Bitcoin ETFs are everywhere in the news right now. The false alarm that BlackRock’s ETF was approved by the SEC shot the price of Bitcoin up to $30,000. But what are ETFs exactly and what effect would an approved Bitcoin ETF have on crypto?

What is an ETF?

An ETF, or Exchange Traded Fund, is a type of investment fund and exchange-traded product with shares that are tradeable on a stock exchange. It is designed to track the performance of a specific index, commodity, bond, or a basket of assets like stocks.

ETFs are traded on stock exchanges, which means their prices can fluctuate throughout the trading day. This provides investors with flexibility in buying and selling shares, similar to individual stocks.

ETFs are popular for their transparency, liquidity, and typically lower fees compared to traditional mutual funds. They offer exposure to various asset classes and investment strategies, making them a versatile tool for investors seeking diversification and targeted market exposure.

What is a Bitcoin ETF?

Bitcoin ETFs would give investors an easier way to invest in Bitcoin. Instead of buying Bitcoin directly, you can buy shares of the ETF. These shares represent a part of the total Bitcoin owned by the ETF. It’s like owning a small piece of Bitcoin without having to deal with all the technical stuff.

This makes it easier and safer for people to invest in Bitcoin.

Why are Bitcoin ETFs in the news now?

Bitcoin ETFs are being spoken about now because there have been a number of developments in the last week related to two Bitcoin ETFs: Grayscale and BlackRock.

On Friday the US Securities and Exchange Commission (SEC) chose not to contest a recent court ruling that criticized its rejection of Grayscale Investments‘ application to convert its $16.7 billion Bitcoin Trust (GBTC) into an exchange traded fund (ETF).

The court stated that the SEC’s decision was “arbitrary and capricious” in denying applications for direct Bitcoin ETFs while approving those based on Bitcoin futures contracts.

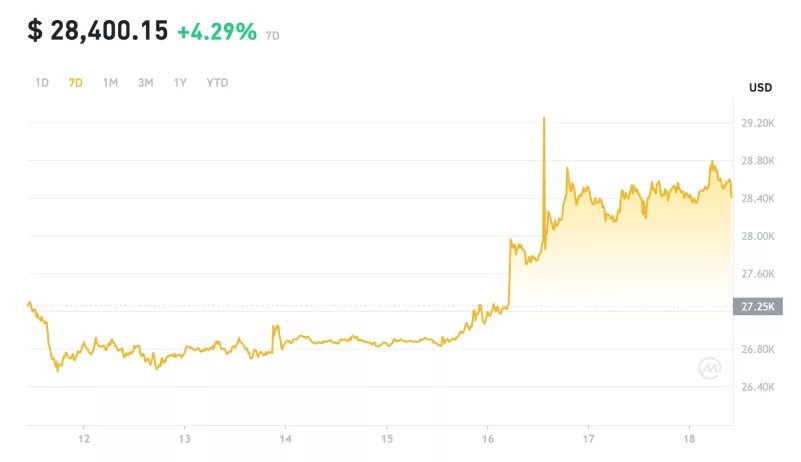

Then on Monday the price of Bitcoin shot up to nearly $30,000 fuelled by a false report from Cointelegraph on Twitter that the SEC had approved BlackRock’s spot Bitcoin ETF.

BlackRock clarified that no decision has been made yet. A spokesperson from BlackRock said, “The iShares Spot Bitcoin ETF application is still being looked at by the SEC.”

Cointelegraph quickly retracted their claim and issued an apology on their website detailing exactly how the rumor was started.

What would a Bitcoin ETF mean for Bitcoin?

Bitcoin ETFs would allow investors to gain exposure to Bitcoin’s price movements without having to directly buy and store the cryptocurrency.

This could potentially have a wide range of benefits, making cryptocurrency investing more accessible for mainstream investors, reducing the barrier to entry, and providing regulatory oversight.

Importantly, Bitcoin ETFs would be a less risk-averse way to invest in cryptocurrency compared to directly buying and holding the coin. An ETF typically holds a diversified portfolio of assets, even if the underlying asset is a single cryptocurrency like Bitcoin.

This could potentially offer investors a more balanced risk profile.

The launch of Bitcoin ETFs could have significant implications for the broader cryptocurrency market, attracting new investors and potentially leading to increased demand for Bitcoin.

But others are more cautious about the effect a Bitcoin ETF would have. Daniel Kuhn writing on CoinDesk says, “The idea that ETFs will drive institutional adoption is plausible, but likely overhyped — like every other major crypto event known in advance[…] interest in bitcoin ETFs stems from this never-ending need to find something to be hopeful about.”

So are Bitcoin ETFs coming?

Failed applications for Bitcoin ETFs date back to 2014. So there is a long tradition of efforts being blocked. But the US court’s ruling that the SEC was “arbitrary and capricious” for blocking Grayscale’s Bitcoin ETF feels like a big step on the way to approval.

There are right now a number of companies seeking approval for Bitcoin ETFs, including Grayscale, BlackRock, Fidelity, and VanEckre.

Bloomberg analysts are very optimistic, claiming there is a “90% chance for the Spot Bitcoin ETF to receive approval by January 10, 2024.”

So despite a long history of rejections and the recent false alarm, things are looking promising for Bitcoin ETFs. The effect they will have on cryptocurrency in the long-run though is something that will only become clear in time.