Bitcoin Gold Price Spike

Pump and dumps are common in cryptcurrency markets, but looking at the sudden Bitcoin Gold price spike this weekend, a pump and dump might not be the only possible explanation.

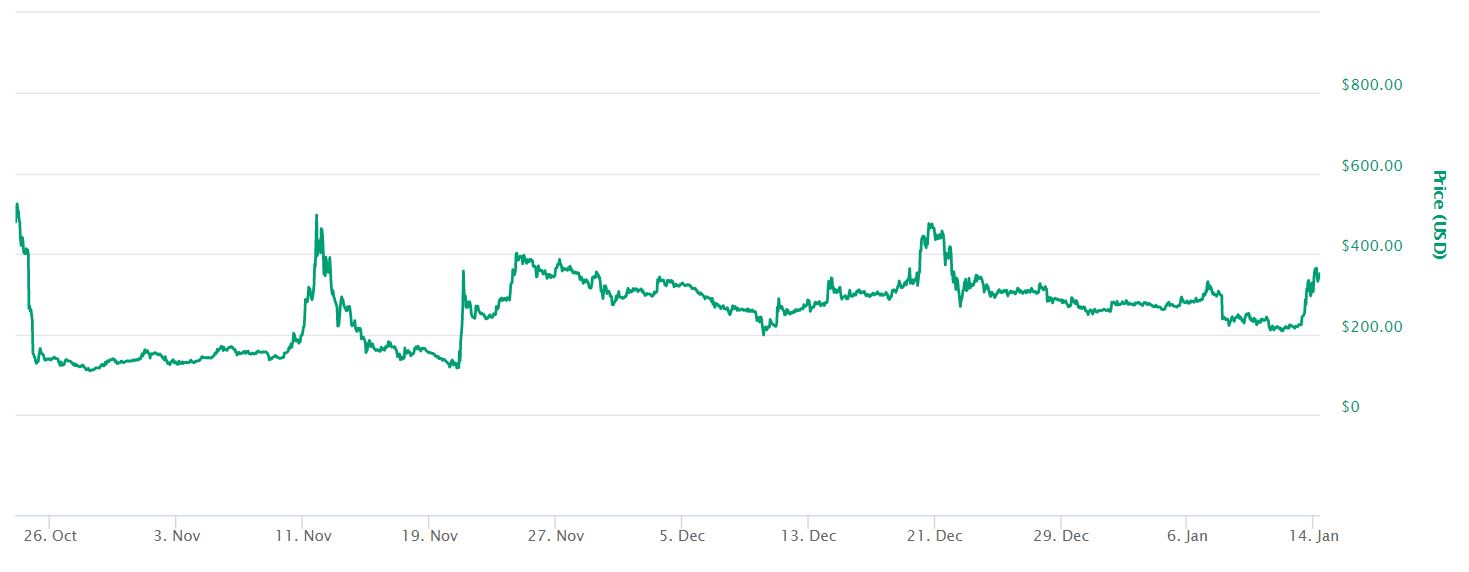

Bitcoin Gold price spiked this weekend on no particular news or additional information, prompting questions about the sustainability of this recent price increase. Reports have surfaced calling the activity this weekend a pump and dump scheme. Trading volume exceeded $1,000 million USD, topping Bitcoin Cash trading volumes for the last 24 hours. The price quickly followed the rest of the markets, giving back most of its gains by morning time – EST – on Sunday. This sudden Bitcoin Gold price spike however, should be taken as a part of a more complex movement in the markets.

Bitcoin Gold Price in Context

Over the last 2 weeks, cryptocurrency markets have been struggling to find their footing. Pullbacks have followed small gains on virtually any top 100 currency during the last few weeks. The notable exception is Ether, which has kept a substantial portion of its gains and is building momentum in a sluggish market. All these movements come hand in hand with cash outs, i.e. fiat flowing out of the markets, coming back in again when the slump hits a low point. Bitcoin Gold prices might be showing the market that there are enough investors trying to find a move to make a gain in cryptocurrency markets without recurring to fiat.

Can Bitcoin Gold Offer an Alternative?

It seems that this weekend, as prices on other assets tumbled again, these investors were looking for an alternative. Bitcoin Gold could be that alternative on a temporary basis or as a long-term go-to coin to weather the storm elsewhere in the markets. Technically speaking, Bitcoin Gold is quite a close substitute to Bitcoin in terms of functionality – transaction fee structure notwithstanding. This could make it the temporary go to asset for when markets are punishing Bitcoin and other stronger cryptocurrencies, also because it is familiar enough and can be safely stored on hardware wallets off an exchange. This is another advantage it has over other top cryptocurrencies like IOTA, Cardano and Stellar.

Stable Prices Show Pump and Dumps on Bitcoin Gold are Rare

Bitcoin Gold prices over the last month and a half have stabilized also, making it an unlikely target for a pump and dump. Its wide distribution and initially high market cap also make it more difficult for pump and dump schemers to target it. This means Bitcoin Gold is becoming a more stable asset with desirable characteristics to weather sudden changes in cryptocurrency markets. Just as investors should not count on the sustainability of this weekend’s Bitcoin Gold price spike, they can’t rule it out as a useful hedging asset in the future.