GDAX Ether Price Crash Explained

The price of Ether plunged on June 21st, 2017. Although Ether was headed for a correction before, due to its quick rise towards the $400 mark and other issues, this price crash went beyond expectations. It is now known that a GDAX multi-million-dollar trade triggered the Ether price crash. This trade effectively became “trade zero” in a chain reaction that triggered up to 800 stop-loss orders. As a result, the GDAX Ether price crash reached epic proportions. Reports in various media outlets sustain that the price of Ether on GDAX quickly fell from $319 USD to as little as $0.1 USD.

GDAX Ether Price Crash Losers

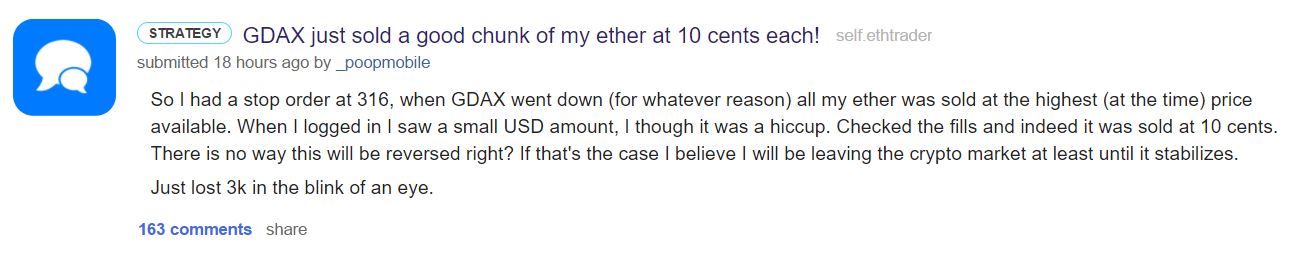

Many traders lost substantial amounts of money on their stop-loss orders and on margin trading – leveraged trading. Following the sudden crash, GDAX suspended ETH trading. Nevertheless, the damage at that point was already done. GDAX Ether price crash losers reported losses ranging from $3,000 USD up to $9,000 USD according to Reddit posts.

GDAX Responds

Some of those users also complained that the GDAX Ether price crash was orchestrated and that the exchange was at fault. GDAX quickly released an official response on its blog, claiming that there was no wrong-doing and that it will not reverse any trade. In the meantime, other users on social media claimed that this GDAX Ether price crash made some traders instant millionaires. John DeMaise claimed that a trader who had buy orders on ETH for $0.1 USD made a million dollars off the flash crash. He substantiated his claim with a screen-shot, but Bitcoin Chaser cannot independently verify the veracity of the claim.

Lessons Learned from the GDAX Ether Price Crash

Beyond the potential for quick profits from the GDAX Ether Price Crash, traders have a few lessons to learn from this ordeal:

- Every exchange works like a semi-contained market for cryptocurrency.

- Price fluctuations within the microcosm of each exchange can be much higher than the average.

- The liquidity of these digital assets is low within that microcosm too; big asset sales can have a disproportionally large effect on prices.

- Therefore stop-loss orders can trigger an avalanche of sales that will make the price of a given digital asset plummet.

- Margin trading – leveraged trading – worsens the situation.

- Therefore, traders should always invest an amount they are willing to lose. They should also be careful when using stop-loss orders and margin trading features.

- Long-term investment outlooks also reduce the risk of falling victim to the kind of domino effect we saw from the GDAX Ether price crash.

Final Thoughts

Investors who internalize these lessons will be better positioned to prevent future losses from similar events. Whoever thinks that the GDAX Ether price crash was a one off could pay the price on any given day at any other exchange. This flash crash was an outlier, but that doesn’t mean it cannot happen again.

June 24th Update on the GDAX Ether Price Crash

As of June 24th, 2017, the exchange posted that it will use its own funds to compensate “affected customers who had margin calls or stop loss orders executed.” Compensation for people affected by the GDAX Ether price crash will not affect those traders who had their buy orders filled at discounted Ether prices. In other words, GDAX is taking the hit for the customers who had stop-loss orders or engaged in margin trading and lost their money. GDAX will restore the value of their ETH:USD accounts.