerability that the hacker exploited in this case had nothing to do with the network code in itself.

Other Cryptocurrencies also have Weaknesses

If a blockchain-powered project can act as pragmatically as Ethereum did and it is based on sound programming, then it may have some merit after all. Additionally, there are enough people willing to take a chance on cryptocurrency projects that face major governance challenges, like bitcoin. The whole block size debate has also shown that bitcoin is also vulnerable to a different kind of governance issue, given that consensus among the community is paramount to change anything. That didn’t hold bitcoin’s price from staging a historic rally since December until mid-January.

Are we Judging Ether and Ethereum too harshly?

This means that some analysts might be judging Ethereum too harshly. If bitcoin can stage rallies like the one it held recently, then Ether certainly has the same potential. After all, investors might see these governance problems as an opportunity, at least in the short term. There are enough people out there investing in Ether, who chose to forget the whole DAO ordeal and focus on the bright side of Ethereum. Only time will tell if this is just a short term memory lapse or a genuine sign of things to come.