One Year On: How Bitcoin Hit its All Time High and What Happened Next

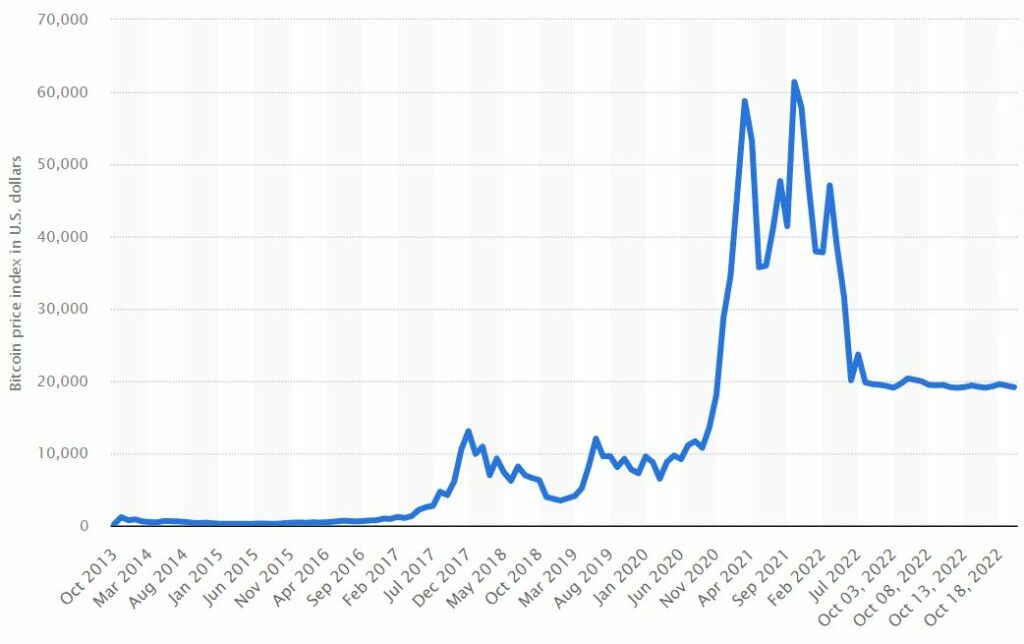

On November 10 last year, Bitcoin (BTC) made headlines once again when it reached a new all-time-high (ATH) of $68,990. Right before that, the hopium was strong and there was a bull run for the cryptocurrency as many HODLers truly believed that BTC would finally break the $100,000 USD barrier that they had long been dreaming of and make them rich. But as with all other bubbles that came before, the bubble burst and descended rapidly into the crypto winter that has dominated much of 2022. In fact, within two months of hitting that high, the price of BTC plummeted by almost half its value.

What Caused the 2021 Bitcoin Bull Run?

In October 2020, PayPal’s announced that they would be allowing their users to trade and store Bitcoin and other cryptocurrencies on their app in late October 2020.

Following this announcement, the price of Bitcoin increased steadily over the next few months until it finally hit $58,730 in March 2021, at which point it steadily decreased until it went down to around $35,800 in price.

This crash was expected, as this has been the pattern for previous Bitcoin bull runs and bubbles. Fortunately, there was a turnaround in May 2021 following the Bitcoin halving in May that year.

The Bitcoin halving is an automatic part of the Bitcoin blockchain’s protocol that causes the rewards generated by the mining of new blocks to halve every four years. The purpose of this is to curb the inflation rate by reducing the new supply of Bitcoin.

Following that, the price of Bitcoin steadily rose until November that year, boosted further by other events such as PayPal extending their cryptocurrency services to the UK in August 2021. Additionally, many more financial institutions began recognizing and offering cryptocurrency investment opportunities and services to their customers in 2021, which also helped to foster the public’s perception of and trust in cryptocurrency in general and BTC in particular. All of these factors and others helped to bolster the demand for BTC and therefore its price as well.

The fluctuation of BTC’s price can be seen in the graph below, taken from Statista:

Bitcoin Hits Its All-Time High

In November 2021, the crypto community hit a frenzy as the price of BTC hit $60,000 again for the second time that year, and remained around $60,000-$66,000 for most of the 34 days that followed, until the price dipped below $60,000 again on November 18, 2021, as indicated by the records of BTC’s daily price history taken Yahoo Finance. The height of the BTC excitement was obtained on November 10, 2021, when BTC hit its current ATH of $68,789.63 USD. At the time, the Bitcoin maximalists and crypto community in general fervently hoped that the $100,000 mark would be hit by the end of the year, but unfortunately, that never came to be.

What Caused the 2021 Crypto Crash?

During 2021, there was a burst in cryptocurrency regulations from many countries in response to the rapid increase in cryptocurrency that began in 2020 in the height of the COVID-19 pandemic.

Some notable countries include China, who banned all cryptocurrency mining early in 2021 year and then outlawed cryptocurrency trading altogether in September that year, the US where most states also implemented their own sets of regulations on top of the SEC’s, and the EU as a whole, among others.

Therefore, even though there was a spike in optimism based on the burst and rapid correction following the previous bull run that year, in hindsight it seems clear that the price was bound to decline.

The general decline of major economies such as the United States and United Kingdom also impacted the cryptocurrency economy, since the cryptocurrency sector is becoming more intertwined with mainstream global financial and investment sectors as the space itself becomes more widely adopted.

Why Bitcoin Investors are Still Optimistic

Over the years, the price of bitcoin has fluctuated dramatically, yet despite its relatively low value in contrast to its ATH, the value of a single BTC is still high, especially if we look at it from a broader perspective.

While it is true that BTC remains at the lowest price that it has been in two years, at between $16,000-$21,000, this is still around the same value that it held in late 2020, and far higher than most might have hoped even back in early 2020.

Therefore, there is no real reason for people to panic yet, and just as much reason to believe that there will be another bull run when the global economy improves again, and when some new factor sparks interest in the cryptocurrency space again.

Hindrances to Future Bitcoin Adoption

The main blocks to cryptocurrency adoption are arguably its price volatility, regulation and weaknesses in intermediary service providers such as blockchain bridges.

In the case of regulation, it can be either a strength or a weakness, depending on the investors’ perspective. On the side of strengths, once there are laws and regulations protecting consumers and governing behaviors, it provides security to those who might be robbed, scammed or hacked in the cryptocurrency space by giving them recourse to justice and assistance.

As for the weakness, the regulation arguably undermines the key purpose of the creation of cryptocurrency; namely to provide a method of transaction that is anonymous, borderless and completely transparent. Bitcoin was created in order to produce a currency that was not subject to the laws and restrictions of government and yet that is being corroded the more widespread the use of cryptocurrency and blockchain technology becomes.