One Week Of Bakkt: Will Institutional Investment In Bitcoin Take Off?

Try to get institutional investors to buy a contract for which they will have to hold the underlying asset when it settles. Even if that asset is digital, their reticence is evident

Last week saw the much anticipated launch of Bakkt, an “open and regulated, global ecosystem for digital assets.” This platform was broadly seen as a product which would finally draw institutional investment to Bitcoin. Bakkt, a subsidiary of the Intercontinental Exchange (ICE) launched monthly and daily Bitcoin futures where Bitcoin must be delivered to fulfill the contract when it matures.

This move was supposed to bring institutional investors to Bitcoin itself, in contrast to the futures offered by CME or CBOE, which are settled in cash. Despite the anticipation and fanfare, the first week of BTC futures trading on Bakkt has been by many measures underwhelming.

Comparing Bakkt to Similar Products

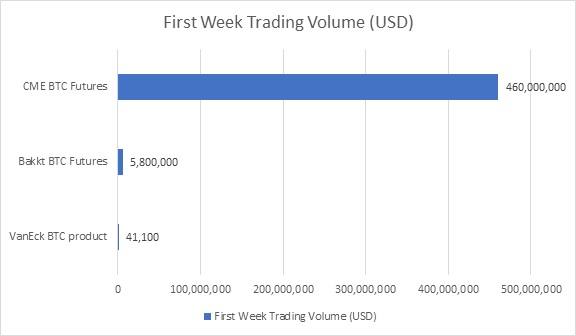

When compared to similar products, Bakkt BTC futures reeled in more investment than an “ETF-like” product launched to attract institutional investors by VanEck, but traded orders of magnitude below its closest competitor: CME Bitcoin futures. Although these numbers may exaggerate the difference in participation, given that CME futures launched when Bitcoin was at 19,000, Bakkt still only had 71 deals in the first day, which pales in comparison with CME’s 5298.

Why Did This Happen?

There is a lot of speculation about why institutional investors have not moved into Bitcoin in force yet. The main reasons given for their trepidation is the volatility of crypto markets and the lack of regulation. While Bakkt sought to address both these issues, it still requires fulfillment in BTC, which institutional investors may not quite feel fully comfortable holding.

There is a learning curve to consider. Anyone that has had to learn how Bitcoin works in order to transact and keep the coins safe – how to deal with wallets, hot vs cold storage, wallet and address security and anonymity – can understand that there will be some resistance.

Conservative institutional investors may need some time to get cozy dealing with contracts that are settled with Bitcoin. In contrast, CME’s futures are settled in fiat. This might also mean that institutional investors are comfortable speculating on an asset as long as they get cash for their “bets” instead of the underlying commodity.

Many institutional investors love derivatives, in which they know they will never touch the underlying asset or commodity. According to the Bank for International Settlements (BIS), the derivatives market has notional amounts outstanding for contracts in the range of $542 trillion (!!!) USD, with a gross market value of just a fraction of that – $12.7 trillion USD.

What is Next for Institutional Investors Looking at Bitcoin?

In the meantime, the 2,000 USD dip in the price of Bitcoin has been attributed to the slow start of Bakkt. Analysts all seem to agree that more time is needed for institutional investment to learn, adapt, and move into the crypto space. That is, if they can abandon their strange love affair with contracts that are based on pure speculation and deliver nothing but air and money that central banks print at will when they are settled.

It is still early and despite the sluggish start the fact that a regulated trading platform exists in the US for financial instruments that are settled in Bitcoin bodes well for a future where institutional investors participate in crypto – or are completely replaced within the new financial landscape. Whatever happens, Bitcoin doesn’t care and that will always be a constant in the market.