The Ultimate Guide ICO White Paper

White papers are often one of the first things that investors look for when they want to find out more about a new ICO. Here everything you should consider when reading or writing a whitepaper.

White papers are often one of the first things that investors look for when they visit a new ICO website (after perhaps the summary and video). They depend on it as the definitive reference source of information on what the ICO venture is hoping to provide. Before delving further, we need to realize that the requirements and expectations of an ICO white paper will differ based on the industry that it is being applied to. This will also dictate the expectations of what should be dealt with in the white paper, as well as how it should be structured. For instance, what is expected of a white paper dealing with a stablecoin, will be vastly different from that of an ICO dealing with AI deployment. However, there are some basic prerequisites that apply in all fields. In general, a white paper should be detailed, well written and edited. It should also be structured in a logical, easy-to-follow style. While authors can use graphs, tables and images to illustrate the concepts being described, it is not essential. The white paper should also have an appropriate length to fully describe the topic, which means that the author should not try too hard to be concise at the expense of leaving out critical information.

What is a White Paper?

In general terms, an white paper is an in-depth analysis of a specific topic or product. The intention of the author is to persuade others of the value of their perspective, concept or product. It is not meant to shamelessly promote a product, but rather to minimally provide deeper insight as to:

- What problem is being addressed

- The solution being offered

- A proposal of how this will be conducted

- Other relevant information.

It is therefore meant to focus on an intellectual approach over an emotional one. In ICO terms, it is meant to inform the potential investor about their proposed platform. Additional crucial information includes:

- Token utility

- Necessity (why is a blockchain required for this?)

- ICO details

- Team members.

Why is an ICO White Paper Important?

ICO investors want to know what they are investing in, and an ICO white paper should provide them with insight. A white paper with little content and no real mention of the purpose of the token, or that promises the moon, but fails to outline a real plan of how the rocket will be built with specific detail, can convey a message to a potential investor that the ICO has not been adequately thought out. However, even if it is well thought out, legible and detailed, it also provides the investor with an idea of how organized, realistic and achievable the ICO’s founders’ goals are.

Breakdown of an ICO White Paper

An ICO white paper generally contains variations of the following sections. Sometimes they fall under different headings, and one or two are also occasionally grouped together under a single heading. It is important for potential investors to go to the ICO’s site regularly to review the white paper, as they are often subject to many revisions based on feedback, development concerns, economic considerations of new concepts being added to the paper. It might be advisable to download each version to compare the various versions.

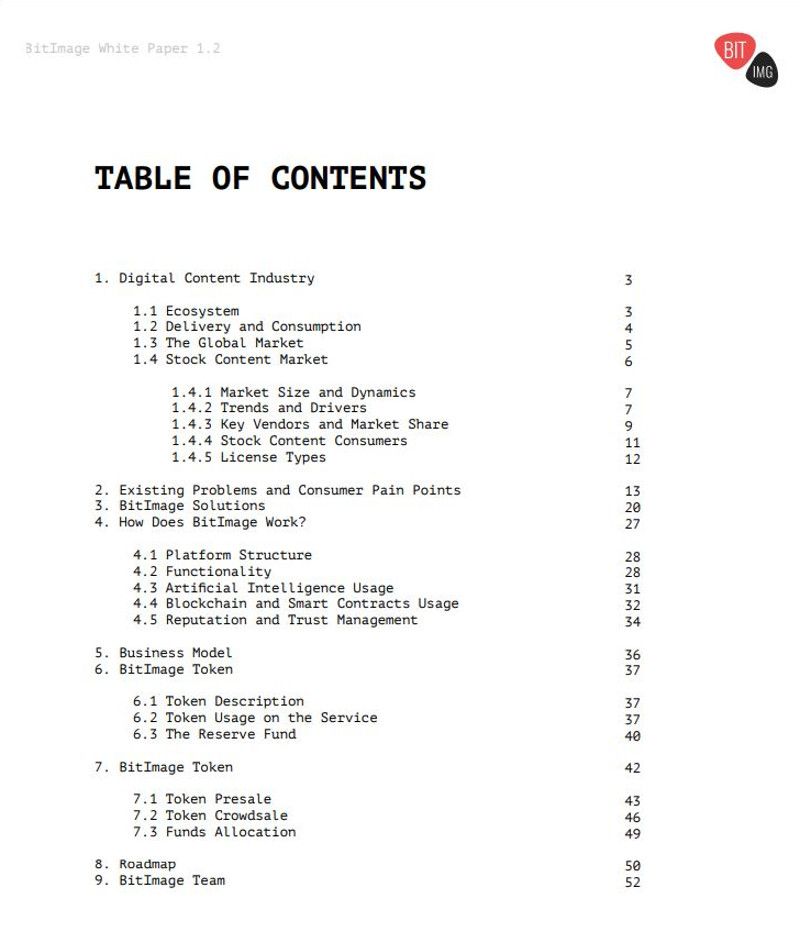

1. Table of Contents

As per usual.

2. Disclaimer/Legal Disclaimer

These are the legal disclaimers that the ICO is required to make, such as the liabilities and risks involved in investing and the degree of accountability that they will maintain rights to. It is a good idea to read through this to avoid unpleasant surprises at a later stage, such as discovering that an investor’s information will be permanently stored in their databases, or that there is a consent-free buy-back policy or time-lock on their tokens. However, this type of legal information is usually included in the ‘Tokenomics’ section of the white paper. The Legal Disclaimer also includes terms of use, such as redistribution and intellectual property rights in relation to the paper itself. The concept would have to be patented separately. This section could also contain a paragraph outlining why their token is not considered a security, or conversely, provide a list of countries that are excluded from participating in their token sale. This exclusion obviously implies that they are concerned that may not be SEC-compliant, which is also something that a potential investor may want to bear in mind when investing in a particular token. This section can be anywhere from a paragraph to several pages depending on how careful the ICO wants to be, or the nature of the ICO. Understandably legal, data-sharing, and financial ICOs generally tend towards large legal disclaimers. The Legal Disclaimer can be found nearer the end of the ICO white paper, rather than the beginning. If it is not present in the ICO white paper at all, it is possible that it would either be found as a page on the website, or as a separate downloadable document under the ‘documents’ section of the ICO’s website.

3. Abstract

This is a brief overview of that touches on the main problems that he ICO plans to address as well as the potential innovation that they hope to develop to address this concern. The authors do occasionally sneak in statistics and other relevant information to introduce their platform.

4. Historical / Industry Overview

These sections are not always included in the white paper, but they both serve to contextualize and substantiate their upcoming observations, goals and conclusions. This can add extra weight to the ICO’s platform proposal, especially if the ICO brings credible statistics and proofs to substantiate the need or niche for their project.

5. The Problem

As it sounds, this section presents the investor with the current lacks or inefficiencies that are present in their market or industry. They may even reference the innovations of other companies towards resolving these issues, as well as the failings or limitations to their current solutions. This section could also combine elements of the industry overview, rather than dividing them into separate categories.

6. The Solution

Once the history and problems have been introduced, the company will attempt to provide the investor with a protocol, platform or product that will either partially or totally resolve the inefficiencies listed above. This section usually discusses the concepts in broad terms, so as to give the investor a picture of how this process or product will function if the ICO is successful in actualizing their concept.

7. Overview of Competition and Comparison

This section isn’t as common as it should be. It basically provides the reader with a selection of ICOs that are competing in the same industry. The extent of these comparisons varies from white paper to white paper, but they generally serve to highlight the ICO founders’ acknowledgment of the challenges that they face and provide some insight as to how they plan on overcoming these obstacles.

8. How it Works/Business Model

This section provides more a detailed accounting of how they will accomplish the proposals introduced under the ‘solution’ section. In doing so they will try to illustrate how their ideas are implementable and realistic. Contents can include:

- Technical content as outlined in the ‘Technical White Paper’ section described below,

- The tasks and outreach that they will undergo to develop their project,

- Which blockchain the platform will be launched from and the rationale behind the decision,

- How they plan on developing the project in the long-term past the initial goals, and,

- Their plans for approaching potential customers as well as how they will enter new markets.

9. Tokenomics

This section provides a break down of the following information, often emphasized with pie-charts:

- How the tokens will be distributed, namely what percentage will be sold, allocated to the private sale, bounty and airdrop campaigns, kept in reserves, and as well as any other relevant categories.

- An overview of the ICO’s expected expenditures. Some ICOs split this into segments based on funds raised, meaning that they will begin with the minimum that they would be able to accomplish if their soft-cap is reached, and then incrementally illustrate how much capital would be required for each new development until the full hard-cap amount has been accounted for. This is an effective method of gaining the investor’s confidence, especially if there is a large gap between the soft and hard cap values.

- Token utility on the platform.

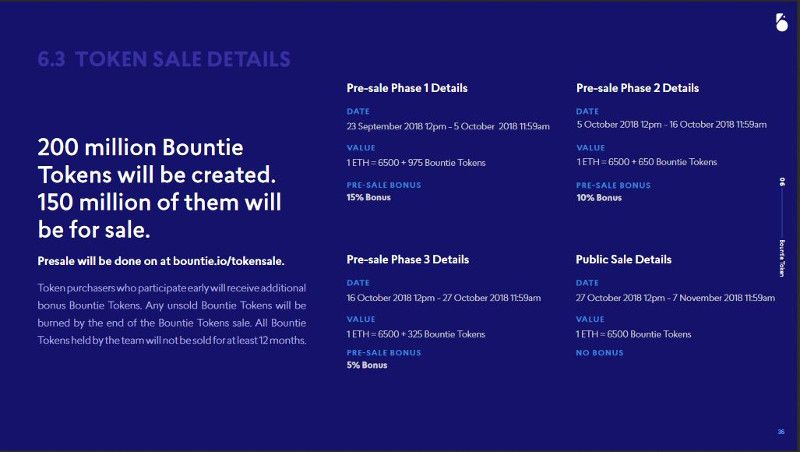

10. ICO Details

This section provides information regarding the upcoming private sale, pre-sale and main sales. Not all ICOs hold all three of these sales. As dates are often subject to change, it’s best to regularly check for updates on the ICO’s website and social media sites, rather than to rely on the information provided in the white paper. In fact, this is why the investor might find that these dates are omitted from the ICO details section altogether. Details such as the tokens name, ticker, blockchain platform, total number, number offered for token sale, base price, currencies accepted for payment (fiat, BTC, ETH, or other currencies) are also generally included in this section, among others.

11. Roadmap/Timeline

The roadmap outlines the ICO team’s projected dates of task fulfillment. They are often approximate, focusing on quarters than months, even regarding ICO dates. It is common for them to include past accomplishments to date, rather than only focusing on future goals, in order to provide investors with a sense that the ICO founders are capable of fulling their objectives. Items listed on the roadmap could include:

- the various token sale dates,

- alpha and beta testing dates,

- alpha and beta launch dates,

- when tokens will be issued to bounty hunters, early investors, etc.,

- when the token will be listed on exchanges,

- the official dApp or platform launch,

- tests and launches of particular tools on the platform,

- and other ICO-specific considerations.

12. Team

Here, the white paper provides concise profiles and photographs of the core ICO team and advisors. These profiles include the relevant qualifications and accomplishments of each member in relation to the ICO. They also often include links to the team member’s LinkedIn or other social media profile. Again, it is a good idea to click through to their profiles and to do a background check on the members, as it is unfortunately common for scammers to create fake profiles using the images of unsuspecting individuals, or even providing links to real, renowned experts who are completely unaware that their name is being connected to an ICO.

13. Reference List

This is a list of references and links to data sources for any claims made by the ICO over the course of the white paper. Any claims made in the document that lack substantiation could indicate red flags. Regardless, it would be worthwhile to verify the authenticity of the links, as it could provide some measure of clarity as to the integrity of the rest of the paper.

14. Social Media Links

Very few ICOs include this in their white papers, but they can prove useful, as not all ICOs list all of their social media platforms on their websites. As explained towards the end of this piece, there are many fake accounts created by malicious actors, so it’s best to visit their pages through a legit source than through guesswork.

Other Related Documents

1. One-pager

This is a brief overview of the main points of an ICO’s platform proposal. It often adopts a more casual-tone than the ICO white paper and can be either text-based or image based. It is not uncommon to see a flow-chart or pictorial summary being used. Aside from the summary, a one-pager can also include:

- Token utility,

- ICO sale details,

- Some information about the team,

- Other relevant basic info.

As its name suggests, it shouldn’t comprise of more than one page.

2. Light-paper

This document serves the same function as a one-pager, except that it is generally a few pages longer. This is because it contains more information than can be included on a single page.

3. Token Sale Agreement

The token sale agreement is an amalgamation of the ‘ICO Details’ and ‘Tokenomics’ sections of an ICO white paper, however these sections are usually either completely or partially omitted from the white paper if this document is available on the site. Furthermore, this paper is usually more detailed than what could be found in the white paper, as they could include information such as an outline of how to purchase, exchange and store their tokens, which wallets work best with their token based on the blockchain platform that the chose to launch from. A major addition to this paper is collection of some token-specific legal disclaimers, such as the countries included or excluded from participating in the token sale, token holder rights, platform rights, ICO or blockchain platform risks, investment risks and limitations of liability. It is crucial to read this section, as it may contain disclaimers that the investor may not want to agree to, such as being barred from the platform at the platform’s discretion or token buy-back against the token-holder’s wishes.

4. Technical White Paper

For an ICO, this is a white paper that focuses on outlining the technical logistics of how the platform will operate. This can include an overview of how the smart-contract protocols will operate, or how various product algorithms will function (for example, if the ICO is developing an energy-sharing platform, they might want to provide the algorithms for how the nodal distributions and tracking would function, or how a new blockchain will be constructed.) The technical white paper is generally written using a great deal of technical and programming jargon and calculations is therefore mostly relevant to developers. This is why the ICO founders will generally keep it as a separate document, although there are ICOs who include it in the regular white paper itself. Inclusion of this type of information might be ill-advised. People tend to stop reading after they scroll through a few pages, so giving them information about topics they don’t understand, makes them tune out. There are some ICOs that understand this, and they add the technical details to the end of the document as an annex.