Is E-coin The Biggest Pump And Dump Scheme Of 2018?

Cryptocurrency markets have suffered from their fair share of pump and dump schemes. E-coin could be the latest one and it can also end up being the biggest pump and dump scheme of 2018

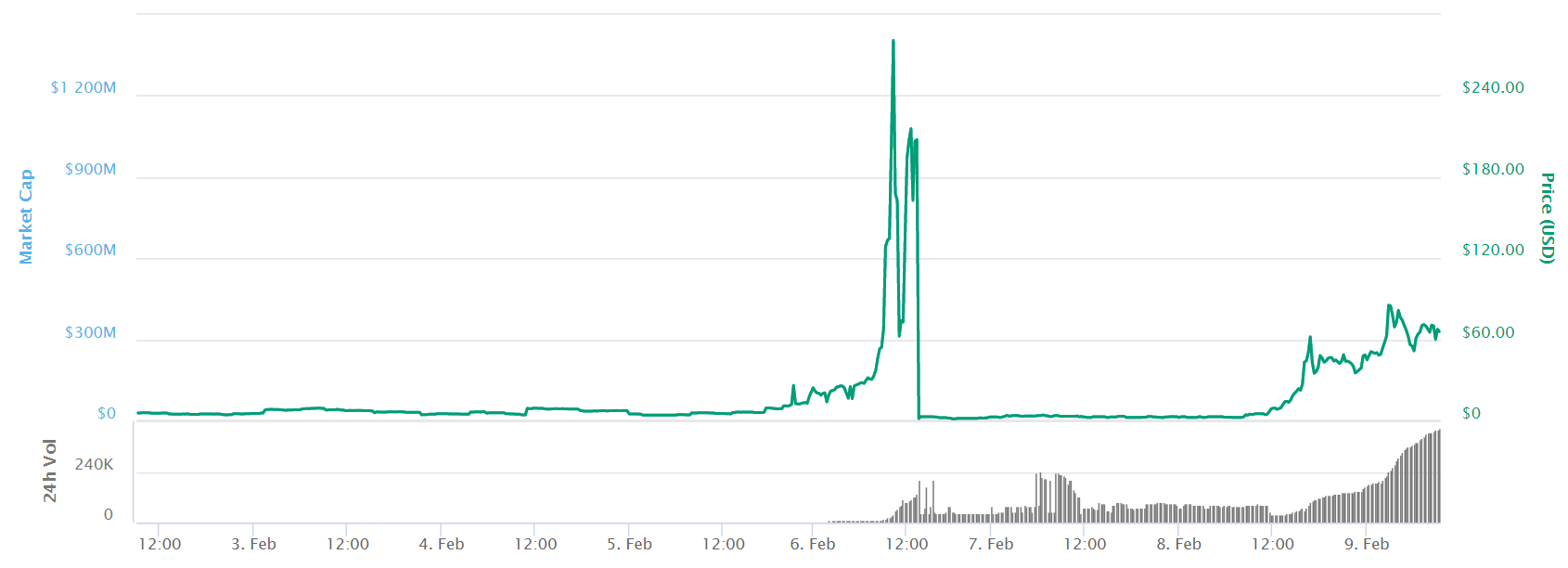

A little-known coin is making its way up – and down – cryptocurrency market rankings. E-coin – ECN – is a currency based on a coin that is featured in the Mr. Robot series – a drama/thriller about a cybersecurity expert and hacker that suffers from social anxiety. Its creation was probably meant to be a joke, just like Dogecoin was, but it seems cryptocurrency markets can take jokes way too seriously sometimes. E-coin skyrocketed to a staggering 4,900% gain before crashing down in a matter of hours on Monday. It did rise back again shortly before stumbling again, and now it is on the rise again. This quick see-saw motion with radical movements up and down, might mean that E-coin could be the biggest pump and dump scheme of 2018.

E-coin Website Down

Everything we know about E-coin so far that indicated this joke could indeed become the biggest pump and dump of the year, comes from market data gathered in the year since the coin came into existence through an ICO, and from its Bitcoin Talk announcement. According to that announcement, E-coin is supposed to be a PoS coin. ECN is an “interest-bearing asset with 120% return per year through PoS minting” according to that Bitcoin Talk announcement. Nevertheless, its website is down and there is no updated information from project creators.

The Joke that Yields 120% Returns

When looking at those characteristics, it is difficult to understand how those 120% returns were calculated. Maybe that is part of the joke. If E-coin yields 120% ECN to each holder, based on their holdings, on an annual basis, then the market will be flooded with ECN after year 1. Without demand, this is a recipe for a quick and steep price decline.

However, it seems that when it comes to jokes, cryptocurrency markets don’t care too much about economic fundamentals. Dogecoin, which was also created as a joke, has no cap, making it in effect an inflationary coin. This hasn’t prevented enthusiasts from adopting it and driving its prices up. Dogecoin is now a market staple, holding steady among the top 50 cryptocurrencies in terms of market cap.

Pump and Dumps are no Joke!

Maturity is where Dogecoin and E-coin differ, if we look at market sentiment. Dogecoin has been around for years now and it has solid trading volumes. It started as a joke and over time its community grew enough to give its prices some kind of backing. E-coin is still just a joke, and one that can be potentially costly for buyers watching the quadruple digit growth ECN is displaying this week. Those who would like to try Mr. Robot’s joke by pouring some of their Bitcoin into it, might be on the wrong side of the biggest pump and dump scheme in 2018.

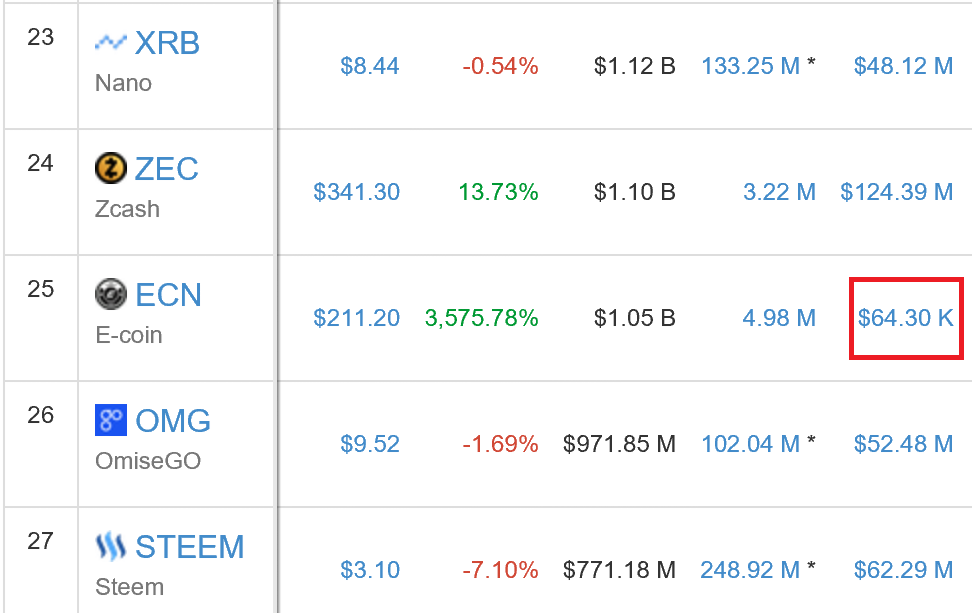

Look at Trading Volume

The reason for this is E-coin’s low trading volume and limited availability on exchanges. On Monday, ECN went on a tear, growing by about 3,500% in just a few hours on a trading volume of just under $65,000 USD. This allowed it to climb into the top 25 cryptocurrencies by market cap, before culminating with a 4,900% increase which was quickly followed by a dump. Additionally, E-coin is not traded across major exchanges. It can be found on YoBit, CoinExchange and C-CEX mainly, according to CoinMarketCap. This strengthens the possibility that the whole E-coin frenzy is little more than a pump and dump scheme.

A Joke that Could Become the Biggest Pump and Dump Scheme of 2018

Low volume trading and sudden, radical price fluctuations are typical indicators of pump and dump schemes. This could turn the Mr. Robot joke into the biggest pump and dump scheme of 2018. However, if it gathers a following, the joke can become a coin that buyers might have to consider seriously, just like DOGE. Buyers shouldn’t jump into it without taking all the warning signs into account.

*The views expressed in this article do not constitute financial advice of any kind. Neither the author nor Bitcoin Chaser are responsible for any kind of trade, acquisition or sale made on the basis of the information presented in this, or any other article.